Fracking operation at Cuadrilla’s Preston New Road shale gas site. Photo: Cuadrilla Resources

Operators of a third of the UK’s newest onshore shale gas licences have been given more time for exploration.

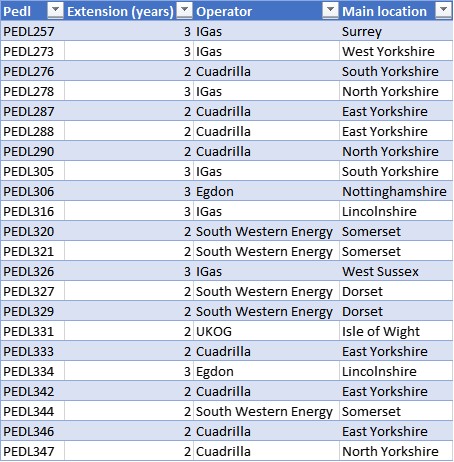

Regulators have confirmed that 20 licences awarded in 2016 to explore for shale gas had been granted extensions to the time allowed for seismic testing and exploratory drilling.

Data disclosed in response to a Freedom of Information request by DrillOrDrop shows that the fracking company, Cuadrilla, along with IGas, South Western Energy Limited and UK Oil & Gas plc got time extensions to all their newest licences.

Two-thirds of the licence extensions were in northern England and the East Midlands. The rest were in Somerset and southern England.

The data is another indicator of the slow development of shale gas in the UK. Even before the current moratorium on fracking, imposed in November 2019, no shale gas sites had been developed in the newest licence areas.

14th round licences granted extensions to their exploration term by the OGA. Source: OGA

There are currently 77 licences, known as Petroleum Exploration and Development Licences or PEDLs, awarded under the 14th round, four years ago. Of these, the main target of 59 was described by the OGA as shale gas.

Under the terms of the PEDL, operating companies committed to carry out work, such as drilling or testing, by the end of the initial or exploration term.

This deadline was originally set for 20 July 2021.

But the Oil & Gas Authority (OGA), which regulates licences, disclosed that this date has been extended for 22 PEDLs in 11 counties of England.

All but two of these PEDLs were granted to explore and produce shale gas.

14 PEDLs had a two-year extension until 2023. These were held by either Cuadrilla, South Western Energy Limited and UK Oil & Gas plc (UKOG).

Another eight PEDLs, held by IGas and Egdon Resources, were granted three-year extensions to 2024.

Company details

Cuadrilla

Cuadrilla’s eight PEDLs granted in the 14th round were all for shale gas exploration and in North, East or South Yorkshire. The company had committed to drill a total of nine wells and frack one of them by the end of the exploration term. Cuadrilla has made no planning applications for sites in any of its 14th round PEDLs.

Last year, correspondence seen by the FT revealed that Cuadrilla had asked the OGA to extend the terms of its fracking licences in England by “whatever time period the recently announced moratorium lasts”.

IGas

IGas got extensions to all six of its newest PEDLs.

Four were for shale gas exploration in Yorkshire and Lincolnshire (PEDLs 273, 278, 305 and 316). The other two (PEDLs 257 and 326) were for conventional hydrocarbons in Surrey and West Sussex.

IGas had committed to drill a total of seven wells in the licences by the original 2021 deadline but has submitted no planning applications.

South Western Energy

South Western Energy got two-year extensions to all five of its 14th round licences. PEDLs 320, 321 and 344 are in Somerset and PEDLs 327 and 329 in Dorset.

The company committed to drilling a total of five wells in the initial exploration term.

All South Western’s PEDLs were described by the OGA in 2016 as shale gas licences. That year, owner Geraint Williams predicted that he could be drilling for shale gas in Somerset by 2018.

But so far, there has been no drilling in any of South Western’s 14th round PEDLs. The company has submitted an application for conventional oil exploration at Puddletown, Dorset, in PEDL 327. No decision has yet been made on this application.

UKOG

UKOG was granted a two-year extension for PEDL331 on the Isle of Wight, its single licence awarded in the 14th round.

