DrillOrDrop’s review of the latest UK onshore oil data for April 2022: daily production at a 12 month low

Key figures

Daily production: 13,835 barrels per day (bopd)

Weight: 54,368 tonnes

Volume: 65,985m3

Volume of onshore as a proportion of UK total oil production: 1.77%

Volume of flared gas at UK onshore oilfields: 679 ksm3

Volume of vented gas at UK onshore oilfields: 107 ksm3

Headline of the month

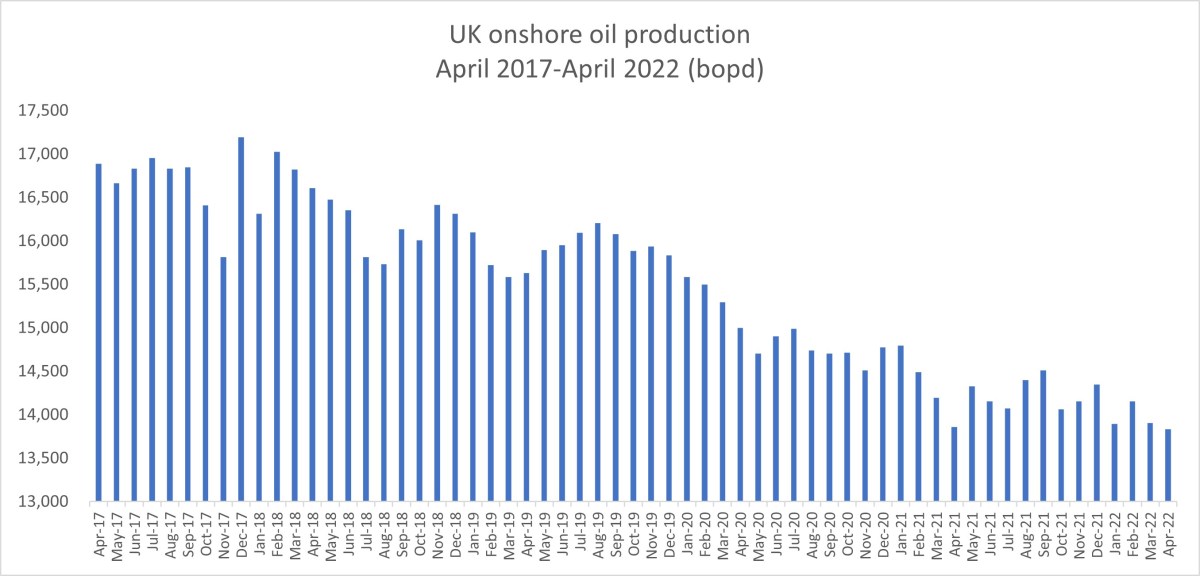

Daily UK onshore oil production fell to the lowest level for 12 months, down for a second consecutive month.

The data in this post was compiled and published by the North Sea Transition Authority (NSTA) yesterday (27 July 2022) from reports by oil companies. It is published about three months in arrears. All the charts are based on the NSTA data.

Details

Daily production

- Barrels of oil per day (bopd) fell to 13,835 in April 2022, the lowest level in the previous 12 months

- Bopd was down 0.5% on March 2022 and 22 barrels per day lower than in April 2021

- Compared with the highest producing month in the past 12 (September 2021), April 2022 was 5% down

- Despite high oil prices, there have been four months in the previous 12 months where daily onshore production was below 14,000 bopd

