DrillOrDrop’s review of the latest UK onshore oil data for July 2022: daily production falls at Wytch Farm to the lowest level for 10 years and the Gatwick Gusher slows to a trickle.

The NSTA updated the source data used in this article after publication. Please see the September 2022 article on UK onshore oil production for the most up-to-date data.

Key figures

Daily production: 13,293 barrels per day (bopd)

Weight: 53,967 tonnes

Volume: 65,515m3

Volume of onshore as a proportion of UK total oil production: 1.86%

Volume of flared gas at UK onshore oilfields: 656m3

Volume of vented gas at UK onshore oilfields: 124m3

The data in this post was compiled and published by the North Sea Transition Authority (NSTA) from reports by oil companies. This is published about three months in arrears. All the charts are based on the NSTA data.

Details

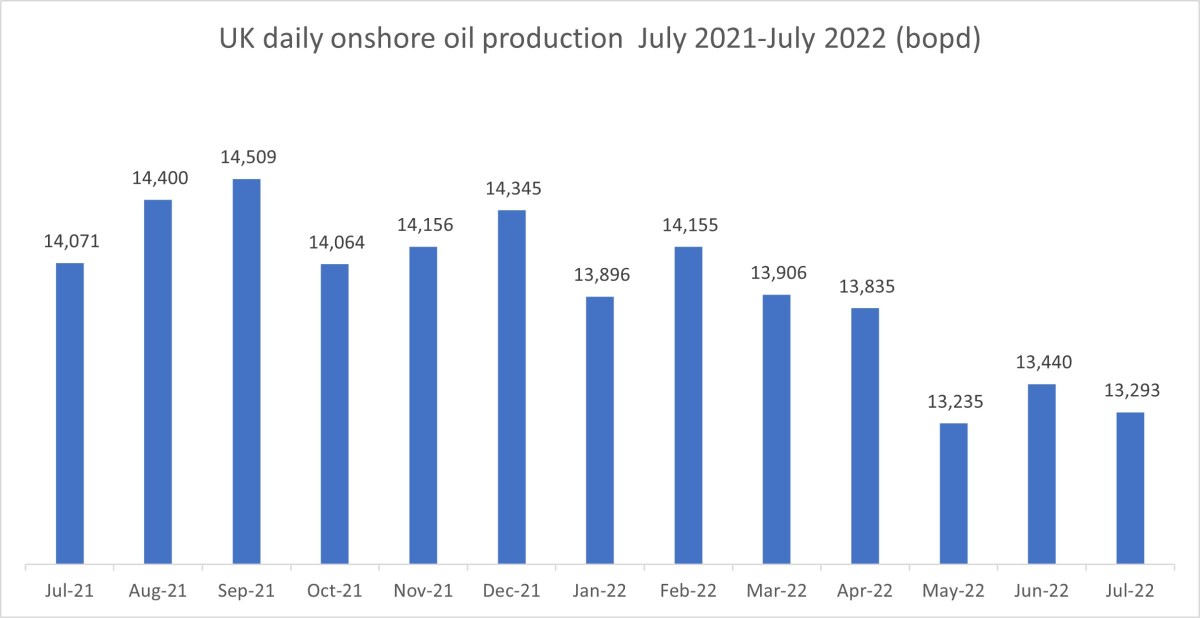

Daily production

- Total onshore barrels of oil per day fell 1% to 13,293bopd

- This is the second lowest level in the past year

- July 2022 was down more than 5.5% on July 2021

Volume and weight

- Volume and weight increased by more than 2% in July 2022, compared with the month before

- But the increase was less than would have been expected by the longer month

- UK onshore fields produced 3,155 fewer tonnes in July 2022, compared with July 2021

