The latest findings from the government survey of attitudes to fracking in the UK puts support at its lowest level since the question was first asked.

The results, published this morning, has support at 16%. This is three percentage points down on the previous survey carried out in spring this year and 12 percentage points down on the response in December 2013.

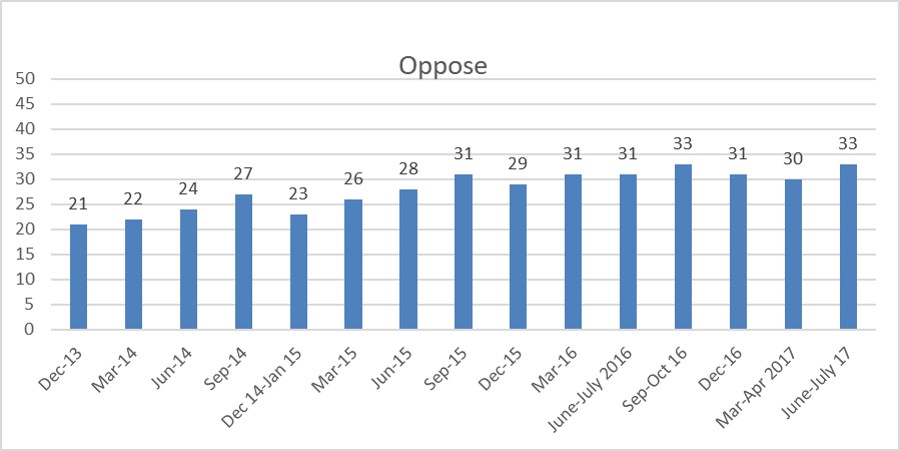

Opposition to fracking was up, at 33%, after falls in the previous two surveys. This was the highest level recorded by the survey, also reached in autumn 2016.

The gap between opposition and support was the largest recorded by the survey, at 17 percentage points.

Reaction

This survey, commissioned by Department of Business, Energy and Industrial Strategy (BEIS), is the second carried out since Cuadrilla began work at its shale gas site in Lancashire in January 2017. It is the first since INEOS submitted shale gas exploration applications for Derbyshire and Rotherham.

A spokesperson for Frack Free Lancashire said:

“The trend is evident – this industry continues to lose support day by day in spite of efforts to alternately buy local support and to attack local opposition using the sledgehammer of legal injunctions.

“It is clear that the fracking companies’ attempts to demonise protest are backfiring and that they are failing dismally to get the social licence they need to operate in our communities.

“Many those that expressed an opinion in favour of fracking cited increased employment, lower bills and using less fossil fuels as their reasons. These arguments are pushed strongly by the fracking PR machine but are almost totally without substance. As people become aware of the reality we expect to see a further decline in support for fracking as the scales fall from people’s eyes.”

Ken Cronin, of the industry body, UKOOG, said:

“These findings shows that the majority of respondents are either supportive or ‘don’t know. The industry will continue to work with local communities in an accountable manner with full disclosure.”

Elisabeth Whitebread, energy campaigner at Greenpeace UK, said:

“Communities don’t want the unnecessary industrialisation of our countryside for shale gas we don’t need. And more than three-quarters of people support renewables, so the government should listen to their own opinion polls, stay true to their manifesto promise, and support offshore wind and solar instead of a new fossil fuel industry.

“Concern about climate change is at its highest since 2012, and to meet our climate targets, we must leave fossil fuels in the ground. The fracking industry is pulling UK energy policy in entirely the wrong direction and the public is right to be concerned.”

Rose Dickinson, Friends of the Earth campaigner, said:

“This makes bad reading for the industry because they know they are desperately fighting an unwinnable battle for support. In just the last week INEOS has taken desperate measures to try and stop peaceful protest, and Cuadrilla had to deliver machinery under cover of darkness – all in a bid to try and force fracking on communities that don’t want fracking.

“The extent to which this industry has failed to win over the public is undeniable, opposition is increasing not only where fracking is proposed, but across the whole country.”

More on support and opposition

According to the survey, strong support for fracking had fallen to 2%, the lowest level recorded.

Strong opposition has risen for the second consecutive survey to 13% but is still one percentage point below the highest ever recorded by the survey in March 2016.

Participants who said they neither supported nor opposed fracking remained the largest proportion in the survey at 48%. This was down 1% on the previous survey and was the first fall since the survey carried out in June 2015. The number who said they didn’t know was up one percentage point at 3%.

Awareness

Awareness of fracking was 78%, up from 75% in the previous survey. Participants who said they knew a lot was still only 13%, but this figure was up from 10% in the spring. Participants who said they had never heard of fracking or shale gas was down slightly at 22%.

BEIS said awareness of fracking was highest among participants in social grade AB (90%), aged over 65 (90%), with incomes over 50,000 (91%) and homeowners (88%).

Reasons

The most common reason for supporting fracking remained “the need to use all available energy sources” (42%). This has continued to rise since December 2106 and the latest figure is an increase on the previous survey of seven percentage points. Other reasons for support, such as reducing dependence on other fossil fuels, cheaper energy bills and reduced dependence on other countries remained fairly constant. But “good for local jobs and investment” fell from 30% to 26%. “Positive impact on the UK economy” also continues to fall.

“Loss or destruction of the environment” remained the most common reason for opposing fracking. This saw an increase of eight percentage points in this survey to 68%. Other reasons, such as “risk of contamination”, “too much risk/uncertainty”, “risk of earthquakes”, “unsafe process” and “use of chemicals” saw falls of between nine and four percentage points.

Of participants who were neutral or did not know whether they supported or opposed fracking, 73% said this was because they didn’t know enough about it.

Methodology

The Wave 22 survey for BEIS carried out 2,097 face-to-face interviews in homes among a representative sample of UK adults, aged 16+. The interviews were conducted between 30th June 2017 and 4th July 2017 on the Kantar TNS Omnibus, which uses a random location quota sampling method. The questionnaire was designed by BEIS and Kantar Public drawing on a number of questions from previous surveys.

Link

Wave 22, the latest BEIS quarterly public attitudes survey

Categories: Research

Why won’t it be as cheap here? The USA has had the large scale drilling mania, the heavy machinery, the big roads, the wide open spaces and much OG infrastructure around for years. Furthermore, not only is there a surfeit of semi redundant drilling and gasfield companies who can offer keen rates when there’s an upswing in demand, there’s also been the habit of drilling more shale wells than needed – for completion at a later date. So the low prices and resilience to down/upturn cycles now established in th US is something that wouldn’t be gained for over a decade in the UK.

The ‘S’ curve I’ve mentioned before for a reason. The acceleration in energy storage technologies is going exponential in scale, viability and public acceptance. I suggest fibs and other investment management / lobbyist types do homework in this area and look at how that curve is going to overtake best projections for shale gas .

… The pro frackers would do well not to end up as the shame-faced advocates (even more so than you are already) that help delude the UK into investing in a messy, unclean and risky venture that will basically be unwanted within a decade (that’s even if tests go better than expected) and will have many legacy issues including unaccounted costs and impacts for health and environment.

Philip – it’s unwanted now 🙂

Agreed RF, but arguments still need spelling out for the undecided.