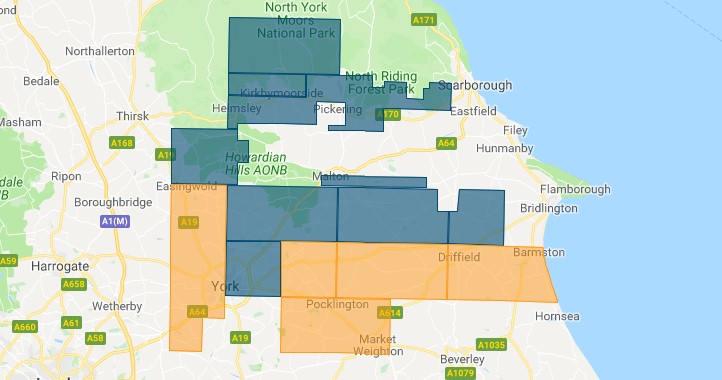

Petroleum Exploration and Development Licences. Source: Ineos Upstream

Agreement has been reached between Ineos and Sirius Minerals over which areas in North Yorkshire should be reserved for potash extraction and which would be available for oil and gas exploration.

The two companies clashed at a meeting last year over the relative importance of shale gas and potash.

At that meeting, Ineos claimed the establishment of protected areas for potash mining amounted to a “prohibition” on oil and gas drilling.

But both sides compromised at an extra session of the examination in public of the North Yorkshire Minerals and Waste Plan yesterday (25 January 2019).

Sirius agreed to redraw the “safeguarded area” for potash mining so that it no longer included land in Petroleum Exploration and Development Licences or PEDL.

It also agreed to remove a 2km buffer zone around the safeguarded area.

Ineos dropped its objection to a proposed policy on drilling for shale gas in the potash safeguarded area.

That policy said permission for deep drilling for the safeguarded area:

“will only be granted where it can be demonstrated that the proposed development will not adversely affect the proposed future extraction of the protected mineral [potash].”

Ineos had wanted the policy to include the words “permanently sterilise”, in place of “not adversely affect”. It had argued that the proposed policy would block drilling the safeguarded area.

Sirius said the potash resource was unique in the UK and the company had already compromised. If Ineos’s proposals were accepted, it said, there would be a serious impact on the business and the ability to recover potash.

There will now be consultations on the proposed changes.

Reporting from the session was made possible by individual donations from DrillOrDrop readers

Categories: Regulation

Is the Sirius boundary within the National Park? If it is then one would presume INEOS must only be contemplating conventional gas extraction. And one would hope that any future planning application for oil and gas development in the National Park would take account of the significant cumulative impact of the potash mine. The scale of the potash mine could yet impact upon further industrial development.

Well its Sunday again, good morning ladies and gentlemen, its the 14th frack free Sunday since the failed operation at Cuadrilla started and there are moves to “reframe” the scientific criteria that Cuadrilla themselves agreed to for the earthquake TLS, because they cannot use the full pressure without causing earthquakes that exceede the TLS limits.

We are told that raising the TLS stop light limits is “all for our own good”, yes we have heard that phrase before havent we? And it was not true then and it is not true now.

C. S. Lewis said something on the tyranny of good intentions, so i thought it would be appropriate to reproduce it here:

“Of all tyrannies, a tyranny sincerely exercised for the good of its victims may be the most oppressive. It would be better to live under robber barons than under omnipotent moral busybodies. The robber baron’s cruelty may sometimes sleep, his cupidity may at some point be satiated; but those who torment us for our own good will torment us without end for they do so with the approval of their own conscience. They may be more likely to go to Heaven yet at the same time likelier to make a Hell of earth. This very kindness stings with intolerable insult. To be “cured” against one’s will and cured of states which we may not regard as disease is to be put on a level of those who have not yet reached the age of reason or those who never will; to be classed with infants, imbeciles, and domestic animals.”

C.S. Lewis

There are those who write often here on Drill or Drop that would seek to label us all as “infants, imbeciles, and domestic animals” and their attitude is nothing but contempt and hatred to anyone who stands in their path towards that mythical “£profit” motive.

