As UK Oil & Gas publishes its latest results, DrillOrDrop reviews the company’s holdings, finances, plans and personnel.

The company reported a loss after tax of £16.7m for the 12 months to September 2018, compared with £2.268m for the same period a year before.

The figures included exploration and evaluation write-offs of £11.56m for sites at Broadford Bridge and Holmwood/Leith Hill and higher administrative costs.

But there were also increases in cash levels and total assets.

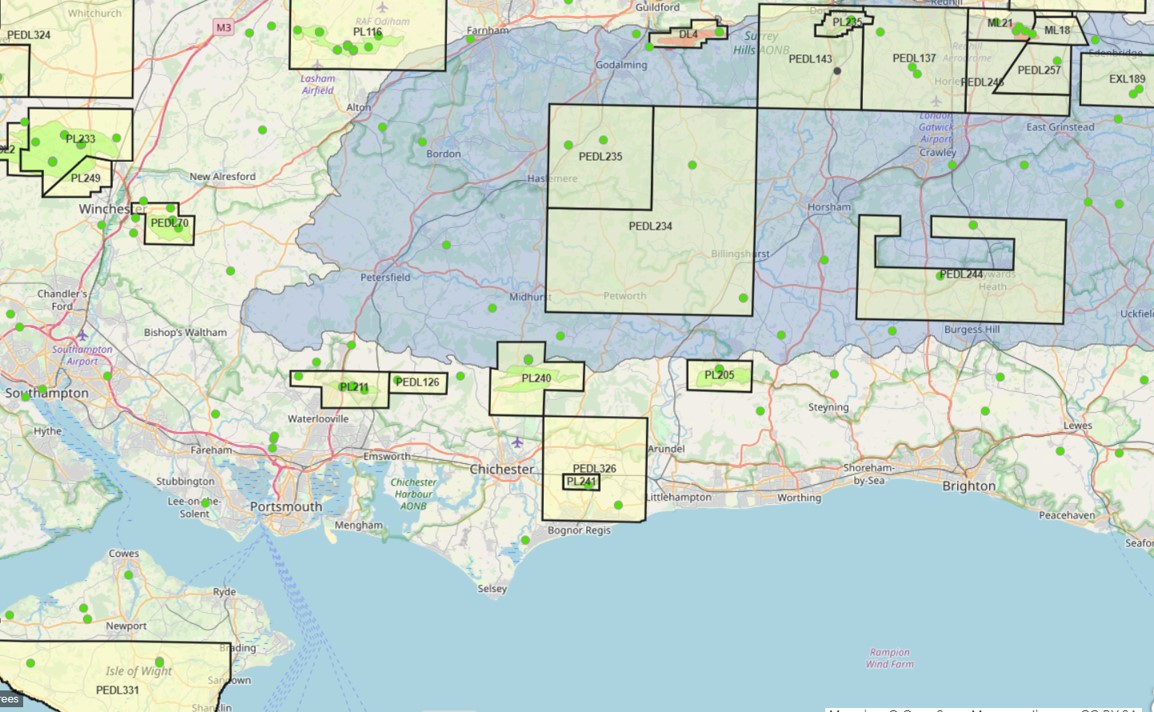

Licences

Interests

PL211 Horndean, Hampshire, 10%

PEDL070 Avington, Hampshire, 5%

PEDL126 Markwells Wood, West Sussex, 100%, operator

PEDL137 Horse Hill, Surrey, 50.64%,

PEDL143 Holmwood/Leith Hill, Surrey, 40%, operator subject to transfer consent

PEDL234 Broadford Bridge, West Sussex, 100%, operator

PEDL246 Horse Hill, Surrey, 50.64%

PEDL331 Isle of Wight onshore, 95%, operator

Licences in southern England. Map: Oil and Gas Authority

Recent acquisitions/relinquishments

25 September 2018: Acquired further 22% in Horse Hill Developments Ltd, which increased the company’s holding to 71.9%

9 July 2018: IGas relinquished PEDL233, Baxters Copse, West Sussex, in which UKOG held 50%

31 January 2018: UKOG relinquished P1916 offshore Isle of Wight (100%)

21 January 2019: UKOG purchased 30% interest in PEDL331 onshore Isle of Wight, which increased holding to 95%

20 February 2019: UKOG completed purchase of a further 6% increase in Horse Hill Developments Ltd, taking interest to 77.9%