The company recently submitted a planning application to drill a vertical and horizontal oil well at a site at Arreton in PEDL331. The details were published this week but a public consultation has been delayed by the Covid-19 outbreak.

PEDL331 was described by the OGA in 2016 as a shale gas licence but UKOG has said it was not a fracking company and would not use fracking to extract oil on the Isle of Wight.

Egdon Resources

Egdon Resources got extensions to two of its four 14th round licences.

The extended licences are in Nottinghamshire (PEDL306) and Lincolnshire (PEDL334) and were both for shale gas. The company had committed to drill a well in each PEDL.

No extensions

The OGA’s data shows that up to May 2020, there have been no extensions to the 55 other 14th round PEDLs. Of these, 39 were for shale gas, eight for conventional oil or gas, one for coalbed methane and six for coal seam vents.

These licences are held by 13 companies. They include Ineos Upstream, which has the largest acreage of 14th round PEDLs, but has been granted no extensions.

DrillOrDrop has asked the Oil & Gas Authority how many extensions to 14th round PEDLs had been refused. We’ll update this post when then the regulator responds.

No work

So far, no site work has been carried out in any of the PEDLs granted in the 14th round.

The village of Marsh Lane from Bramleymoor Lane, where Ineos has permission to explore for shale gas. Photo: DrillOrDrop

Planning permission was granted to Ineos in 2018 for shale gas exploration at Harthill in South Yorkshire (PEDL 304) and at Marsh Lane in Derbyshire (PEDL300). There has been no activity at either site.

A decision has still to be announced on an Ineos application for a shale gas site at Woodsetts, in South Yorkshire (PEDL304).

Since the moratorium on fracking, some operators have said they are looking to conventional prospects, rather than shale.

Cuadrilla predicted no fracking would happen in 2020 and said it was investigating conventional oil and gas opportunities in the UK.

Egdon Resources, in its annual accounts, said it expected the moratorium to be lifted but said “in the short-term we will focus on our conventional resource portfolio”.

IGas said in its annual accounts it was writing off shale assets in north west England and was focussing its shale gas work on the Gainsborough Trough.

The award of PEDLs has become a free-for-all, where the cowboys move in and sit on acreage with no real intention of exploring them. They treat them as a trading asset – parasitic behaviour, in short, to inflate their share price.

Formerly, in the days of the Department of Energy, then DTI and then DECC, PEDLs were issued subject to a work commitment. If you didn’t fulfil this legal commitment you lost the licence. But now, with the semi-autonomous privatised OGA, licences are treated as private contracts between the agency and the operator. The work commitment (i.e. spending actual money shooting seismic and drilling wells within a realistic and defined time-frame) is regarded as an empty promise which the operator knows can be circumvented by a simple friendly call to its cronies in the OGA – like the schoolchild’s plea, ‘the dog ate my homework’. But now it’s along the lines of: We couldn’t get a rig, or, There are no seismic crews available, or (God forbid) those nasty protestors have blocked the road. OK – no problem, says Ms xxx of the OGA – here’s another two years to play with; makes our maps look better anyway, doesn’t it.

This goes against the whole ethos of licensing of a public good (i.e. the hydrocarbons in the ground owned by us, the public) in which, in most civilised countries, speculative licence acquisition is discouraged. Clearly this is no longer the case in the UK.

I speak with some experience, as probably the only person who has ever sat on both sides of the table at licence award interviews (not at the same time, of course!); once in 1984 on the DEn side when BP was being interviewed, and later when I represented a client in 2008 at a DECC interview, requesting (and getting) two PEDLs in the south of England.

Ouch bitter much….

1984 & 2008 was a while ago, hand me two sticks and I’ll rub them together akin to you primitive rhetoric! Probably the only person to have sat on the table during two interviews, who was the client?

I’ve worked extensively in industry and academia as well as more limited work with regulatory authorities but have never heard a single person praise his expertise or judgement – odd isn’t it!

For someone who spends a great deal of their time NOW David, joined with those trying to DELAY on shore oil and gas exploration, a bit rich to moan about the process being extended!

