The operator of the UK’s largest onshore gasfield is facing doubts over its ability to continue as a going concern.

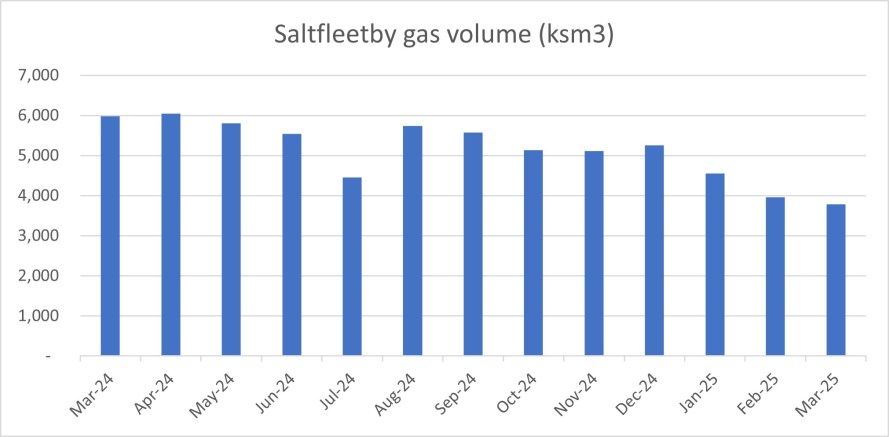

Angus Energy identified a “material uncertainty” over the impact of suspension of gas production at the Saltfleetby field in Lincolnshire.

In interim accounts, published today, the company said its forecast cashflows relied on no suspension of Saltfleetby production for an “unforeseen significant period”.

It also said the forecasts depended on completion of work to enhance production at Saltfleetby and also restructuring of its £20m loan with Trafigura.

Any significant delays to the cashflow assumptions would require negotiations with Angus Energy’s derivative holder and lender or further funding, the company said.

Last month, Angus blamed variable production at Saltfleetby in the first quarter of 2025 for missing the deadline for the first repayment on the loan.

Shares were later suspended when the company announced it had entered a non-binding agreement to buy a group of producing assets, offshore in south-east USA.

Earlier this month, the chief executive, Richard Herbert, resigned .

Today’s accounts reported that a new booster compressor at Saltfleetby had increased production by 15%, compared with pre-booster forecasts.

The company said it was considering coil tubing workovers to increase production further at the field. The work was scheduled for autumn 2025, it said.

A new well, which would add a fourth producer to Saltfleetby, was planned for the first quarter of 2026, subject to funding and equipment delivery. The new well would add 2-6mmcf/d to field production in the second quarter of 2026, Angus estimated.

At the company’s other producing site, at Brockham, in Surrey, oil extraction averaged 24 barrels of per day during the period, the accounts said. An assessment was underway of bringing the BRX4Z well back into production, they added.

The company said it was evaluating options for an extended well test of its oil well at Balcombe in West Sussex. This followed a failed legal challenge this year by local campaigners.

Angus also said it planned to test the integrity of the Lidsey X2 well, also in West Sussex, as preparation for future production. Formation fluid from the well would be transported to the Brockham site for disposal, the company said.

Key figures

(Six months to March 2025)

Net revenue: £11.302m (six months to March 2024 £12.131

Gross profit: £4.872m (six months to March 2024 £4.236m)

Admin expenses: £1.505m (six months to March 2024 £2.005m)

Operating profit: £3.367m (six months to March 2024 £2.151m)

Profit on ordinary activities before taxation: £0.756m (six months to March 2024 £5.775m)

Cash: 0.785m

Total assets: £77.773m (six months to March 2024 £91.546m)

Total liabilities: £37.016m (six months to March 2024 £44.021m)

Earnings before interest, tax, depreciation and amortisation: £6.943m

Gross production at Saltfleetby gasfield and Brockham oilfield:

17,361 barrels of gas condensate (£0.610m 2025, £0.849m 2024),

3,695 barrels of crude oil (£0.192m 2025, £0 in 2024)

10.443mm therms of gas (£10.5m 2025, £12.131m 2024)