Volume and weight

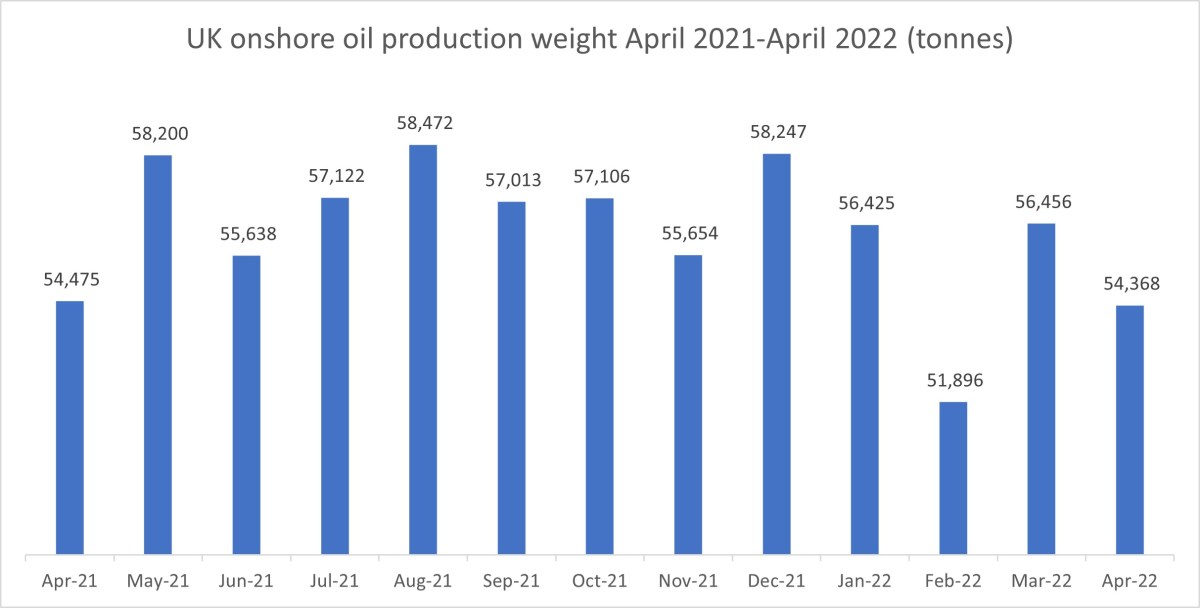

- Volume and weight both dropped in April 2022 to 65,985m3 and 54,368 tonnes

- Both measures were down 3.7% on March 2022, a bigger fall than would have been expected, given the shorter month in April

- April 2022 saw the second lowest monthly volume and weight in the previous 12 months

Contribution to UK oil production volume

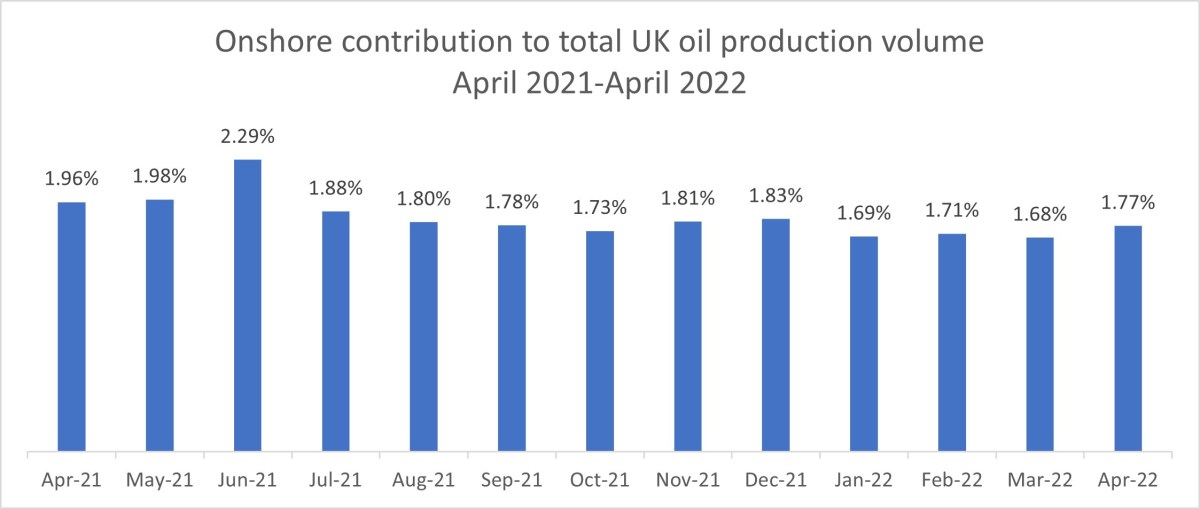

- Onshore oil’s contribution to the UK total rose to 1.77%, up from 1.68% in March 2022

