Saltfleetby site B. Photo: Angus Energy

Shares in Angus Energy rose this morning as the company announced it had taken out a £1.4m loan with a property company.

The loan is from Edinburgh-based Knowe Properties Limited, which holds 10% of shares in Angus.

£250,000 would be used to repay part of the £600,000 outstanding from an earlier £3m loan with Riverfort Global Opportunities, Angus said.

It also said the new loan would help to pay to reconnect the Saltfleetby gas field in Lincolnshire to the mains network. The company has estimated it will cost £1.5m to bring the field onstream and drill a horizontal sidetrack well.

Angus also said the new loan would fund what it described as “the more involved planning process at Balcombe” in West Sussex.

County council planners have recommended refusal of a planning application for three years of flow testing at Balcombe. They said the scheme would compromise the protected landscape of the High Weald and “establish a continued presence of industry which is not appropriate to the area”.

Last month, Angus told shareholders that production at Saltfleetby and oil flow at Balcombe would “mark a turnaround in the group’s fortunes” and bring “material cash flow for the first time”.

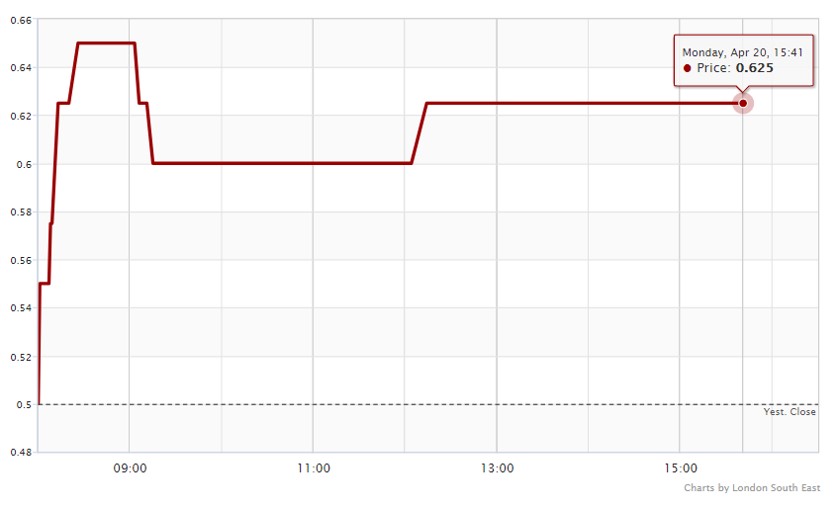

Shares initially rose 30% this morning. At the time of writing they were up 25% at 0.625p.

Angus share price on 20 April 2020. Chart: London South East

Angus said the new loan note was unsecured, at 4% interest and was convertible into shares at maturity after two years at 1p.

Managing director George Lucan said:

“Due to Covid-19 we face an unprecedented situation which makes a variable price and freely convertible instrument exceptionally difficult for the market to price.

“For the moment, we are very pleased to have secured £1.4 million of new core capital for the company at a time when few can have confidence that equity capital markets will be open for fundraising for the foreseeable future.

“This issuance is not to meet any particular identified cash need but is first and foremost one of prudence with the aim of strengthening the company’s capital base ensuring we are able to meet any unforeseen challenges that lie ahead.”

The most recent annual accounts in Knowe Properties Limited show it has fixed assets of £13.3m and current assets of £26.76m, of which debtors make up £23.70m.

Companies House records notices for compulsory strike-off for Knowe Properties for each of the past four years. On each occasion, the strike-off actions were discontinued after the filing of company accounts.

The controlling party in the company is 80-year-old James Manclark, who represented Britain at the winter Olympics on luge and bobsleigh and helped found the sport of elephant polo.

- Angus also announced today that the repayment terms on the Riverfort loan had changed. Six equal monthly instalments would be paid between 24 May and 24 October 2020, it said. If Angus elected not to pay on the due date, the sum would be converted into shares or repayable at final maturity. Since early December 2019, Angus has issued more than 63 million shares in loan conversions totally £400,000. The Riverfort loan was announced in January 2019 primarily to finance future development at Balcombe.

unsecured loan when the oil price has just gone negative !

US Texas price is Negative, the Brent Crude price is $26 a barrel, there is still a difference of $50 between the two… it’s not good but completely different oil price benchmark ratios!

Ellie, it’s also worth noting that the negative oil price is for end May delivery and you have to actually collect a minimum of 1000 barrels from Oklahoma!

The low oil price is likely to have an interesting impact on gas. Much gas to hit the market is coproduced with oil. If oil production is cut then gas production will reduce and prices will go up https://www.google.com/amp/s/seekingalpha.com/amp/article/4338647-natural-gas-is-clear-winner-from-oil-blow-up

Good thing that they are now primarily a gas company i guess.

Another example of mug investors continuing to believe the hype.

This is a death spiral, we have seen it already with Europa, quite soon will be UKOG, with Angus not far behind.

The only ones who get paid are the directors.

Not just the directors that get paid, the employees get paid as well as contractors and suppliers the councils and HMRC ( a point that must be a statement of the bleeding obvious ).

There may well be an oil and gas company where employees are happy to work for free, but I do not know if one.

Indeed, the willingness of companies to fund Angus and UKOG borders on charity for the group of people and businesses noted above.

Is the UK oil and gas industry close to the far left dream of jobs being supported without any link to the economics of the operation ( as the NUM wanted coal mines to stay open without any reference to the economics of the mine, until all the coal had been extracted?).

Strange times. I fully expect there next loan to be provided by momentum.

Well, Dave, perhaps you know something about Knowe Properties that you are not sharing? Or, perhaps you don’t.

Either way, EXPLORATION companies can still raise funds to ermm EXPLORE and DEVELOP. Always been the case, continues to be so. Those that fund usually do their due diligence.

By the way, share holders get paid also, as and when they sell their shares. The mugs may do so at a loss, others do not. No different to share holders in M&S and Tesla. Some might even do so at 3.32am!

Good on them , get them wells flowing again