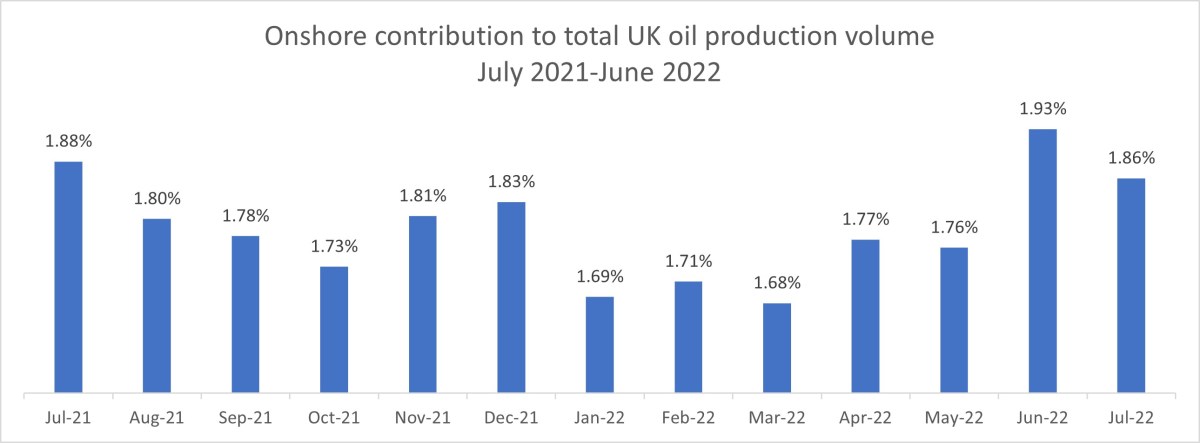

Contribution to total UK oil production volume

- The proportion of onshore oil to the UK’s total production fell from 1.93% to 1.86% between June 2022 and July 2022

- July 2022 was the third largest contribution in the past year

Flaring and venting

- Both flaring and venting of waste gases increased in July 2022

- Vented gas in July 2022 was the highest volume in the past year

- Flared gas was the fifth highest monthly volume in the past year

Top 20 fields

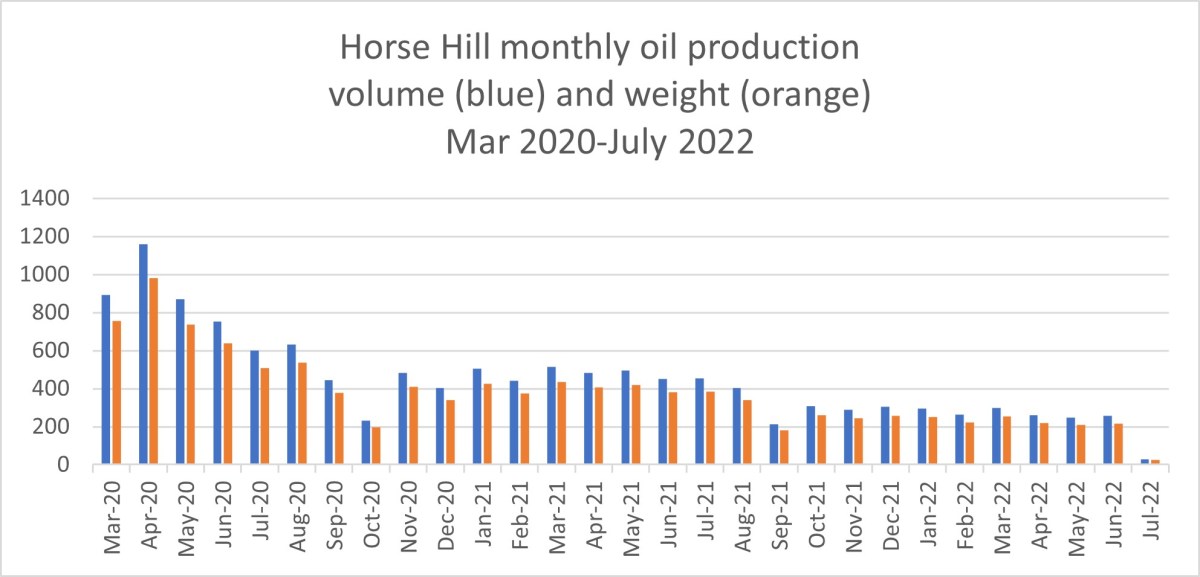

Horse Hill

This UK Oil & Gas site in Surrey, once nicknamed the Gatwick Gusher, dropped out of the top 20 producing fields in July 2022 as it reported the lowest ever figures on all measures since the well went into production.

