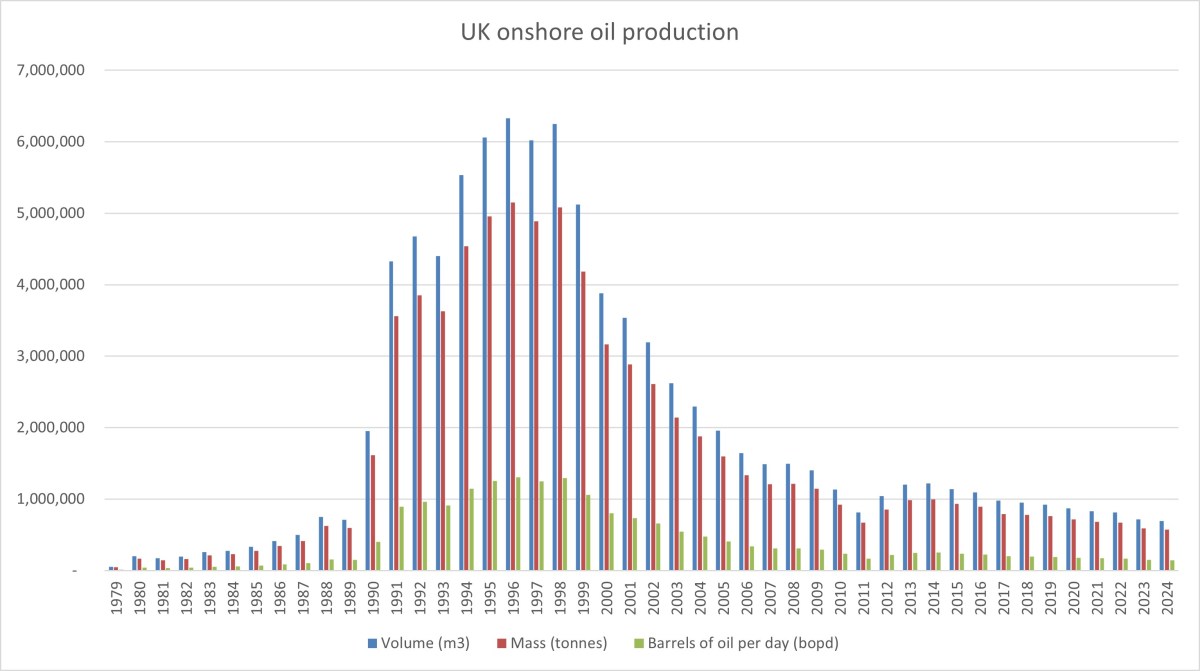

2024 UK onshore oil production fell for the 11th consecutive year to the lowest level for 37 years, according to official data published this week.