14 March 2019: Europa transfers operatorship of PEDL143 to UKOG, subject to Oil & Gas Authority consent

Sites

Producing

- Horndean, Hampshire: 140-150 barrels of oil per day (bopd)

- Avington, Hampshire: currently shut in

Exploration/Appraisal

- Broadford Bridge, West Sussex: BB-1/BB-1z currently suspended following wellbore damage and non-commercial well test

- Holmwood, Surrey: site restored after renewal of lease refused

- Horse Hill, Surrey: currently flow testing

- Markwells Wood, West Sussex: plugged and abandoned, to be restored to woodland by end of 2019

Horse Hill oil site near Gatwick Airport, October 2018. Photo: Used with the owner’s consent

Horse Hill flow tests

On 15 March 2019, UKOG said flow tests in the Portland formation at Horse Hill had produced more than 10,000 barrels (bbl) and the Kimmeridge more than 25,000bbl. 165 tankers of crude oil has been sent for processing, mainly to the Hamble oil terminal.

The company said the Kimmeridge section of the well was currently shut in for a long-term pressure build up test.

The company has said repeatedly that operations at Horse Hill were not linked to an ongoing swarm of earthquakes centred on Newdigate, which began on 1 April 2018.

Plans

Based on annual report for year ending September 2018

PEDL126, Markwells Wood, West Sussex

2019: Landscape restored back to woodland, using original top soil

PEDL137/246, Horse Hill

Spring 2019: Drill horizontal Portland well HH-2 and carry out long-term test. Target production levels 720-1080bopd

Spring 2019: Application for long-term production and four additional wells due to be decided by Surrey County Council

End 2019: Start of long-term production, subject to permissions

PEDL234: Broadford Bridge, West Sussex

Date not given: Drill and test a further sidetrack well, BB-1y

2020: Appraise BB-1y and long-term well test

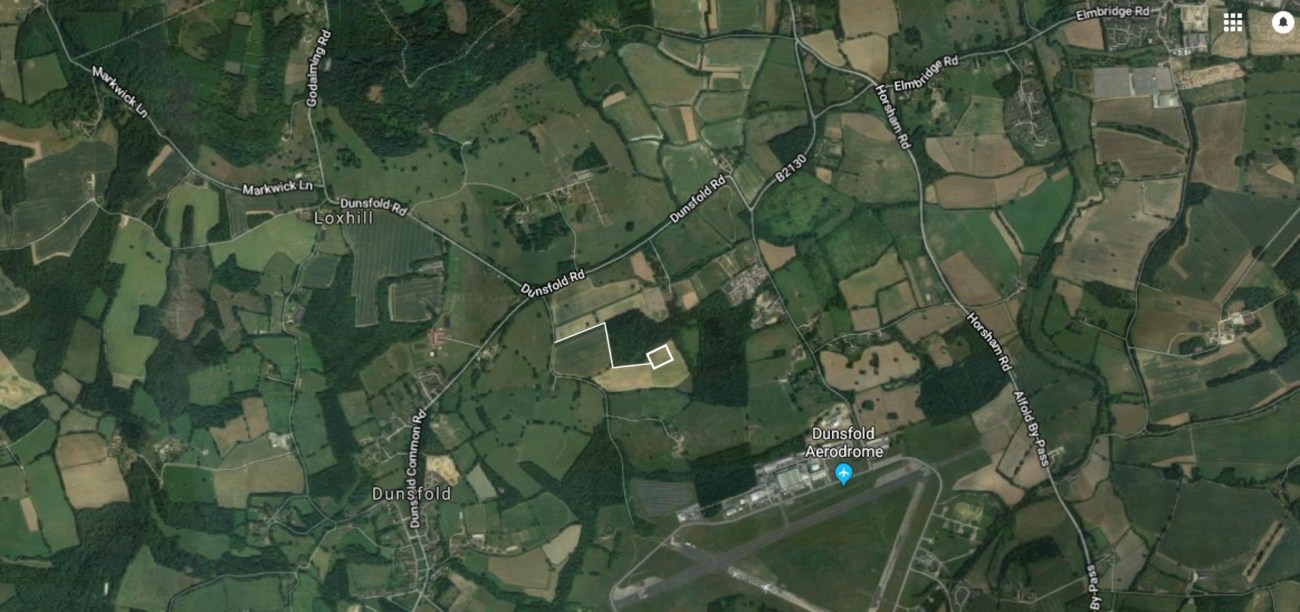

PEDL234: Dunsfold/Loxley, Surrey

Location (marked in white) of UKOG’s Dunsfold site and access track, based on information in the company’s leaflet. Image source: Google Maps

