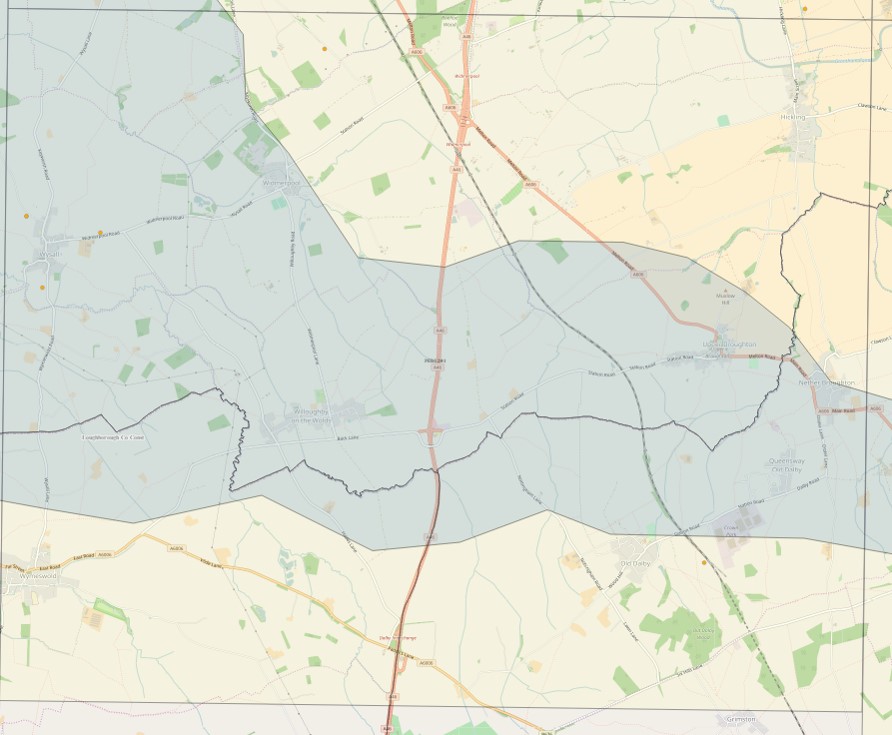

PEDL201 showing prospective shale area in grey. Map: Oil and Gas Authority

Egdon adds to licence stake

Egdon Resources has announced it has increased its stake in a potential shale gas area in the East Midlands.

The company has acquired an extra 12.5% in petroleum exploration and development licence (PEDL) 201 from Corfe Energy Ltd.

The transaction brings Egdon’s interest in the PEDL on the Leicestershire-Nottinghamshire boundary to 45%, making it the majority stakeholder. The remaining partners are: Celtique Energie (32.5%), Terrain Energy (12.5%) and Union Jack Oil PLC (10%).

Egdon said PEDL201 was part of its core area, which it believed had significant conventional and unconventional oil and gas potential.

The PEDL includes the village of Widmerpool, which has given its name to the Widmerpool Gulf, identified by the British Geological Survey and others as a possible source of shale gas.

The transaction adds 2,471 acres to Egdon’s licence holdings. The company is the operator of the neighbouring PEDL306, which stretches north from Loughborough to the centre of Nottingham.

Mark Abbott, Managing Director of Egdon Resources plc, said:

“We are pleased to have now completed this acquisition which is in line with Egdon’s stated strategy of enhancing our position in core areas where we see significant oil and gas potential.”

- Earlier this month, Egdon unexpectedly failed to secure planning permission for its oil exploration site at Wressle, near Scunthorpe, north Lincolnshire. DrillOrDrop report

Legal challenge and funding exploration at Cuadrilla’s fracking site

One of Cuadrilla’s main investors has released legal and financial details about the company’s operations in Lancashire.

One of Cuadrilla’s main investors has released legal and financial details about the company’s operations in Lancashire.

The Australian mining firm, A J Lucas, which has a 45% stake in Cuadrilla, told investors today that the company would participate in the legal challenge to the decision by the Communities Secretary. Sajid Javid announced in October last year he was granting planning permission for drilling, fracking and testing for shale gas at Preston New Road.

The statement said Cuadrilla would be represented by the legal team which successfully appealed against Lancashire County Council’s refusal of planning permission. That team was led by Nathalie Lieven QC, of Landmark Chambers.

A J Lucas said:

“A positive High Court decision in favour of the Secretary of State will allow Cuadrilla to continue to progress its exploratory work program at the PNR [Preston New Road] site according to schedule.

“A J Lucas is confident that there is no material merit to the cases being brought against the Secretary of State’s decision to grant this permission.

“The outcome of the program at PNR will be important to the company as it will provide further information to assess the recoverability of the shale gas resource”.

The statement also gave details of the investment by Centrica PLC, which became a partner in the Lancashire exploration licence (PEDL 165) in 2013 (Cuadrilla press release).

It said under a farm-in agreement, Centrica was required to pay a further £30m of exploration costs, which would be spent in drilling and fracking the first two exploration wells at Preston new Road. It added:

“Subject to the appraisal of the Preston New Road exploration wells and certain milestones being met, Centrica is then required to fund a further £46.7m for appraisal and development in the Bowland tenement.”

Cuadrilla Bowland has a 51.25% stake in PEDL165, Centrica has 25% and Lucas Bowland 23.75%.

IGas makes offer to bondholders

IGas told investors today it was making a mandatory offer to buy back US$2.3m in bonds.

IGas told investors today it was making a mandatory offer to buy back US$2.3m in bonds.

The offer to bondholders, which is open until 1 March 2017, was made because IGas’s investment in conventional gas assets for 2016 fell below the target figure.

Under a restructuring deal with bondholders, the company was required to invest US$15m a year. But in 2016, it invested US$12.7m. As a result, it has made a mandatory redemption offer of US$2.3m to cover the short fall.

And news from last week: £3m contracts for tender in Cuadrilla exploration site

A shale gas website is offering fracking contracts in Lancashire worth about £3m, according to business organisations.

A shale gas website is offering fracking contracts in Lancashire worth about £3m, according to business organisations.

Chambers of Commerce for East Lancashire and North & Western Lancashire relaunched the Shale Gas Supply Chain Portal last week with the promise of tender opportunities for suppliers to Cuadrilla’s shale gas exploration site at Preston New Road.

It is not possible to verify the figure because details are available only to businesses that register on the site.

But Cuadrilla’s chief executive, Francis Egan, said:

“This is a great opportunity for local businesses to engage directly with our shale gas exploration operations and ensure that millions of pounds of spend remains in the county supporting local jobs.”

The Chambers of Commerce said more than 700 companies had registered since the original website launched two years ago. The businesses must now re-register to access tenders.

Categories: Industry

Sorry Ruth the igas RNS states 1st March 2016. More gold standard.

Cuadrilla’s statement,is cloaked in secrecy because local businesses are too embarrassed to be named and shamed as being willing to facilitate the destruction of their own Community in return for very dirty money

They also are aware that local environment Protectors will not let them sleep easy and that their existing customers will of course turn against them when they become subject to the toxicity that results from Fracking!

By the way, why would a Chamber of Commerce wish to conspire in the destruction of local businesses in its own region?

I mean the Fylde Coast and the Ribble Valley can both say goodbye to their tourism and farming industries if Fracking proceeds!