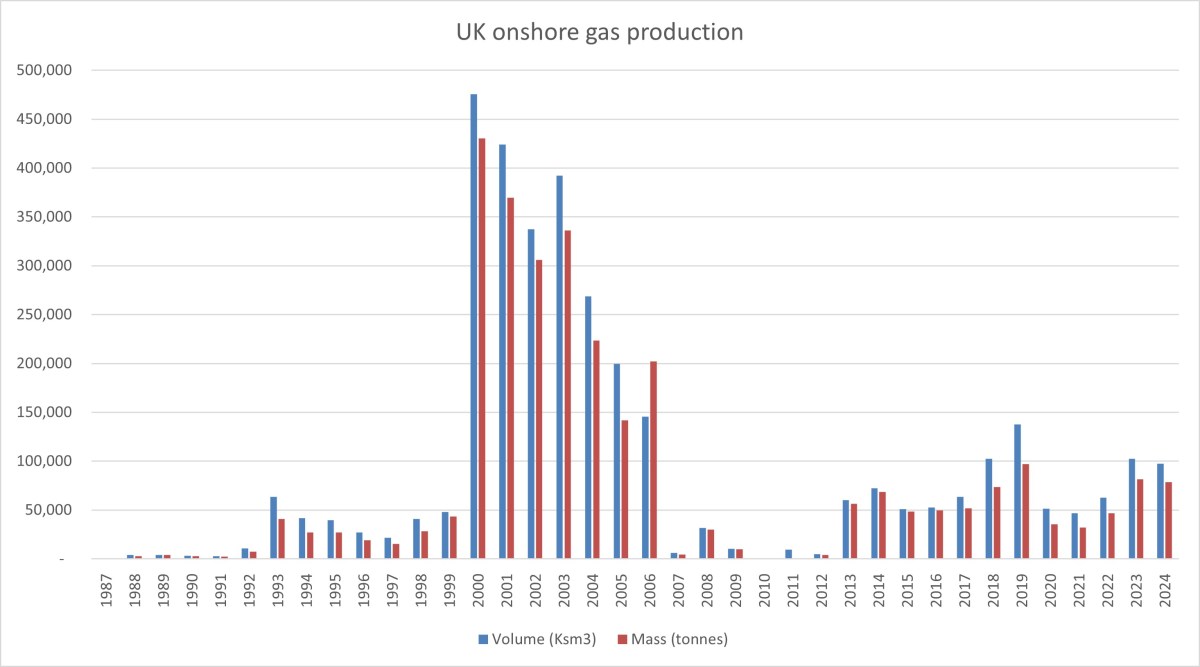

Onshore dry gas production in the UK was also down: 5% lower than the previous year but up on 2022.

Oil headlines

The data, from the industry regulator, the North Sea Transition Authority, showed the volume of UK onshore oil in 2024 was 693,761m3, down 3% on 2023 and down 15% on 2022.

The data also reveals that for onshore oil production 2024 was:

- The 11th consecutive year of falling onshore oil production volumes

- The 10th lowest production year since official records began in 1979

- The eighth consecutive year where onshore oil volume was below 1 million m3

- Well below the average (2,009,480m3) of the past 46 years

But the contribution of onshore oil to total oil production rose in 2024 to 2.07%, up from 1.88%. This probably reflects a 12% fall in UK offshore oil production.

Gas headlines

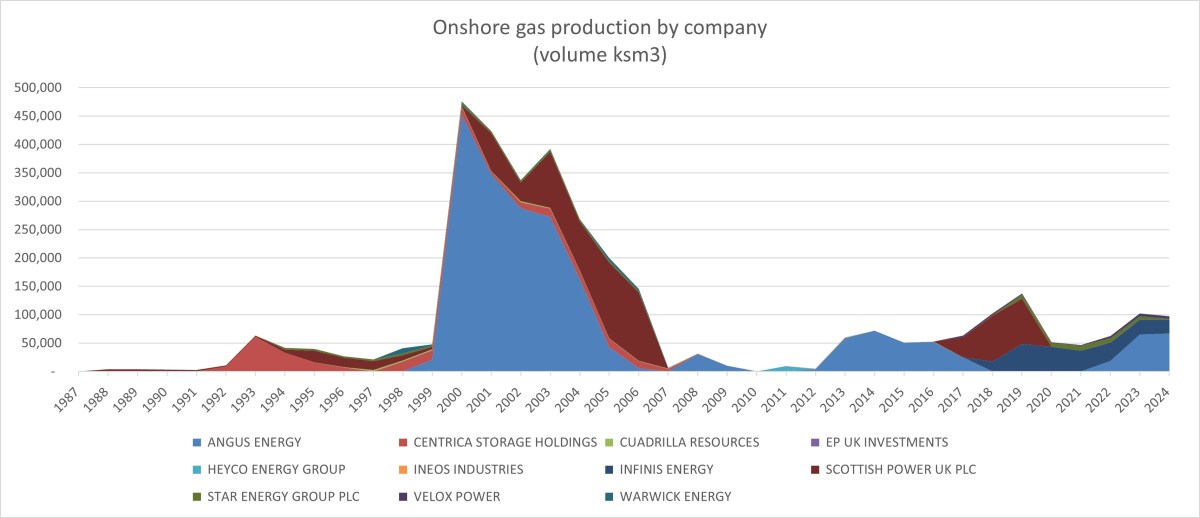

Onshore dry gas volume was 97,441ksm3 (thousand standard cubic meters), down 5% on the 102,329ksm3 in 2023 but 55% higher than the 2022 level (62,810ksm3).