Spring 2019: Submit planning application to drill, core, test Loxley-1 well targeting Portland gas accumulation and core/test underlying Kimmeridge

2020: Spud Loxley-1

Date not given: If successful, drill and test horizontal sidetrack, Loxley-1z, within Portland and carry out long-term test to establish viability

PEDL331, Arreton, onshore Isle of Wight

Late spring 2019: Apply for planning permission to drill and test exploration well, to be called Arreton-3

Early 2020: Drill and test Arreton-3 in Portland and Kimmeridge

Date not given: If Arreton-3 is successful, drill and carry out long-term test of horizontal sidetrack, Arreton-3z

Date not given: If Arreton-3 is encouraging, drill, core, test vertical pilot well in Arreton South prospect

Date not given: If Arreton South pilot well is encouraging, drill and test horizontal sidetrack

Company

Structure

Parent company: UK Oil & Gas plc

Subsidiary companies (Proportion held by UKOG plc in brackets): UKOG (GB) Limited (100%); UKOG Solent Limited (100%); UKOG Weald Limited (100%); UKOG (234) Limited – previously Kimmeridge Oil & Gas Limited (100%); Horse Hill Developments Ltd (77.9%); UKOG (KOGL) Ltd – previously Kimmeridge Energy Limited (100%); UK Oil & Gas Investments Limited – previously UK Oil & Gas Limited (100%)

Status

UKOG plc was readmited to the AIM junior stock market on 1 August 2018 as an oil and gas operating company

Key personnel

Stephen Sanderson. Photo: DrillOrDrop

Chief executive: Stephen Sanderson

Non-executive chairman: Allen Howard

Finance director: Kiran Morzaria

Non-executive director: Nicholas Mardon Taylor

Staff numbers

Year ending September 2018

Administration: 4

Operations: 2

Pay

Total director’s pay: £744,000 (2017: £645,000)

Total Stephen Sanderson’s pay: £584,000 (2017: £339,000)

Stated company aim

Stephen Sanderson said on 15 March 2019:

“Our stated aim is to become the largest oil producer in the Weald Basin and amongst the top three UK onshore oil producing companies by winter 2019/20.”

Injunction

Opponents of the UKOG injunction outside the High Court in London, 3 July 2018. Photo: DrillOrDrop

On 3 September 2018, UKOG was granted an injunction against protests outside sites at Broadford Bridge and Horse Hill and its Guildford headquarters. The Court of Appeal is to hear a challenge against the injunction in June 2019.

Finances

Key financial figures

All for year ending 30 September 2018 and, in brackets, for the previous 12 months

Production: 137 bopd

Operating costs: £18/bbl

Income: £0.23m from Horndean

Revenue: £0.225m (2017: £0.207m)

Gross profit: £0.128m (2017: £0.047m)

Costs of sales: -£0.097m (2017: -£0.254m)

Administrative costs: £3.24m (2017: £1.86m)

Legal and AIM related expenses: £1.1m (2017: £0.36m)

Operating loss: £3.76m (2017: £2.40m)

Loss on ordinary activities after taxation: £16.747m (2017: 2.268m)

Exploration and evaluation write off: £11.56m

BB-1 well and B-1z test: £9.25m

Holmwood: £1.21m

Loss before taxation: £16.75m (2017: £2.27m

Decommissioning expense: £0.697m (2017 -)

Net cash outflow from operating activities: £2.82m (2017: £1.85m)

Cash outflow from investing activities: £3.53m (2017: £8.2m)

Cash and cash equivalent at end of period: £12.43m (2017: £1.75m)

Total current assets: £13.65m (2017: £5.54m)

Total non-current assets: £31.0m (2017: £21.71m)

Exploration and evaluation assets: £22.6m (2017: £15.11m)

Total assets: £44.65m (2017:£27.25m)

Total current liabilities: £6.5m (2017: £3.73m)

Total non-current liabilities: £1.34m (2017: 0.36m)

Total liabilities: £7.86m (2017: £4.08m)

Categories: Industry

Abracadabra!

How long can we allow these loss making fossil fuel energy companies to milk the ‘addicted to money punters’ and naive pensioners who invest in ‘funds’ that prop up these crooks?