Oil production weight dropped from 216 tonnes to 25 tonnes for the month, and from 53 bopd to 6 bopd. Volume was down from 256m3 to 30m3.

DrillOrDrop asked the Horse Hill operator for the reason for the fall. It did not respond. There have been no updates to July 2022’s figures on the NSTA database since they were published. The only recent formal statement about Horse Hill production was in August 2022. This said:

“Following the Environment Agency’s full Horse Hill production consent in May this year, a new Unico pump has recently been installed in the HH-1 oil producer. The prior pump is being refurbished as an additional spare. Preparatory work towards converting HH-2z into a produced saline water reinjector continues.”

Wytch Farm

Daily production at Wytch Farm, the UK’s biggest onshore producing field, fell to its lowest level since 2013. Barrels per day was down at 11,178 bopd.

The field’s contribution to UK onshore production fell in July from 84.70% to 83.51%. Weight and volume were both up slightly (0.76%).

Other fields

The Wareham field in Dorset rose from 16th to 9th place, with production weight up more than 60% from 181 tonnes in June 2022 to 297 tonnes in July 2022. This was almost as high as levels last seen in October 2021.

Production at the IGas field at Singleton, in West Sussex, rose 30% from 1,340m3 to 1,746m3.

Another IGas site at Welton, in Lincolnshire, saw volume fall more than 40% from 1,577m3 in June 2022 to o 906m3 in July 2022. The field dropped from 2nd to 5th place in the top 20. Its contribution to UK onshore oil dropped from 2.99% to 1.68%.

Humbly Grove in Hampshire remained volatile, almost tripling the volume of oil produced from 416m3 in June 2022 to 1,597m3 in July. It rose from 8th place to 3rd in a month.

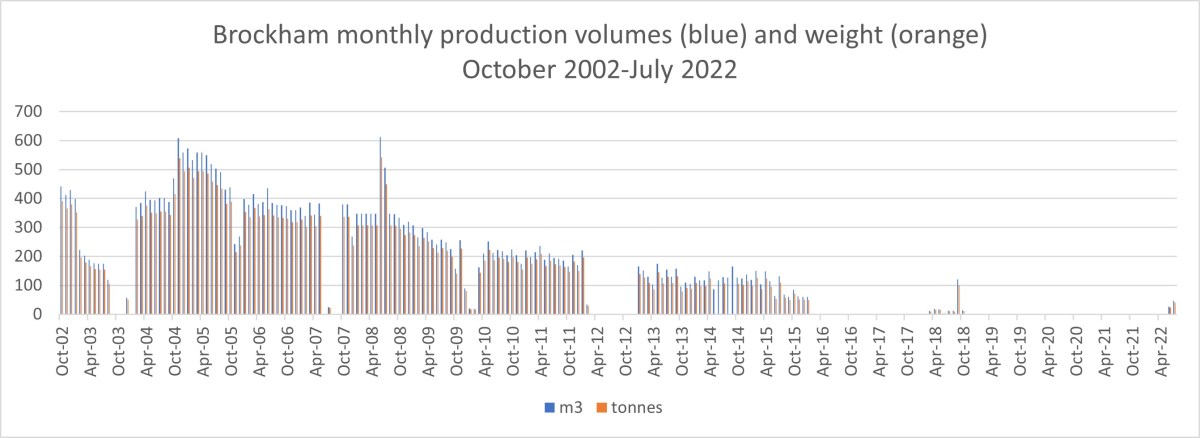

The Angus Energy site at Brockham in Surrey reported 40 tonnes of oil production in July, This represented 0.07% of UK onshore production, at a rate of 9 barrels per day. Production resumed at Brockham in June after a gap of nearly four years.