The data also reveals that that the 2024 total onshore gas volume was:

- Above the average (92,486ksm3) for the past 38 years when onshore gas production data was first recorded

- The 11th highest annual onshore gas production since 1986

- 0.89% of total UK production, down from 0.96% of UK total gas production in 2023

All the charts in this article are based on data from the NSTA and analysed by DrillOrDrop.

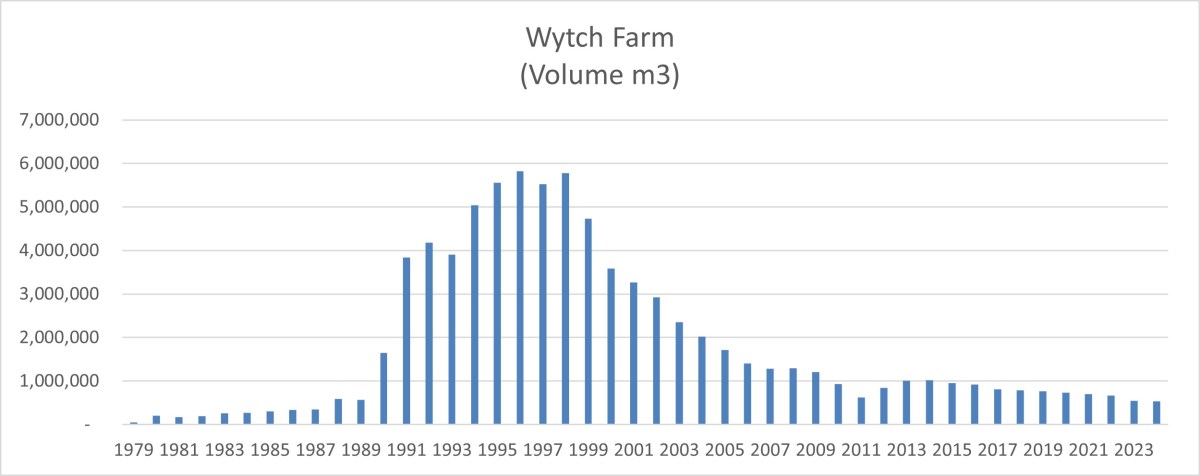

Oil down at leading fields

The UK’s largest onshore oilfield, Wytch Farm, saw production fall by 2% in 2024, compared with the previous year to the lowest level since 1987.