We don’t need any more fossil fuels due to the escalation of climate change; the shocking revelation that BP wants to be the last oil producer standing – together with the rest of the big producers declaring the same this week – suggests that these business directors are contemplating murder in the first degree?

The kids are standing up; we all need to stand up and remove these leeches from our society, before it’s too late…

The company reported a loss after tax of £16.7m.

They will voluntarily pay local communities 6% of the profits they don’t make, minus the busniness rates they are obliged to pay anyway.

So nothing, with a bit taken off.

Sanderson is paying himself more than the community will get , obscene , Total Stephen Sanderson’s pay: £584,000

Sanderson has given himself 58% increase in salary, but the company has made a huge loss. Makes you wonder where it,s coming from.

Good morning ladies and gentlemen, boys and girls, well, its Sunday 17th March, St Patricks Day, and i am sure that is not lost on the tragically divided Irish people considering the present brexit debacle and the increasingly insane calls for a hard or soft or extended, or frankly stupid Trumpish border.

Perhaps it is well beyond time when the Irish division situation should be ended once and for all and the British government finally bite that fatally fractured bullet and re unite Ireland for good and for all and let them make their own united way without British interference. Now that is an Irexit that no British government wants to touch with their politically soiled fingers?

It is the 21st Sunday since fracking was resurrected in the UK by Cuadrilla only to fail miserably under its own agreed regulations and only succeeded in fracturing neighbours the bone china. How many analogies are we up to now? Bags of flour? Melons on the floor? Manholes in the road? Cars crashing into doorways? Perhaps wriggling cans of worms hitting the fan?

Now Cuadrilla appears to be attempting to resurrect itself yet again with the cries for NSI and fiddling with the gold standard TLS limits and then displaying fizzing cores of….what? Hot air perhaps? Probably not enough to make a profane propane flare giggle with derision anyway. Why no flaring? And wasn’t forbidding flaring one of those gold standard “it’ll never happen in the UK with gold standard regulations” anyway?

No doubt Cuadrilla are attempting to sneak under the wire under the cover of the political warfare and confusion of the current political farce and certainly intending to take advantage of the utter brexit chaos that this government has become so deeply enmeshed in.

First rule of government, never let a good disaster go to waste, many things can be quietly hidden under cover of the diversion of noise and smoke and mirrors.

It was an interesting day on a cold and windy Friday March 15th on the Global Climate Strike protest and just being a part of that in a support capacity it clearly showed us all just how powerful the children’s school strike has become. It was good to see the children plan and prepare banners and posters for the day, as well as with the March 15th march and speeches and cheering a booing appropriately.

All of us who attended felt the power of the strike and it was a very tangible feeling in the atmosphere, like an electric charge, which is i suppose, entirely appropriate.

The Friday school strike was quickly followed by the usual grumpy establishment attempts to discredit and minimise the impact, whilst contributing nothing to the climate change debate, by implying that the children were missing out on a days indoctrination….sorry….education, or not turning up at all, and i saw no instance of that, which only goes to show just how embarrassed the government and the corporate establishment reacts to be shown up by 70,000 children worldwide.

Quite a remarkable day indeed,i was proud to be a part of it.

And speaking of the Global Climate Strike event, here is a report by Scientists’ Warning at Foresight Group, the EU Commission which outlines the situation and the urgency and explains why many are unwilling or even unable to address the crisis and propose some causes for that and some solutions.

That leads to another couple of reports that helps to unravel the causes of the present insane push for growth and the financial greed and insanity that pervades and permeates our present 21st century suicidal civilisation.

Chris Martenson – The Folly of Unfettered Finance (Part 1)

Chris Martenson – The Folly of Unfettered Finance (Part 2)

We are in what can only be called a fiat currency financial drug addict society and like all drug addicts the first thing we do is deny that we have a problem at all. Maybe now at last we are being shown up for the addicts we are by our own children and not before time.

Perhaps it is time to finally admit our destructive financial addiction and begin to deal with that root problem, for without dealing with that addiction, all the fine words and planning are just surface noise and we are fooling ourselves that we will ever be able emerge from this present self destructive suicidal desire for more and more and more at the expense of the planets limited and increasingly under threat stable resources.

It is a hard thing to admit that we are fatally flawed and addicted to unlimited growth in a finite environment, but as with all addictions, the first step is to admit that we have a problem and then to actually DO something about it.

Do we really want to continue like this? Fever Ray – “Keep The Streets Empty For Me” (with Steve Cutts illustrations)

https://www.youtube.com/watch?v=OViRiAUuKxM

As always, please make up your own mind, just as long as we are honest with ourselves, maybe we can learn to wean ourselves off these addictions.