But we know that is all false and empty really, we cannot afford to profit from an operation and an industry that will destroy the very planet we live on, that price, for whatever motive, is too high a price to pay isnt it.

So i leave you with those thoughts, have a good Sunday with family and friends and when you look at your children, just think of the future we will leave them and try to make it the best future they can have.

Kat

The onshore part is.

See page 3 of attached

Click to access non_technical_summary_for_mine_mts_planning_application_september_2014.pdf

Though, given the location of the mine I do not see scope for cumulative affects from that mine and oil and gas activity along the Southern edge of the mines take, around 13km from the mine shafts.

Hi KatT

The agreement was that the Safeguarded Area would not encroach on any existing PEDLs. Ineos didn’t want it to match the National Park bourndaries – they argued that they might want to drill non-fracking wells for exploration or monitoring purposes, which could be allowed within the Park.

Ooo I love money 💷💷.

There is nooo money in UK shale. Tooo costly and problematic to access, tooo expensive to extract, and nooot competitive enough with other natural gas sources.

Explains why it has been left untouched by the big players with years of experience of shale gas extraction in other countries.

It has been left untouched by the big players because they don’t want the bad publicity associated with fracking until they know it’s going to be profitable. I’ve been told be two very senior people from different companies that they would buy out any successful shale gas explorer as soon as it’s proved that it can be profitable and that a sufficient number of wells can be drilled to make it worth their while.

That’s fairly obvious

‘that they would buy out any successful shale gas explorer as soon as it’s proved that it can be profitable and that a sufficient number of wells can be drilled to make it worth their while’

The point is that the analysts like Bloomberg, EY, and OIES say the numbers don’t add up. Also Statoil say it won’t make money. Then of course the failing US model.

https://www.desmogblog.com/2018/04/18/finances-great-american-fracking-bubble

John – there is no analyst that I know of who can predict flow rates and EUR in shale until 20 to 50 wells are drilled and tested. While you may take some pleasure in believing the doomsayers you should do so in the knowledge that they are guessing

Though it seems the ‘doomsayers’ are better ‘guessers’ that the ‘guessing investors’……how much UK shale gas since Cuadrilla began their quest?…………..eh, none.

Move over, you are dead in the water. Bring on the real energy and stop wasting gas to make electricity.

there is no analyst that I know of…

Fair enough, but I do. Here are the doomsayers. Ever heard of them? You should have by now.

In a 2013 submission to Parliament, Bloomberg said it would cost between 47 and 81 pence per therm to extract shale gas in Europe (using USD-to-GBP conversion rates).

The Oxford Institute for Energy Studies said in its 2010 report “Can Unconventional Gas be a Game Changer in European Markets” that shale extraction would likely be even more expensive, costing between 49 and 102 pence per therm.

EY, in its 2013 report “Shale Gas in Europe: Revolution or evolution?”, went further still, saying it would cost between 53 and 79 pence per therm.

And Centrica, which backs UK fracking firm Cuadrilla, said it would cost at the very least 46 pence per therm to frack, according to stats referenced in this 2012 EU report.

Gas price trends at a glance

https://www.statista.com/statistics/374970/united-kingdom-uk-gas-price-forecast/

Gas prices in United Kingdom (UK) 2016-2023 | Statistic

http://www.statista.com

This statistic shows the forecasted price of gas in the United Kingdom (UK) from 2016/17 to 2022/23. From the initial price of 34.6 pence per therm, the price of gas is expected to increase to 47 …

By 2022/23 47.5 pence per therm

The average of the above figures comes to 62.87 pence per therm

So in 2023 UK shale would be operating at

MINUS 15.3 pence per therm

Then of course there is the additional cost of ‘gold standard’ , green completion , propane addition for calorific value correction , road damage , environmental damage , and the effects of house price devaluation etc etc

Gas prices will always fluctuate but because the UK has such a diverse range of suppliers we will always be able secure good prices way below the high costs of UK shale.

Potash is extremely soluble by groundwater, and just one rogue gas exploration well would endanger future potash mines and the miners.

Therefore the Government should extinguish PEDL licenses that are within tens of kilometres from the predicted extent of the potash resources.

It is not for the companies to decide, because company financial considerations are by their nature short-term.