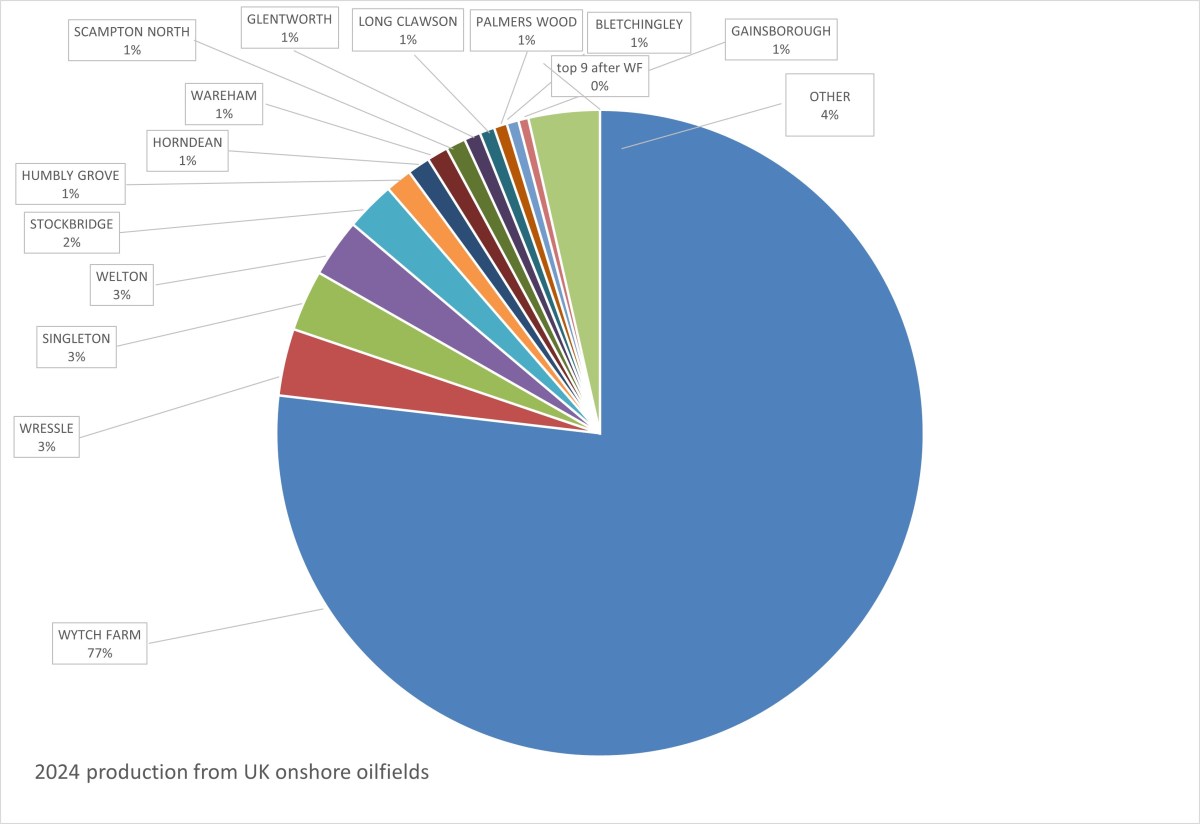

Wytch Farm’s contribution to UK onshore oil was up slightly at 76.9% in 2024, compared with 76.1% in 2023. But this is well below Wytch Farm’s average of 87.3% for the past 46 years.

