A well at West Newton in East Yorkshire could be fractured in the next four to nine months, according to a partner in the project.

Reabold Resources, now the majority investor in West Newton, said it:

“anticipates re-entering and recompleting an existing West Newton well in Q4 2025/Q1 2025 [October 2025-March 2026] in order to establish sustained gas flow”.

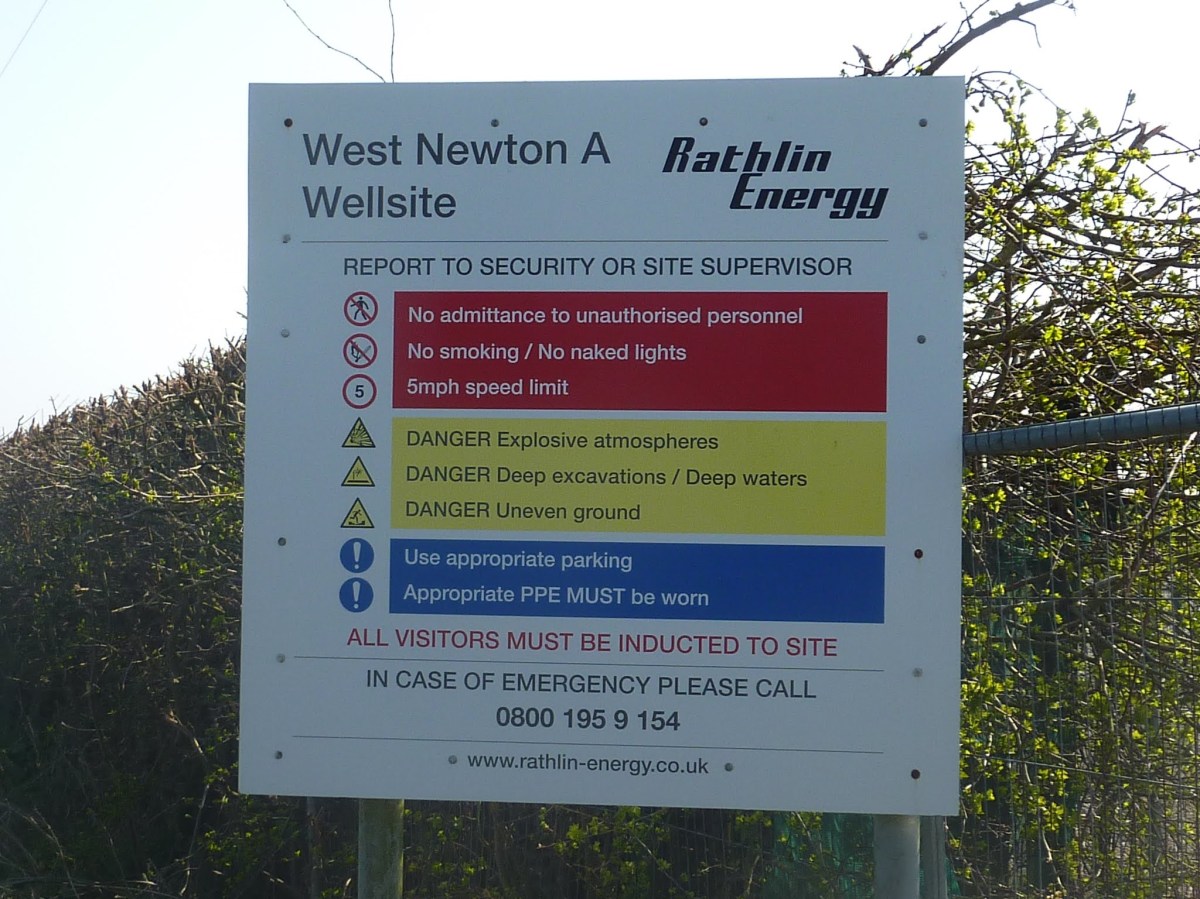

The company indicated that the operation would be on the A-2 well at the West Newton-A site at High Fosham.

Earlier this year, details emerged of plans for a form of fracking on the A2 well, in an application to vary the environmental permit.

The operation, which is carried out during well completion, is expected to use 60m3-70m3 of fluid and 12.5 tonnes of proppant, according to the application.

Reabold said the process, which it described as reservoir stimulation, was “a key step in fully de-risking the subsurface characteristics of the project at a limited cost”.

The low volume of fluid means the operation will not be covered by England’s moratorium on high-volume hydraulic fracturing. But it will need consent from the Environment Agency and the industry regulator, the North Sea Transition Authority (NSTA).

The timetable for the work was reported in Reabold’s annual accounts, published yesterday (11 June 2025)..

The work must be carried out by June 2026 under a work programme agreed a year ago by the NSTA.

Reabold, which now has a 79.8% stake in the West Newton operator, Rathlin Energy, said the work was expected to cost £1.4m and was fully-funded by the partners.

The West Newton-A site, at High Fosham, was constructed in 2013. The first well, A1, was drilled that year and tested in 2014.

The A2 well was drilled in 2019. There was an incomplete test on it also that year. Initially, the well was said to be targeting gas. But the focus switched to oil, only to go back to gas in 2022.

No work has apparently been carried out at West Newton-A since the A2 test was suspended in 2019.

No hydrocarbons have been produced at the site, nor from Rathlin’s other well pad, West Newton-B, at Crook Lane.

Questions over cash and obligations

Reabold said in its accounts said there was a “material uncertainty” that “may cast significant doubt” on the company’s ability to continue as a going concern in future.

It said there was “adequate cash” to meeting obligations for at least 12 months from the date of the financial statements. But the company added:

“Beyond the going concern period of assessment, the Group may exhaust its available cash resources within 18 months if additional funding is not secured. Funding could take the form of farmouts, asset sales or external funding at the subsidiary level.”

Reabold said it considered this scenario to be “remote” but added:

“Given that there is no guarantee that funding will be successfully raised, there is a risk that the group will not have sufficient financial resources to fund its short-term project funding requirements and therefore there exists a material uncertainty concerning the ability of the group and parent company to continue as a going concern.”

The accounts said:

“The directors are actively pursuing funding options and, whilst discussions are at an early stage, the directors are confident in the Group’s ability to secure the additional funding necessary to progress its strategy and realise the value of its assets.”

Key figures from Reabold’s accounts

Year ending 31 December 2024

Loss for the year: £3.4m (2023 £7.2m)

Cash and cash equivalents: £6.2m (2023 £5.4m)

Net assets: £38.9m (2023 £42.2m)

Exploration expenses: £0.3m (2023 £1.6m)

Administrative expenses: £2m (2023 2.2m)

Legal and professional costs (incurred following an attempt by a group of shareholders to remove the board): £98,000 (2023 £190,000)

Payments to co-chief executives: Sachin Oza £308,878; Stephen Williams £309,236

Total remuneration to directors and senior management: £1.124m (2023 £1.015m)

Total unused UK tax losses: £23.6m (2023 £21.4m)

Decommissioning costs for West Newton: £380,000 – expected to be incurred in 2033