No production

No production was recorded at 12 onshore sites:

- Angus Energy: Lidsey

- Britnrg Limited: Whisby and Newton-on-Trent

- Egdon Resources: Dukes Wood, Fiskerton Airfield, Kirklington and Waddock Cross

- IGas: Avington, Egmanton, Nettleham, Scampton and South Leverton

Egdon’s Wressle site in North Lincolnshire has still not reported formal production data. It got approval for formal oil production in May 2022 and, according to the company, has been extracting oil at rates of 700 barrels a day during tests.

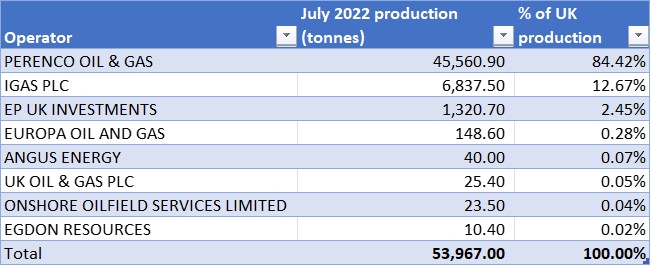

Operators

IGas plc remained below 7,000 tonnes for the second consecutive month, with another fall to 6,837. The company’s share of UK onshore production dropped slightly to 12.67%, down from 13.08% in June 2022. Five of the IGas oil sites did not produce. There has been no production at Avington in Hampshire since December 2017, Nettleham in Lincolnshire since February 2016 and Scampton, also Lincolnshire, since November 2014.

Britnrg Limited recorded no production for the second consecutive month.

Perenco, the UK’s biggest onshore oil producer, saw production rise slightly (from 45,105 tonnes in June 2022 to 45,560 tonnes in July 2022). But its share of UK onshore production dropped from 85.42% to 84.42%.

EP UK Investments increased its share of UK onshore oil from 0.65% to 2.45%, with increasing production at Humbly Grove.

The resumption of production at Brockham lifted Angus Energy from 7th to 5th place in the operator’s table. UK Oil & Gas dropped from 4th to 6th place, with the big fall in production at Horse Hill.

Egdon Resources rejoined the table with the resumption of production at Keddington.

From the Office of National Statistics:

“The UK imported £30.0 billion of oil in 2021 (£17.6 billion crude oil, £12.4 billion refined oil), and exported £28.3 billion of oil (£17.9 billion crude oil, £10.4 billion refined oil).

Norway was the UK’s main crude oil supplier in 2021, with 49.9% (£8.8 billion) of the total crude oil imports coming from Norway (Figure 5). Russia was the primary supplier of refined oil in 2021, with 24.1% (£2.9 billion) of total refined oil imports coming from Russia.

The UK primarily exported crude oil to the Netherlands (£6.2 billion) and China (£3.9 billion). Refined oil was mainly exported to the Netherlands (£2.4 billion) and Belgium (£2.1 billion).”

Perhaps reducing those exports could be achieved by reducing those imports, given how close the £figures are.

Except that assumes all oil is the same, Malcolm. It isn’t.

However, what could be cut out is the refined product from Russia-mainly diesel-and production of diesel at Fawley could have been expanded as planned. However, there are some who think it sensible to try and prevent local oil being available for that. Meanwhile the price of diesel is now 27p per liter above petrol and all those deliveries in diesel vans will be that much more expensive and ambulances will be costing more to get from A to B, reducing funding for nurses. The some are really something, aren’t they?

I’m well aware that all oil is not the same. Thanks for confirming you agree. Hence the claim that home produced oil will replace imports is incorrect. The UK imports diesel because it has insufficient capacity to produce it.

Yes, Malcolm, your final sentence is correct. Fawley Refinery had a £800m expansion plan to help correct that, whilst protestors were trying to interrupt even the current Fawley Refinery activities. Importing oil to then refine to value added diesel in UK has some pretty basic economic advantages in addition to security of supply. Not as ideal as using UK oil for the same purpose, but still an improvement on importing diesel and ending up with 27p premium per liter.

The some are really something, aren’t they?