Well have a good Sunday with family and friends and maybe look at some of those videos and think about just where we are going and why we are reluctant to veer away from our imminent demise?

There is one more video amongst many that may help in a more gentle way that shows us where we are going tragically wrong in our present 21st century society and then presents ways to emerge back into some sort of humanity and sanity.

Its a long video, 3.25 hours long in fact, but what is said and how it is proposed and explained, is possibly the best way of showing just how far we have fallen and just how high we can rise if we were only able to see what we are doing to ourselves and the planet.

There is no Planet B, and it is worth understanding that there is no Human Race B either, this is the only one we have, better not to destroy it, or let it destroy itself. The Planet will continue, but without us and maybe after a couple of million years, life will thrive on the waste ground we have left, i sincerely hope that such a future species will wonder at the piles of bones and burned out cities and promise themselves, that they wont make the same suicidal fatal mistakes as we did.

Money, happiness and eternal life – Greed (1/2) | DW Documentary: It proposes that human nature is not greed, and in fact it is in our nature to be social and caring towards eachother, but that is buried by the survival mechanism that perceives want and poverty of everything as a threat, and our present society and financial exploitation of every aspect of our lives, is an artificial concept and only serves to worship the greed and avarice of the few at the greatest and most tragic expense of the many. All we need to change that, is to realise just how deeply we have been fooled into abject ignorant slavery.

https://www.youtube.com/watch?v=TFQiFUkRpWA

Part 2 of 2, only 42.5 minutes long:

No, it doesn’t Ann. We already know that.This is an AIM exploration company attempting transition to a production company. Absolutely standard.

Bit like Jono’s confusion regarding 6%. This is for one site Jono. The other sites to follow should offer the same thing. Need a few more fingers and toes for multiplication.

So, we may end up with an increase in UK oil to replace some imported US oil. (372k barrels per day-mainly from fracking, and rising.) So the true environmentalists, who agree with the UN report, will welcome a step in the right direction whilst others with different motives will try and cause excitement.

Ever thus, but increasingly exposed.

58% increase in salary. He must be 60ish so If I was in his shoes I’d want to top up the retirement pot and get out as soon as the production permission is granted and he can say job done.

Consider the Danish financial crime thriller.”Follow the Money”.

TV series originally which has been shown world wide.

Based on a fictional wind energy company “Energreen”, but the antics might be similar to the affairs of unconventional oil and gas companies.

Story gets a bit tangled with issues, such as low level crime and marriage break up, but includes all sorts of fraud and financial mischief.

Some summaries here —

https://www.amazon.co.uk/Follow-the-Money-Season-1/dp/B01DA3K7P6

Good program, very realistic, particularly for some UK onshore wind companies. Perhaps also some onshore (and offshore) oil and gas and offshore wind companies. Same with onshore solar farms. Human nature = greed……

Actually Paul. human nature does not = greed.

However, some individuals cannot be satisfied and it is they that drive the illusions and promote the planet destroying financial systems that extend their tendrils into the majority., choking and feeding off lives.

Consumerism, money – all power driven by satiated and deeply disturbed crooks who can never get enough, who are unable to see the destruction they are causing; numbers on a computer, drive to be last person standing….

These individuals have been promoted by the desire for money and power, but are not representative of the many.

That’s no way to talk about Mr. Musk!

Now, what do you think he is paying himself whilst not making a profit?

Very “alternative”.

Could be returning to the dark ages by the end of the Year…

https://www.telegraph.co.uk/business/2019/03/16/fears-grow-lights-will-go-winter-eu-ruling/amp/?__twitter_impression=true

No financial problems at INEOS……

https://www.bbc.co.uk/sport/cycling/47608625

Looks as if the Tour de Frack was an unfortunate promotion by the antis!!

Never mind. I’m sure Sir Jim would offer a little trophy if they could manage to improve on their time this coming year.

Ah yes, an [allegedly] drug induced cycling team….sounds about the right acquisition….loved the way the BBC finished with the controversy of his moving to Monaco to avoid paying UK tax!

[Typo corrected at poster’s request]

But running your company through Luxemboug like Amazon etc. is okay?

wrong blog….

Correct blog – are we not discussing tax avoidance? Or is it okay for the fashion industry who in some ways are even worse re consumersim, greed and climate change impacts?