PEDLs are short-term for oil and gas held by the Government.

Potash is of immediate, short, medium and long-term economic and agricultural importance to the United Kingdom.

Potash mining will remain vital for agriculture for many centuries after oil and gas production is abandoned.

Robin Grayson MSc

Liberal Democrat Geologist

Could you please explain what you mean by a ‘rogue’ exploration well. It is not a term that I am familiar with.

David Berryman

Conservative Drilling Supervisor

Hi David – thanks for your comment.

In this context, a rogue well is any well (e.g. un-mapped, mapped in wrong place etc) for water, oil, gas, anhydrite, potash, coal etc. that becomes a conduit for groundwater or surface water to enter a salt mine.

Here is a video on an example: Oil Driller Breaches Salt Mine Under Louisana Lake

Robin Grayson MSc

Liberal Democrat Geologist

Anything more recent than 1980 Robin? Directional drilling and borehole surveying have come a long way since 1980.

Paul Tresto

Conservative Operations and Drilling Manager BSc Hons Eng, IWCF 1&2, HUET and lots more stuff…..

Paul – Robin clearly has no logical reason why this should be a risk. He’s just following the usual anti-frackers tactic of spreading silly scare stories hoping that some of them stick.

Hi Judith –

There are quite a few reasons why drilling for shale gas might impact on future potash mines, as everyone knows.

For example,

Fracking opens fractures that encourage groundwater flow and so endanger or prevent future potash mines by opening up channels for wild brine deep underground enabling potash, rocksalt, gypsum and anhydrite to dissolve and collapse.

I trust that is sufficient for you.

Robin Grayson MSc Liberal Democrat Geologist.

Robin – it was good enough for me to demonstrate your ignorance of subsurface flow and fracture propagation. Hydraulic fractures don’t propagate to shallow depths where advection of groundwater is important. It’s also the case that the large contrast in the mechanical properties of shale and potash will prevent fractures propagating from the shale into the potash. As well as being very soluable, potash is very ductile and experiences high rates of creep. For this reason, fractures wouldn’t stay open very long in potash.

Evaporites are the most important top seal to petroleum reservoirs. The issues that you imagine may happen never do.

IGAS didn’t mislead people by calling it Pentre Chert because that is a formation name and is not directly related to lithology. This is exactly the same as the Millstone Grit Formation not needing to contain a medium to coarse grained sandstone. The only people misleading the enquiry were you and Smythe by questioning the competence of IGAS and making out that you have some expertise in this area – neither of you do!

Hi Paul, thanks for your comment.

Indeed yes, directional drilling and borehole surveying has come a long way since 1980.

Of course, not everyone. Such as IGAS declaring naturally fractured Pentre Chert in Ellesmere Port-1 Borehole to be their target for further investigation. Indeed! The Pentre Chert is a flint-rock found only in a small area in Flintshire in Wales. They misled everyone.

Even with good drilling, if the intention is hydraulic fracking then any potash, rock salt, anhydrite or gypsum that is fracked will have conduits that risks inflows of groundwater which enlarges the conduits by dissolving these minerals, slowly or rapidly as the case may be.

Robin Grayson MSc – Liberal Democrat Geologist.

Come a long way… https://youtu.be/qW28i9SkUlg

Fertilizer is also produced from oil and gas, Robin!

So, you have just shot your argument in the foot. Oil and gas must be vital for agriculture-and not just for the red diesel.

Oops.

Funnily enough, its also a basic constituent of water-based drilling mud.

Oh dear; there’s a vicious rumor going round that agriculture is to be directed to use less oil and gas products….

Robin, this is total scaremongary. You have provided no evidence that one rogue well would endanger future potash mines. We drill through salt all of the time and although one has to be careful when the well penetrates the rock immediately beneath the salt, due to stress changes, the industry has this one sorted. Of course the link to the Louisiana isn’t relevant – the regulation in the UK simply wouldn’t allow that to happen

Hi Judith, I am impressed with your belief that “the regulation in the UK simply wouldn’t allow that to happen”.