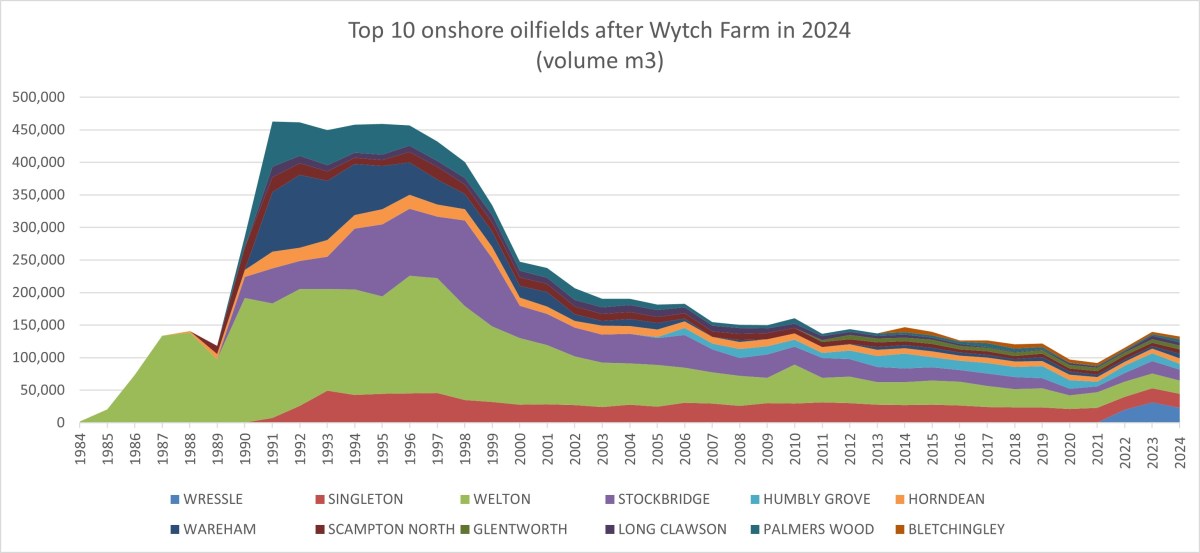

After Wytch Farm, the next nine highest-ranking UK onshore oilfields produced 118,464m3, 17% of the onshore total. This volume was slightly lower than in 2023 but higher than in 2022.

Production at Wressle, the UK’s second largest producer, was down 25% in 2024, compared with 2023. Wressle’s 2024 volume was 23,203m3, compared with 31,152 in 2023. The field’s contribution to UK onshore oil was also down, from 4.36% in 2023 to 3.34% in 2024.

Production also fell in 2024 at the next largest fields at Singleton (down 4%), Welton (down 11%), Stockbridge (down 12%) and Humbly Grove (down 33%).

There were increases in 2024 at Horndean (up 10%), Wareham (up 114%), Scampton North (up 25%), Palmers Wood (up 16%), Bletchingley (up 11%), Kimmeridge (up 6%), Storrington (up 68%) and Bothamsall (up 34%).

There was some production from 32 onshore oilfields in 2024. This was the same number of fields as in 2023. Brockham in Surrey resumed production after recording no production in 2021-2023. But 2024 saw no production at Egmanton in Nottinghamshire, which had previously reported oil data for 13 years up to 2023.

Gas up at Saltfleetby

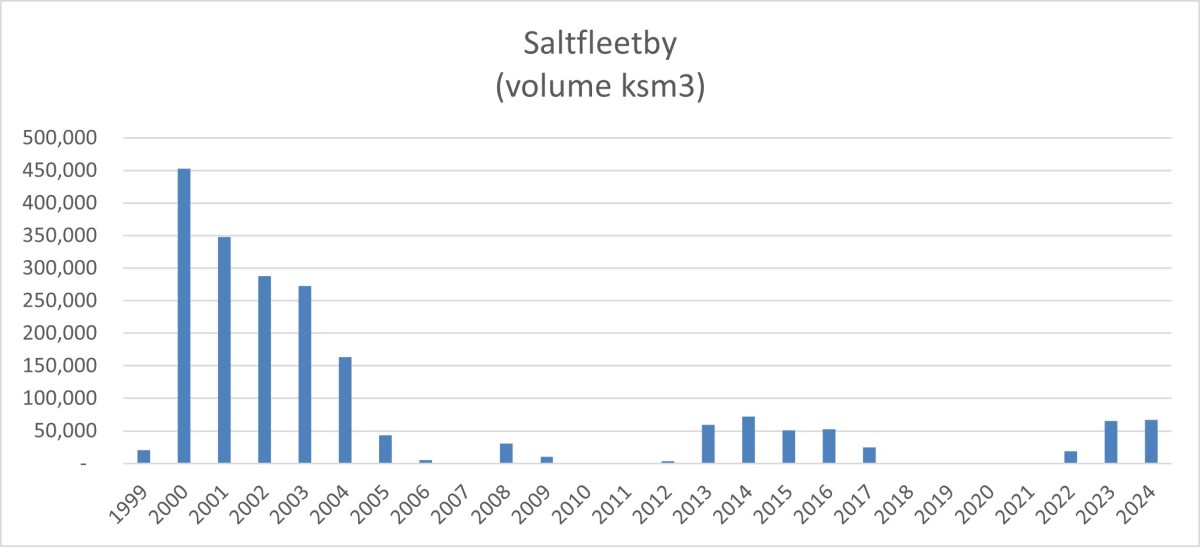

The UK’s largest producing gasfield, at Saltfleetby in Lincolnshire, saw production rise by 3% in 2024.