Perhaps, UK would be better off following the USA?

So. Companies should progress at a set rate, whether the price of oil is $20/barrel or $100/barrel?? I have yet to see that happen anywhere in the world, for any commodity, so I trust your clients were able to deal with the economics themselves.

‘Perhaps, UK would be better off following the USA?’

More than 200 North American oil and gas companies already went bankrupt between 2015 and the end of 2019. By that measure, the shale industry was in financial distress even prior to the global pandemic and oil market meltdown.

http://energyfuse.org/shale-bankruptcies-to-accelerate/

Well organised communities have pummelled UK onshore oil and gas exploration. The ‘delay’ is just the short time until it’s certain demise.

Think the subject was around licencing, and speed to develop, jP!!??

But, if you want to look at North American oil and gas companies, how about looking at the whole picture regarding the consolidation? Such as those companies who bought INTO North American shale during the period you mention? (Wonder how INEOS will get on?)

No wonder really, with 190 BILLION barrels of recoverable oil estimated from shale in USA (S&P Global Platts.)

And keep to the facts in UK. On shore oil in UK is continuing, although slowly, on shore gas in UK is continuing even more slowly-both perhaps something to do with how many fruit are left on the tree? On shore fracking in UK is sperate and for GAS, and may not continue. Your desire to mix up the whole “pallet” simply demonstrates a desire to confuse the picture. Strange approach really when the “fracker tracker” would indicate the undecided are not moved by such and the antis are already confused through not having much knowledge of the subject. For traditional on shore oil and gas, apart from a few, the majority are still using such and local production simply transfers production to a more local source. Just like a farm shop. So, unless you have found alternatives to all the oil derived products that are used jP, there will not be a demise any time soon. The question is whether we maximise using the “farm shop” and cutting out excessive transporting of stuff from around the world. Now, you may have investments in transportation that would explain such a desire, but I think you will find post Covid a rebalancing of trade to utilise local materials and services, where possible and practical.

MARTIN ,

Quote , ” Perhaps, UK would be better off following the USA? ”

So what would that be, to follow the US shale industry with some of the BIGGEST bancruptcies in history ?

I thought you could read, little green jack.

If you are having difficulty with that, ask someone to read you my first sentence of 9.02am.

(Nice to see you have woken up in that back seat of yours.)

But to accommodate the residue of your dream:

What is the Brent crude price now? Oh dear. Your previous excitement proven AGAIN by reality to be just that. Why the stabilising of oil prices?

“Oil at two month high with Chinese demand near pre virus levels.”

Surprised you are not over there, Jack, telling them they are mistaken too! Perhaps you could persuade them to re-introduce the one child policy and cease growth within their economy?

“Saudi Arabia excepted, by 2023 the Permian ALONE will be producing more oil than any member of the Organisation of Petroleum Exporting Countries, IHS Market, estimates.”

Covid-19 will probably delay that date, but not by much. Those $60k/year jobs for dishwashers will return. You will have another opportunity, Jack.

Let JACK help you understand MARTIN,

I’m referring to your comment at 8:53am, 21st May and what you try to imply.

Are you not conscious as to what you write on this page ????? …. Do your fingers have a life e of their own, are they disconnected from your brain ????

No MARTIN , the UK should not follow the US with its toxic , environmentally damaging , dangerous to human and animal health , climate changing , debt ridden, ponzi FRACKING scheme .

Landbanking by another name. Round here Fylde Borough Planning don’t even keep up to date records of how much residential property they have approved for construction. This number isn’t considered relevant when new projects are submitted to them.

Some good and very sensible news for a change:

https://www.theguardian.com/environment/2020/may/22/uk-approval-for-biggest-gas-power-station-europe-ruled-legal-high-court-climate-planning

“The UK government’s approval of a large new gas-fired power plant has been ruled legal by the high court. A legal challenge was brought after ministers overruled climate change objections from planning authorities.”

It would be even better if Drax switched their wood burning generation to gas burning and locally sourced gas was available.

Some good news then Paul!

Bring on the Gas… But haters are going to hate