As it happens, the National Well Record Collection held by the British Geological Survey BGS contains ” more than 130 000 classified records of wells, boreholes and springs within England and Wales; a unique database of hydrogeological information”.

https://www.bgs.ac.uk/data/boreholescans/home.html

Taking Greater Manchester as an example, only half the number of boreholes are in the archive. My thesis contains logs of more than a thousand that are not in the archive but I have gathered. The risk of a rogue borehole creating a risk to mines, tunnels and so forth is ever present, especially where there is too much faith in the completeness of records.

Robin Grayson MSc Liberal Democrat Geologist

Robin, I fail to see your connection between the fact many wellbores have been drilled in the UK and how new wells for onshore hydrocarbons are likely to danger potash deposits.

Hi Judith,

Thanks for your post:

“I fail to see your connection between the fact many wellbores have been drilled in the UK and how new wells for onshore hydrocarbons are likely to danger potash deposits.”

I do see the connection.

Robin Grayson MSc Liberal Democrat Geologist.

Robin, maybe you could enlighten those of us who don’t see the connection or a mechanism by which shale gas exploration will impact potash deposits

Hi Judith – Thanks for your message:

“Robin, maybe you could enlighten those of us who don’t see the connection or a mechanism by which shale gas exploration will impact potash deposits”

Maybe I could, but not going to do so as I have made my point already. Thanks.

Robin – if you call that a point you really can’t classify yourself as a scientist and I think you should stop commenting on subjects that you clearly don’t understand

I’m sure other people like myself will just view your last reply as an admission that you don’t actually know of any geological or engineering reason why drilling for shale gas would impact future potash mines. Thanks for clearing that up for everyone

Hi Judith

One point which came out in Friday’s discussion of the N Yorks mineral plan was that Sirius would not consider extracting potash within 1km of the site of a drilled well, whether or not that well was active. The potash is extracted via long horizontal tunnels underground and any collapse would prove expensive.

This is why Sirius wanted their Safeguarding Area for potash mining – they appear to feel that potash extraction and shale well sites don’t mix.

However, they didn’t appear to have a problem with horizontal drilling under potash beds, as the drilling should be much deeper than the potash.

IGAS didn’t mislead people by calling it Pentre Chert because that is a formation name and is not directly related to lithology. This is exactly the same as the Millstone Grit Formation not needing to contain a medium to coarse grained sandstone. The only people misleading the enquiry were you and Smythe by questioning the competence of IGAS and making out that you have some expertise in this area – neither of you do!

Hi Judith,

As for “some expertise in this area”, I have a track record as geological consultant to more than twenty oil and gas exploration companies in the East Midlands, North Wales, North-West England and the inshore areas of the East Irish Sea Basin.

Now, regarding the Pentre Chert Formation, I have visited the Pentre Chert Formation a good number of times in Wales.

It is the flinty rock that gives its name to Flintshire. Even so, it is found only in a small areas of Wales.

The Pentre Chert Formation is not mentioned in any of the BGS memoirs of the 1:50000 BGS maps of England.

Please read them line by line to verify this.

According to the BGS Lexicon of Named Rock Units the Geographical Extent of the Pentre Chert Formation is:

“Northeast Wales between Prestatyn (SJ 09 83) and Halkyn Mountain (SJ 21 69).”

Check it out for yourself: https://www.bgs.ac.uk/lexicon/lexicon.cfm?pub=PECH

I have no further comments to make on any of your comments at this time.

Robin Grayson MSc – Liberal Democrat Geologist

[Edited by moderator] anti-frackers just don’t like being cross examined do you? When you have published things in peer reviewed journals then people might listen to you. Although you might not wish to respond to my questions – I will continue to challenge you on everyone one of your totally misguided, poorly-informed opinions. I can’t wait to meet you face-to-face when it wont be so easy to wriggle out of discussions.

BTW – BGS might not see the similarities between the basal Namurian but it seems like previous generations did. (e.g. https://www.cambridge.org/core/services/aop-cambridge-core/content/view/792CB8B08D42A4D43598CB695698878C/S0016756800090920a.pdf/lower_carboniferous_chert_formations_of_derbyshire2.pdf)

Anyhow, as most people will realise, those indulging in pedantic arguments about nomenclature do so to try and discredit the competence of industry. Then again, what else can one expect, if they had reasonable knowledge about petroleum geoscience and engineering they wouldn’t object to fracking on safety grounds.