- This was the highest monthly contribution to the UK total since December 2021

- The rise probably reflects a 9% fall in offshore production volumes in April 2022, compared with March 2022

Flaring and venting

- Despite the fall in onshore oil production, the volume of gas flared in UK onshore oil fields increased to 679ksm3 in April 2022

- This was a 22% increase on the volume in March 2022 and the four highest monthly level in the previous 12 months

- April 2022 saw the first monthly increase in flared gas in onshore oil fields since October 2021

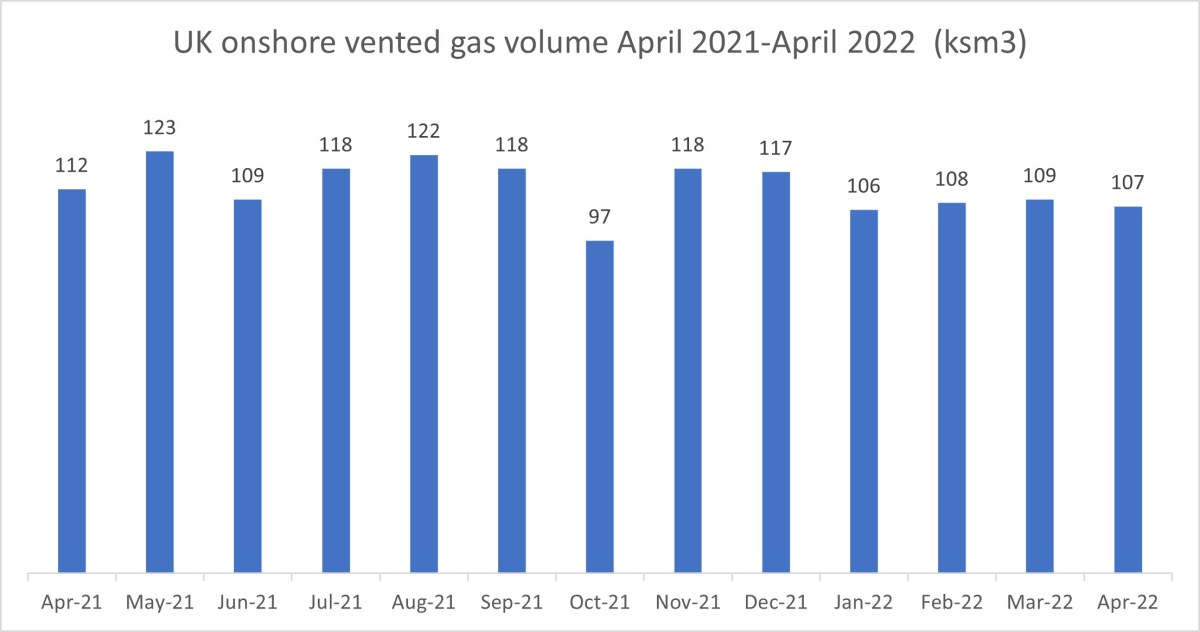

- Vented gas fell slightly in April 2022 to 107ksm3

- This was down 1.8% on March 2022 and 13% down on the 12-month high in May 2021

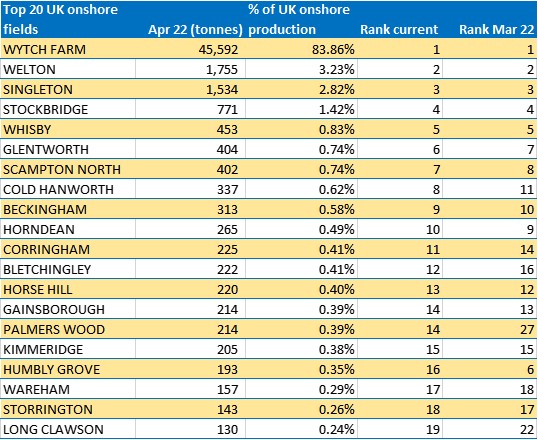

Top 20 fields

12 of the fields in the top 20 saw falling oil production in April 2022. Production rose in the remaining eight.

