East Sussex councillors voted this morning against ending pension fund investments in fossil fuels.

The county council’s pensions committee voted by three to two on each of three divestment proposals (see details at the end of this article).

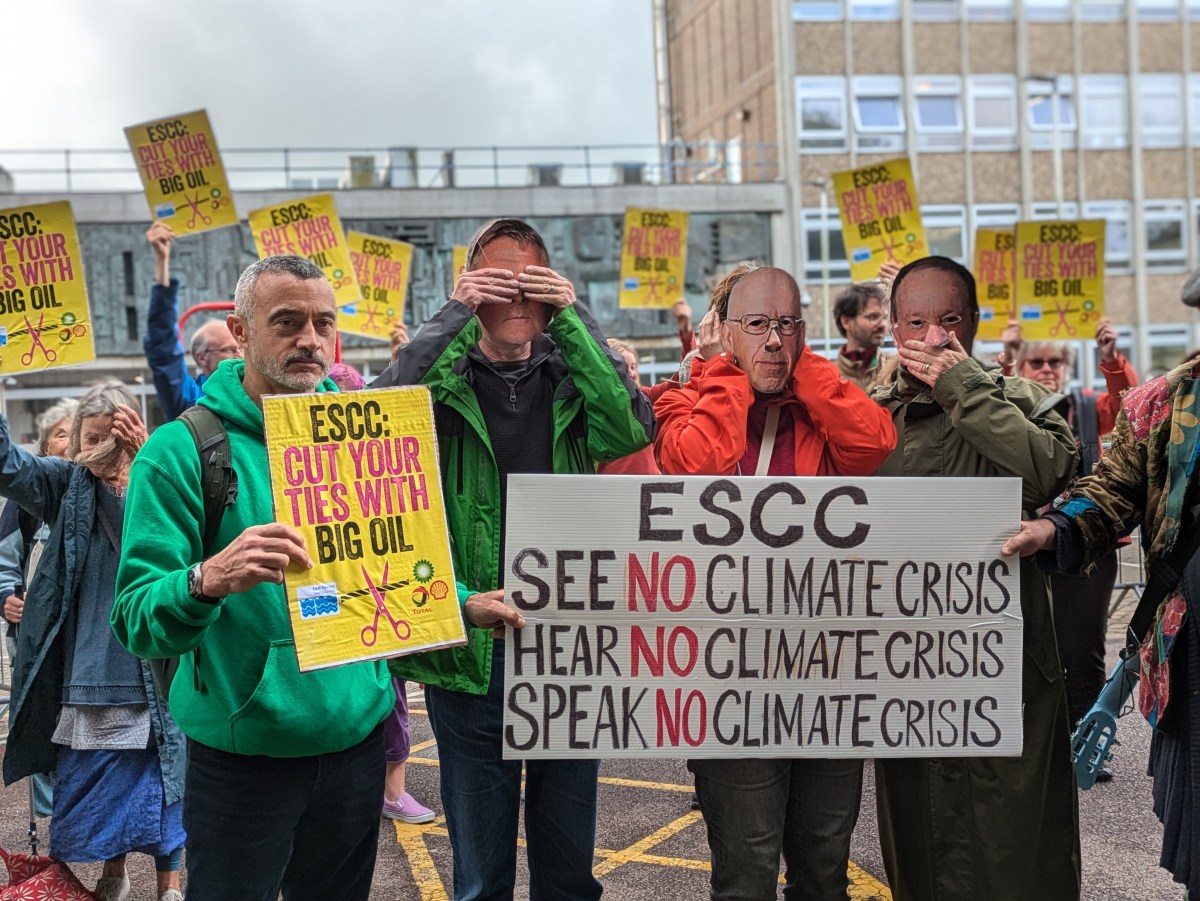

After the votes, a member of the pension fund in the public gallery accused the committee of “procrastination, prevarication, dither and delay”.

Jane Ripley, a scientist, mother and grandmother, read a statement which said despite an 11-year campaign the council had refused to divest from fossil fuels.

She said:

“We’ve written to you. We’ve invited you to debate. We’ve engaged in peaceful protest. We’ve repeatedly forced you as councillors to debate this issue amongst yourselves.”

She accused the council of spending £50,000 in the past two years on what she described as a “whitewash report” that “misrepresented divestment and ignored crucial evidence”.

“And then you spent a further year delaying today’s votes, eventually producing yet more ‘analysis’ crafted solely, it would appear, to justify continued inaction and further delay.”

Ms Ripley presented an award for climate inaction to the three councillors who voted against.

The committee chair, Cllr Gerard Fox, repeatedly told Ms Ripley to stop her statement. He paused the meeting’s livestream and asked divestment campaigners to leave the meeting.