“BTW – BGS might not see the similarities between the basal Namurian but it seems like previous generations did. (e.g. https://www.cambridge.org/core/services/aop-cambridge-core/content/view/792CB8B08D42A4D43598CB695698878C/S0016756800090920a.pdf/lower_carboniferous_chert_formations_of_derbyshire2.pdf)”

If you really must go back 98 years to find a paper, then good for you.

Frankly on this occasion it would be wiser to refer to the very detailed work by the British Geological Survey BGS that prove conclusively that the Pentre Chert Formation is restricted to a small area of Flintshire in Wales, and does not occur in England.

In fairness to you, at the public inquiry in Chester, the IGAS team described the Pentre Chert Formation in the IGAS Ellesmere Port-1 as “shale”.

So that appears to leave only your good self referring to chert.

Judith, you wrote:

“Anyhow, as most people will realise, those indulging in pedantic arguments about nomenclature do so to try and discredit the competence of industry.”

The whole of the oil, gas and coal industries reply upon stratigraphic nomenclature for a number of reasons, such as:

1: Selecting stratigraphic picks on seismic lines, or else lost in time and space.

2: Making stratigraphic nomenclature essential for accurate geological maps, otherwise risk of being rubbish.

3: Making local regional and local stratigraphic correlations to enable oil, gas prospects to be identified and drilled or dumped.

4: And lots more besides.

Judith you then wrote: “Then again, what else can one expect, if they had reasonable knowledge about petroleum geoscience and engineering they wouldn’t object to fracking on safety grounds.”

But in the modern world, “safety grounds” also require inputs from local communities and “reasonable knowledge” of not only petroleum geoscience and petroleum engineering, but also “reasonable knowledge” of general geology, regional geology, onshore geology, paleogeography, micropaleontology, macropaleontology, paleoecology, stratigraphic nomenclature, geochemistry, microbiology, ecology, Quaternary geology, air quality, logistics, transport planning, local government, groundwater …and of course “reasonable knowledge” of Social d Environmental Assessments and much more besides.

I trust we can agree on that.

Robin Grayson MSc Liberal Democrat Geologist

Paul – that’s an interesting insight. I’m not sure on what scientific basis they feel like they want a 1 km exclusion zone. They’re certainly very careful to ensure that they aren’t associated with shale gas exploration companies. They seem to have public opinion on their side and I’m sure they don’t want to compromise the good will that they have built.

Mr G B Kidding – if that is his real name (hey, it’s got to be a ‘he’, right?) – clearly loves money more than he loves clean air, quiet countryside, rural jobs and local democracy. I’m probably not the only person to think that many of the problems we face in the UK and the rest of the world is that people like him love money too much and love the environment too little.

As much of the Sirius extraction will be under the North Yorks Moors and, maybe, the sea, it will be quite easy to keep them apart. Especially, as Sirius have decades of material to mine. Pretty easy to phase around that.

But, an interesting one.

Sirius “enjoyed” the same geological and economic nonsense whilst it was in it’s infancy. Strange how this has now changed. It usually does, when locals see how much money they can make. Some will become millionaires. I think GBK has a point!

Perhaps Ellie could take a look at the local benefits that are starting to accrue from Sirius plans. Lots of local jobs, huge boost to the economy and a project that many said initially would be a disaster to the environment yet it will be quite difficult to find much physical evidence of up to 20m tonnes of material being mined per annum. Sound familiar?

Drilling for anything through a mineable deposit reduces the amount of recoverable reserves.

This is due to the need to leave a protection barrier around the well. The size of the barrier depends on your extraction method of course. How many barriers depends on well density ( and hence inconvenience ).

Looking at the mine plans and PEDL shape, any Shale Exploration would precede mining by 20 years or more ( being along the Southern Boundary of the mines take ). The trick would be for the miners to miss the existing wells, rather than the gas wells to miss mineworkings.

There are already at least 2 oil wells in the mine take in the first 20 years ( Robin Hoods Bay ) so they should get some practice.

I do not believe the rogue well scenario credible in this particular case.