The field saw its highest output since 2014. But Saltfleetby’s 2024 total volume (66,980ksm3) was below the average (78,770ksm3) for the past 26 years in which it produced gas. The total was also a long way short of the peak year for production (452,812ksm3 in 2000).

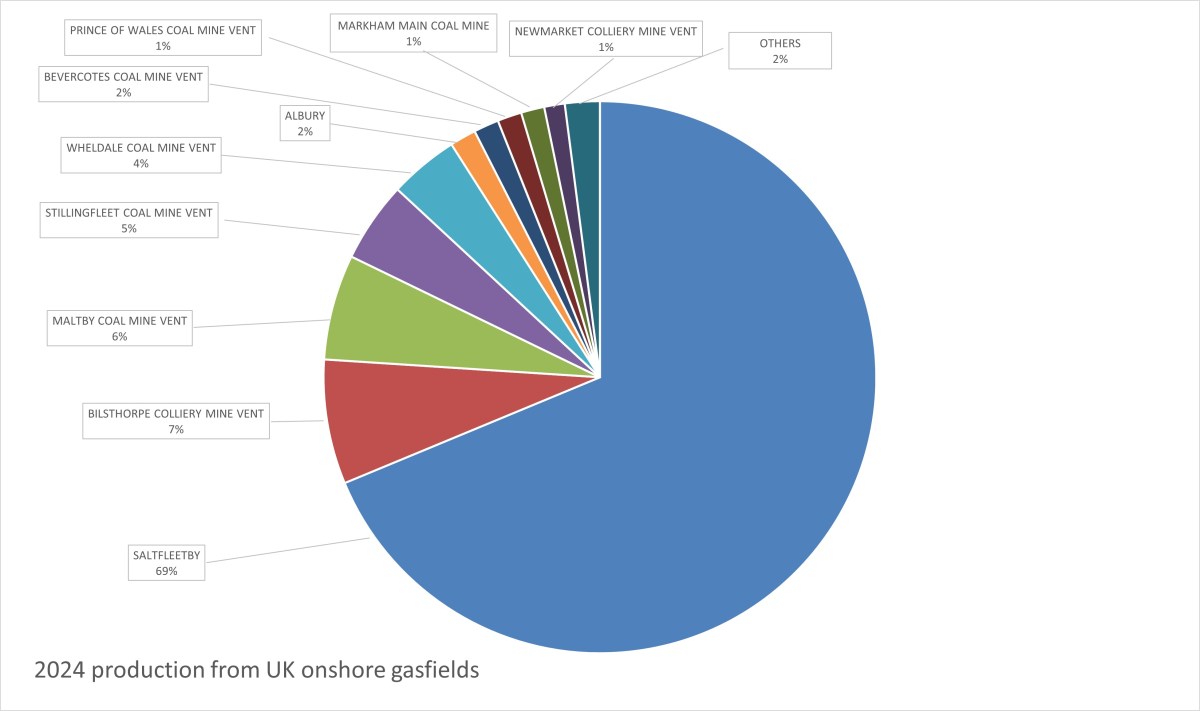

In 2024, Saltfleetby produced 69% of UK onshore gas. This was up on 2023 (64%).

The next four highest UK onshore gas producers were all coalmine vents. Together they produced 21,667ksm3, 22% of the onshore total. Their total production has declined slightly each year since 2022.

Albury in Surrey, the highest ranking onshore gasfield (not a coalmine vent) after Saltfleetby saw its production fall 76% in 2024, compared with 2023. DrillOrDrop previously reported Albury produced no gas from April-August 2024.