The largest UK onshore producer, Wytch Farm, in Dorset, saw production fall 3.98% to 45,592 tonnes or 55072m3 in April 2022, compared with the previous month. This was slightly more than would have been expected by the shorter month. This was the second lowest monthly total at Wytch Farm in the previous 12 months and the third lowest since February 2020. Daily production was down 0.78% from 11,770bopd to 11,678bopd, the third lowest level in more than two years.

Welton, in Lincolnshire, the second ranking UK onshore oilfield, saw production rise from 2,060 tonnes in March 2022 to 2,107 tonnes in April 2022 (or 1,716m3 to 1,755m3). This was a rise of 2.28%. Daily production in April 2022 rose 5.69% compared with the previous month to 442bopd.

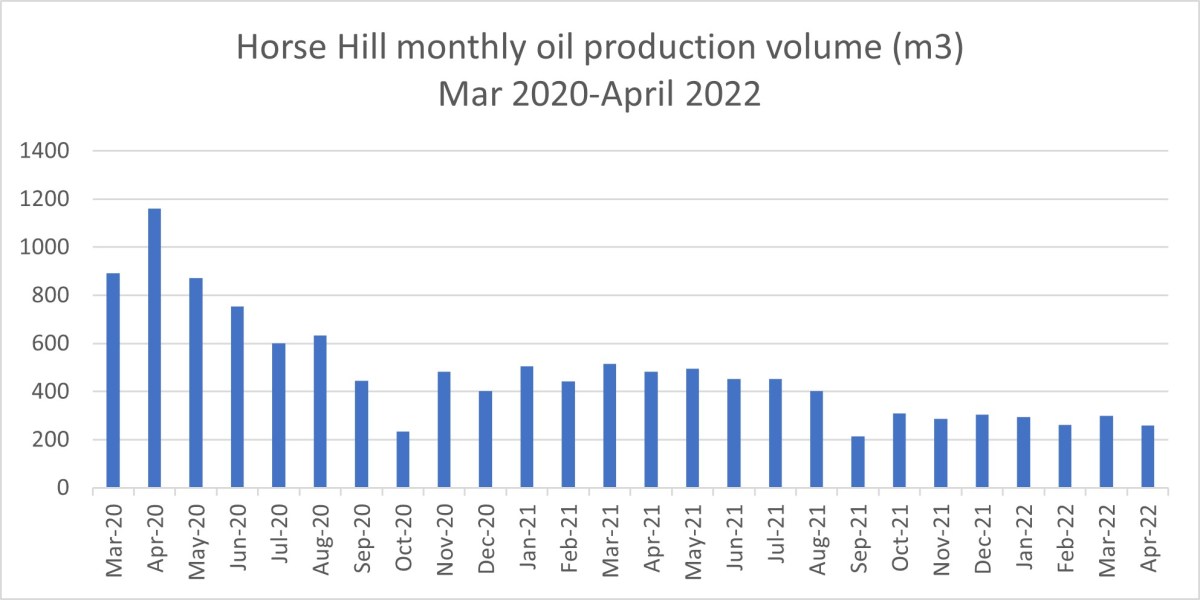

Oil volume at Horse Hill in Surrey, at 260m3, was 78% down on April 2020, the first full month of production at the site. Compared with March 2022, volumes in April 2022 were down 13%. The April 2022 figure was the third lowest since production began. The site slipped another place in the top 20 rankings to 13. Produced water volume in April 2022(141m3) was down 15% on the month before and was the fifth lowest in the past two years.