If the wells were fracked then I leave that discussion to those who believe shale fracking is confined to the shale and others who believe it opens up pathways for water to permeate the Potash deposits, causing them to dissolve and fail.

Sirius will be mining in 5.5m x 12m wide takes. In the thickest parts the take, which seem to be predominantly onshore, can be up to 44m high.

They intend to produce at a rate building up to 13 to 20 times that of Boulby Potash in its heyday.

Success or failure will occur over the next 10 years at the most in my opinion, and like all mining ventures, you need to be careful what you invest in. But good luck to them, it could be a major export earner.

https://uk.finance.yahoo.com/news/why-think-time-could-running-110033087.html

The information on PEDL Bpundary is above, mine take is in an earlier link above. Old well Data on UKOG website.

The Potash miners are clearly concerned about cross-contamination and not from fracking ‘water’. They are not as guillible as councillors, politicians and the general public.

Wandering

Potash Mining has its own challenges, and one of them, not generally the most pressing, is proximity to oil and gas.

Indeed, the Boulby Potash deposits were discovered during drilling for oil and gas, and there are existing oil wells in the Sirius Mine take.

What they end up with is an agreement on how that proximity is managed, be it by agreement between companies, or ( as in America ) legislation. I am sure they ( Sirius ) would prefer no other activity in their take and may feel peeved that their development is quite specific, but shale gas opportunities are diverse ( or so it seems ).

But how they manage ( or not ) the geology directly above them as they manage caving makes gripping reading.

Click to access cfoue.pdf

Or how Boulby do that, and they are out under the sea.

https://www.mining-technology.com/projects/boulby/

In my opinion they would argue the case no matter who was drilling and no matter what they were after.

There is a traditional view that fissures do not develop in plastic salt sequences.

So, plastic salt sequences are assumed to be water-tight and capable of providing a protective cover to potash mines.

Unfortunately this is now realised to be not always true, and fissures in plastic salt have caused the flooding and loss of the world’s largest potash mine. It follows that fracking should not be allowed in or near active or future potash mines.

This major disaster is documented in a paper by Vjacheslav ANDREJCHUK 2002 in which he writes:

“Studies during the last 10 to 15 years, especially those conducted in the Verkhnekamsky deposit, have led to a revision of traditional beliefs concerning fissuring in salts. Fissures were commonly observed by mine geologists during routine inspection of the productive sequences and in mine shafts. It was found that the “waterproof sequence” contains rupture deformations with zones of weakness developed along them. Various defonnations develop as a result of both natural and anthropogenic factors, Rocks within the waterproof sequence also contain localized zones of fissuring, developed during halo-kinetic deformation of the beds. Fissures and ruptures in the salts are commonly re-sealed (zones of replacement; but fresh ones (mining-related) can be open and penetrable by fluids.”

“Rupture deformations, especially anthropogenic fissures of displacement, foliation and unloading, present a considerable hazard as potential routes for brine rush into mines. In most cases anthropogenic ruptures develop inevitably along weakened zones, such as former deformations that have been sealed.”

The well-illustrated paper can be download as a PDF free of charge: https://scholarcommons.usf.edu/ijs/vol31/iss1/8/

Worth a read. Robin Grayson MSc – Liberal Democrat Geologist

It is well known that temporary hydrofractures can develop in evaporates. This tends to occur when the pore fluid pressure is close to the overburden pressure. The main point about hydraulic fractures is that they won’t penetrate up into the salt because they will experience blunting at the interface with the salt. It’s also the case that salt cannot support a differential stress so at the interface with the underlying sediment there will be large stress discontinuity, which will also work to stop fractures propagating into the salt. There are many conventional and unconventional reservoirs that are overlain by evaporites but I rally can’t think of a single example where production-related fluid movement has lead to issues (i.e. leakage or significant dissolution). The fact that only small amounts of fluid are pumped underground and that upward movement will be dominated by buoyancy forces (i.e. gas movement) also indicates that fracking is not likely to have an impact on these deposits.

Absolutely outrageous from INEOS and anyone who colludes with them.

Graham

Are you saying Sirius have colluded with INEOS?

No, I think he is implying anyone who types out a message on plastic keys do so!

Oops.