UK Divest says five UK local authority pension funds (Waltham Forest, Southwark, Islington, Lambeth and Cardiff) have committed to divest fully from fossil fuels. South Yorkshire and Haringey have committed to divest from coal.

Many more local authorities have agreed motions to show support for divesting from fossil fuels. There are 46 in England, four in Northern Ireland, seven in Scotland and five in Wales.

The East Sussex pension fund has 85,000 members. Less than 2% of the fund is invested in fossil fuel companies, the council says. The fund’s policy favours engagement over divestment.

The most recent report to the committee found that a fossil fuel divestment policy could cost the pension fund about £79m from transaction costs and a shortfall in returns.

Sian Kunert, head of pensions at East Sussex, said costs could be incurred in removing a fund manager with an exposure to fossil fuels. Challenged by Greens councillor, Georgia Taylor, Ms Kunert said the total costs were unknown, “a finger in the air”.

East Sussex pension scheme is part of the ACCESS pool, which handles investments for eleven local authorities, with total assets of about £45bn.

Ms Kunert said investment outside the ACCESS pool would incur greater costs. But Cllr Taylor said the pension would not need to leave the ACCESS pool.

Cllr Taylor, who supported all three proposals, said:

“We all agree fossil fuels need to stay in the ground and the primary driver of global heating are carbon emissions from fossil fuels.”

She said:

“Having a divestment statement and commitment is really important, not least for reducing emissions, for which we are responsible.

She predicted the pension fund would have no fossil fuel assets in five years if investment continued in the current direction. Fund managers were increasingly interested in investments aligned to limiting warming to 1.5C, agreed at the Paris international climate conference in 2015, she said.

Cllr David Tutt, Lib Dem, who also supported the proposals, said:

“I genuinely believe there is a risk to continuing to invest in fossil fuels in the next five years and we will get a better return elsewhere.

“I believe fossil fuel investment is damaging to this authority. I believe there are better opportunities for this fund. The best option is to divest within the next five years.”

Cllr Fox (Conservative), who voted against all three divestment proposals, said the pension fund had an emerging income deficit, which would “become problematic in the early 2030s”. He said:

“We will need to invest in an income fund to pay pensions. There is only one income fund on the ACCESS pool that we could go to. This has a modest exposure to fossil fuels. Divestment would close off that opportunity.”

Cllr Fox said future prosperity would rely on both energy dense fossil fuels and renewables. The energy transition required rare earth metals, he said, which needed substantial fossil fuel input. Crop yields were also reliant on fossil fuels, he said.

“Without fossil fuels, people will freeze, starve and die.

“I am not saying we should not decarbonise. We are talking about divestment.”

Cllr Ian Hollidge, who also opposed the proposals, said the pension fund had a duty to provide safe and secure pensions for its members.

“If the council had to put more money into the fund it would be at the cost to council taxpayers.”

He said the council should not invest with one hand tied behind its back. He also said the UK’s 2050 legal commitment to reach net zero in 2050 was “about emissions, not about stopping using fossil fuels”.

Cllr Paul Redstone, the third opponent of the proposals, asked whether they would save carbon emissions. “If they do not save carbon, why are we doing it?”

William Bourne, an independent advisor to the pension fund, said exit from the ACCESS pool would not be feasible. He said the fiduciary duty of the pension administering authority meant that the power of investment must be for investment purposes only, not for wider purposes. He said the proposals before the committee represented investment for wider purposes.

After the meeting, Gabriel Carlyle, of Divest East Sussex, said this would be the group’s last attempt to secure fossil fuel divestment from the minority Conservative administration at East Sussex. Council elections are due in May 2025 and he predicted a change of leadership.

East Sussex failed divestment proposals

Proposal 1: The fund commits

- To make no new investments in fossil fuel extractors

- To fully divest from all fossil fuel extractor public equities and corporate bonds within five years

- To make no new private equity investments that include fossil fuel extractors.

Proposal 2: The fund commits

- To exclude (over a reasonable timeframe the public equity or corporate bond of any fossil fuel extractor that has failed to commit to ‘no new fossil fuels’ by the September 2024 Pension Committee meeting;

- Not to make any new private equity investments in such fossil extractors;

- To immediately inform our investment managers of this commitment so that they can take whatever actions they deem necessary in response

Proposal 3: The fund commits

- To make no new investments in thermal coal

- To fully divest from all thermal coal public equities and corporate bonds within one year

- To make no new private equity investments that include thermal coal

DrillOrDrop has closed the comments section on this and future articles. We are doing this because of the risk of liability for copyright infringement in comments. We still want to hear about your reaction to DrillOrDrop articles. You can contact us by clicking here.