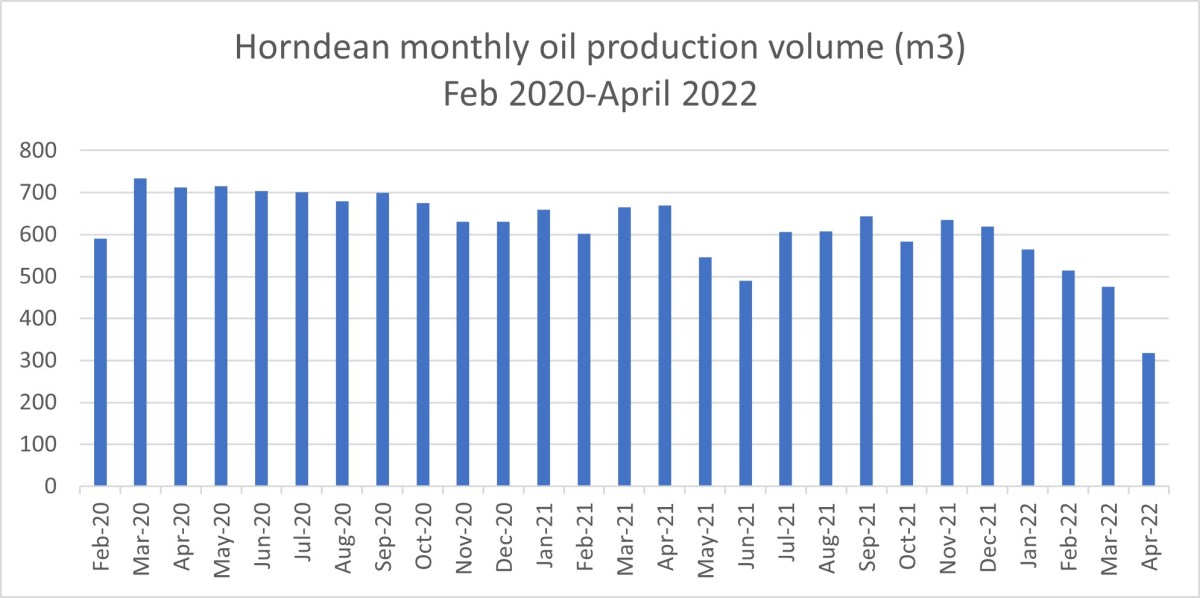

According to the data, Horndean, in Hampshire, saw a 33% fall in oil volume in April 2022, compared with the month before. At 318m3, this was the lowest volume produced by the site since November 2016. Daily production was also down 31% in April 2022 (667bopd), compared with March 2022. This figure was larger only than daily production in April 2011 and November 2016. The operator’s annual report, published in April 2022, had no reference to disruption of production at Horndean.

Oil production at fifth-placed Whisby, in Lincolnshire, fell 12% in April 2022, compared with the month before. But monthly volumes have remained above 500m3 for nine months.

Variable production continued at Humbly Grove (with a 59%) fall. There were also falling volumes from Gainsborough (14%), Storrington (6%) and Kimmeridge (5%).

The data suggests that production at Palmers Wood, in Surrey, rose 785%, up from 29m3 in March 2022 to 257m3 in April 2022. Production at this site has varied over the past two years, from more than 300m3 in February 2021 to zero for 13 months.

April 2022 also saw rises in production at Cold Hanworth (16%), Wareham (42%), Long Clawson (32%) and Crosby Warren (61%).

No production

There was again no production at 13 oilfields: Avington, Brockham, Duke’s Wood, Egmanton, Kirklington, Lidsey, Nettleham, Newton-on-Trent, Palmers Wood, Scampton, South Leverton and Waddock Cross.

In about a month, we expect to report on production data from Wressle, in North Lincolnshire, which got formal approval for production in May 2022, and Brockham in Surrey, where production resumed.

Operators

The UK’s biggest onshore operator, Perenco (Wytch Farm, Wareham and Kimmeridge), saw production fall in April 4% from 47,806 tonnes in March 2022. This is a slightly bigger fall than would have been expected by the shorter month in April and reflects an equivalent fall at Wytch Farm. The company’s share of UK onshore oil production dropped slightly from 84.68% in March 2022.

Production at fields operated by second-placed IGas rose for the third consecutive month. April’s total was up 1% on March 2022. The company’s contribution to UK onshore production was also up, from 12.75% in March 2022.

Total production at Europa Oil & Gas sites was up 62%, possibly reflecting increases at its Crosby Warren site. UK Oil and Gas plc saw production fall in line with lower volumes from Horse Hill. But the operator moved into fourth place, overtaking EP UK Investments, whose Humbly Grove site saw a large fall in production. Egdon Resources sites was down slightly but its contribution was marginally up.