2024 saw a 44% fall in gas production at Cadeby Coal Mine Vent and falls at other former collieries at Maltby, Wheldale, Prince of Wales and Gedling. But gas production rose 33% at Newmarket Coal Mine Vent.

16 onshore gasfields produced in 2024, two more than in 2023. The additional two fields were Elswick in Lancashire and Mansfield coalmine vent in Nottinghamshire.

Company volumes

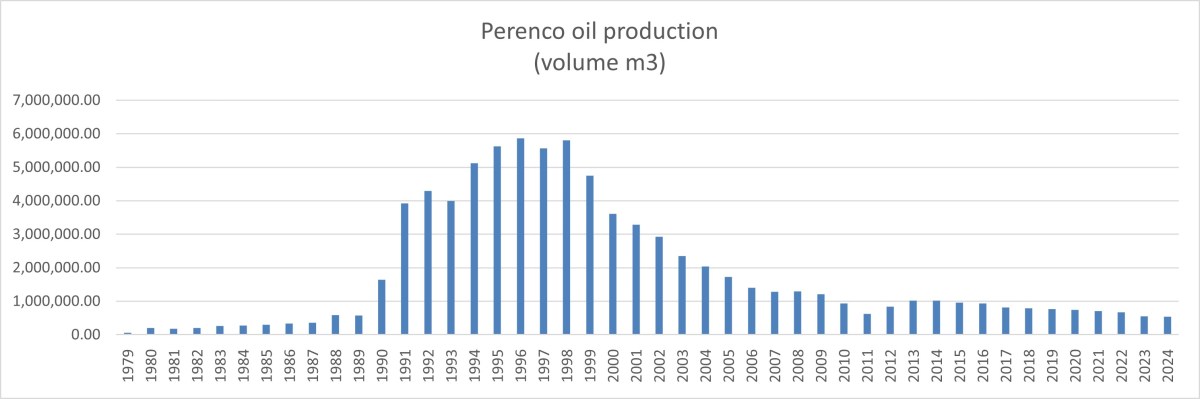

As in previous years, the Wytch Farm operator, Perenco, was the largest individual UK onshore oil producer, with 78% of UK onshore production, totalling 543,579m3.

Perenco’s total volume in 2024 was down 1% on 2023 (550,371m3) but the contribution to onshore production was slightly higher than the 77% reported in 2023.

The second-placed UK onshore oil producer, Star Energy (formerly IGas) saw a small fall (0.8%) in volume. But its contribution to total UK onshore oil production rose slightly to 16%, compared with 15% in 2023.

Heyco, the Texas-based owner of Egdon Resources, saw its total production fall 27%, largely because of lower volumes from Wressle. The company contributed 3% to total UK onshore production, down 1% on 2023.

2024 saw the lowest oil volume for UKOG since its production records began in 2020. The company’s 2024 total (mainly from Horse Hill in Surrey) was down 44% in 2024, compared with 2023 and down 74% on 2020.

This is mainly because of falling production at Horse Hill throughout the first half of 2024. In October, Horse Hill stopped producing because its planning permission was quashed by the Supreme Court. There was a small amount of production in November 2024 but none in December 2024.

Angus Energy produced 69% of UK onshore gas in 2024, all from its Saltfleetby site.

The second largest onshore gas producer, Infinis Energy, which operates coal mine vents, saw production fall for the fifth consecutive year, down 7% on 2023.

But the largest fall was at Star Energy, where total gas volumes were down 76%, because of suspended production at Albury.

Cuadrilla produced gas in 2024, for the first time since 2013, with the resumption of production at Elswick in Lancashire.

Ineos had no production in 2024, for the first time since 2011. The company did not produce at its Doe Green site in Cheshire during the year.

DrillOrDrop has closed the comments section on this and future articles. We are doing this because of the risk of liability for copyright infringement in comments. We still want to hear about your reaction to DrillOrDrop articles. You can contact us by clicking here.