Angus Energy confirmed this morning that its chairman transferred 39 million shares to a company that appears to be less than six months old with one officer, a 20-year-old Hungarian living in Poland.

Photo: Angus Energy

In a statement to investors, Angus said Jonathan Tidswell-Pretorius (pictured right) transferred the shares for “nil consideration” on 7 June 2018, to America 2030 Capital Limited.

Based on a share price of around 6.5p, the shares were apparently worth about £2.5m.

The statement said America 2030 Capital Ltd was based at Kemp House, 160 City Road, London, EC1V 2NX.

According to the Companies House register, America 2030 Capital Limited based at this address was incorporated on 21 February 2018.

America 2030 Capital Limited entry on the Companies House register

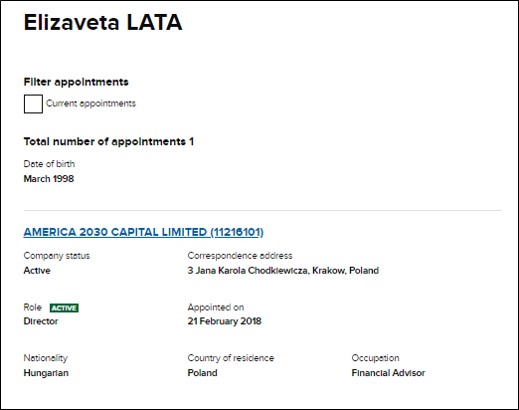

The register has two entries for current company officers, both Elizaveta Lata. One of the entries lists her as a director with a correspondence address in the Polish city of Krakow. Her date of birth is given as March 1998 and her nationality as Hungarian.

Entry for Elizaveta Lata on the Companies House register

This morning’s Angus statement said Mr Tidswell-Pretorius no longer has a notifiable interest in the company. It added that he continued to hold 500,000 ordinary shares, which represent 0.16% of the company’s issued share capital.

Yesterday, Angus announced it was investigating the transfer of shares to America 2030 Capital Limited.

It said the transfer was “in contemplation of a possible equity-linked loan” against the shareholding and that the paperwork for the possible loan was was not finalised.

Yesterday’s statement said 10.8 million shares in the transfer had already been sold by American 2030 Capital Limited.

It also said Mr Tidswell-Pretorius contested the right of American 2030 Capital Limited to sell the shares.

At the time of writing this post, Angus shares had fallen more than 15% to 5.375p.

In a separate statement to investors, Angus announced that an extra 9.3 million shares would begin trading next week following the exercise of conversion rights. This puts the total number of ordinary shares in Angus Energy at more than 316 million.

Categories: Industry

Oh dear. If it looks dodgy, smells dodgy, feels dodgy, sounds dodgy, tastes dodgy, it probably is. Just about sums up the state of finances in the fracking industry. Third energy ran out of money, INEOS are 5 billion pounds in debt, iGas, Cuadrilla, fortunes like a yo-yo. I trust the Government looks VERY closely at the finances of these companies before they are allowed to even drill, let alone flow test and frack their way through England’s green and pleasant land.

That address is associated with a company formation firm ie mail box address.

The Hungarian girl has probably been paid a couple of hundred pounds to act as named person or could be entirely fictitious.

This sort of thing does go on a lot and gives capitalism and business in general a bad name. I doubt anything illegal has been done but certainly not ethical.

Thank you GBK for saying something sensible , not ethical but will be brushed under the carpet . Just another CEO bailing out of a dodgy O&G company .

Its not fracking you idiots and it seems strange that a website lording it up about ethics when the very same website gains information from councilors at mole valley and scc about Angus and posts them before the company itself finds out.Also tries to convince locals Angus are fracking when they’re clearly not.Yep drill drop is very dodgey indeed.

Is that the USA definition of fracking or the avoidance of the word UK definition of fracking? Avoidance does not impress, why are you so scared of the word? If the flat cat frack cap fits, wear it.

The process is fracking (fracturing by one method or another) by any rational definition, since the process requires that rocks are fractured to extract the gas, and will be called so regardless of attempts to avoid the word by “idiots”

The Ponzi scheme continues, this smells of money laundering

Another shale Ponzi scheme in the US? Chevron invests more in shale? Another super major selling up in the North Sea as costs go up, profits go down, abandonment liabilities begin to bite……. An opportunity for John Powney here?

Oil firm Chevron is set to put its assets in the Central North Sea up for sale.

The Alba, Alder, Britannia, Captain, Elgin-Franklin, Erskine and Jade platforms are included in the plans.

The operations employ 610 staff and 220 contractors.

Chevron said it was confirming an intent to market its assets in the Central North Sea, and that those assets may or may not be sold.

The company, the second largest US oil producer after Exxon, was among the first oil companies to drill in the North Sea in 1964.

Chevron has been turning its attention more towards shale extraction, in particular in the Permian Basin of Texas and New Mexico and the giant Tengiz field in Kazakhstan.

BP, Royal Dutch Shell and ConocoPhillips have all sold assets in the North Sea in recent years.

https://www.bbc.co.uk/news/uk-scotland-north-east-orkney-shetland-44710181