Europa Oil & Gas Limited has been making headlines since it announced controversial plans a year ago for gas drilling and lower-volume fracking in the North Yorkshire village of Burniston, near Scarborough.

The company repeatedly said its proposal for a proppant squeeze did not amount to fracking, even though it used the term in correspondence with regulators. The process qualifies as fracking under the North Yorkshire minerals plan, supported by a legal opinion. Details here and here

The volume of liquid proposed for the Burniston proppant squeeze would exceed that used to frack Cuadrilla’s shale gas wells at Preston New Road. Those operations caused earthquakes in 2018 and 2019 and led to an injunction on fracking in England.

About 1,600 formal objections about the Burniston application have been made to North Yorkshire Council.

The planning application will be considered at a meeting of the council’s strategic planning committee in Scarborough on Friday 30 January 2026. Details

Company details

Subsidiary of: Europa Oil & Gas (Holdings) plc

Incorporated: 22 August 1995 by Erika Syba and Paul Barrett. They resigned as directors in 2008 and 2011.

Shares: Europa Oil & Gas Limited owns all the ordinary share capital of the company.

Largest shareholders: The largest shareholders of Europa Oil & Gas (Holdings) plc are: Hargreaves Landsdown, stockbrokers 20.78%; Interactive Investor 20.52%; HSDL Stockbrokers 8.23%. The largest private shareholder is Bo Kroll (7.78%), appointed nearly a year ago as non-executive chairman.

Total shares held by directors of Europa Oil & Gas (Holdings): 9.09%.

Current onshore interests

Operator

Europa Oil & Gas Limited is the operator of three UK onshore licences:

- PEDL343 (40% holding) Cloughton/Burniston, North Yorkshire (initial phase just extended for two years to March 2028)

- DL1 (100% holding) Crosby Warren, North Lincolnshire

- DL3 (100% holding) West Firsby, Lincolnshire

(Source: NSTA licence data)

Other licence interests

Europa Oil & Gas Limited also holds interests in:

- PEDL180 (30%) Wressle oilfield, North Lincolnshire, operated by Egdon Resources UK Limited

- PEDL182 (30%) Wressle oilfield, North Lincolnshire, operated by Egdon Resources UK Limited

(Source: NSTA licence data)

Key people

William Holland

Chief executive since March 2023, replacing Simon Oddie. Formerly Europa’s chief financial officer. Previously worked as an engineer with Halliburton in the North Sea and West Africa. He later led teams at Macquarie Bank Limited on equity investment and pre-production structured debt for upstream exploration and production companies. He currently holds 1.31% of shares in Europa Oil & Gas (Holdings) plc

Bo Kroll

Non-executive chairman of Europa Oil & Gas (Holdings) plc since February 2025, replacing Brian O’Cathain. Bo Kroll has a current stake in the holding company of 7.78%. He was born in Denmark in May 1957 and has a degree from the country’s Technical University. Former geophysical engineer with Schlumberger. Currently also chair and CEO of SeeRealTechnologies which works in holographic 3D displays.

Alastair Stuart

Chief operating officer since April 2023. He has Worked with Europa since 2012. He began his career with Total CFP in Paris, before joining Enterprise Oil with the North Sea and the Far East.

Plans

Burniston

Europa Oil & Gas Limited has submitted applications for planning permission and environmental consent to construct a wellsite, drill an appraisal well and carry out proppant squeeze operations, a lower-volume form of fracking.

The planning application is due to be considered on Friday 30 January 2026 in Scarborough.

The environmental permit is being considered by the Environment Agency. This month, the North Sea Transition Authority extended the initial phase of PEDL343 for two years until March 2028.

Wressle

Europa Oil & Gas Limited is a partner in a proposal to drill two development wells and build a gas export line at the Wressle oil site in North Lincolnshire.

Planning permission was granted in September 2024 but later rescinded following a legal challenge based on the Supreme Court judgement in the Finch case.

A revised application has not yet been decided. The 2024 accounts said:

“these activities remain contingent upon the budget being approved by the JV partnership and the availability of a suitable rig”.

The accounts estimated total net cost of the Wressle plans to Europa at £1.3m in 2025 and £2.5m in 2026.

Crosby Warren

Europa Oil & Gas Limited reported in interim accounts in 2025 that it was looking at optimising production at Crosby Warren through a workover programme.

Finances

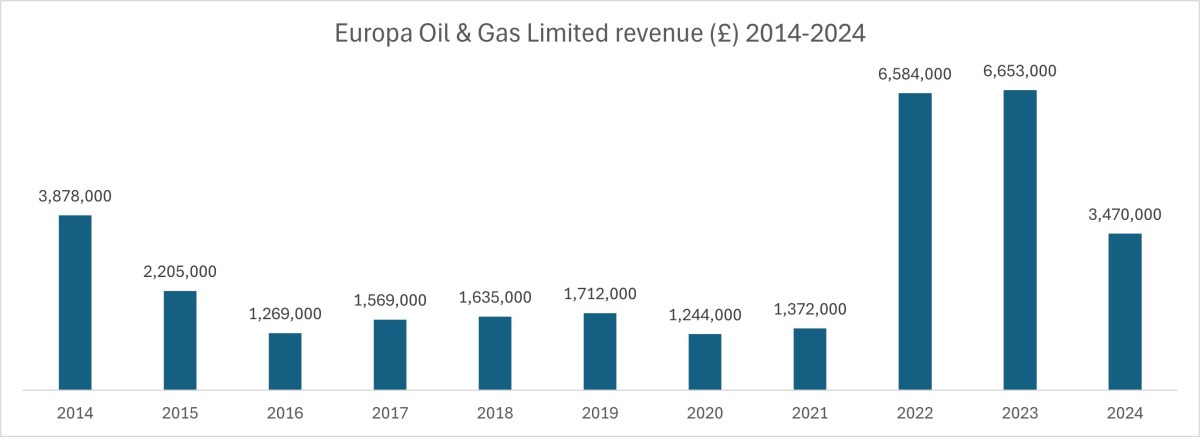

Europa Oil & Gas Limited reported revenue of £3,470,000 for the year to July 2024, the most recent published accounts. This was almost half the revenue achieved in both 2023 and 2022.

Since 2022, the company’s onshore production has been dominated by its share of oil from Wressle. On average, Wressle represented 79% of the total. The remainder was from Crosby Warren and West Firsby.

The company reported in 2024 it was dependent on the parent holding company for further financial support and not calling in an intercompany loan. Europa Oil & Gas Limited said:

“For the Group to pursue all of its capital projects in a timely and efficient manner it is likely to require additional funding during the going concern period to enable it to meet its obligations as they fall due. In addition, should either or both of the extreme downside scenarios materialise, the need for further funding could be accelerated.”

Key financial figures 2024

Source: Europa Oil & Gas Limited company accounts for year to 31 July 2024

Total net production of onshore fields: 137 bopd (2023: 265 bopd)

Europa’s share of Wressle production: average 107 barrels of oil per day (2023: 213 bopd)

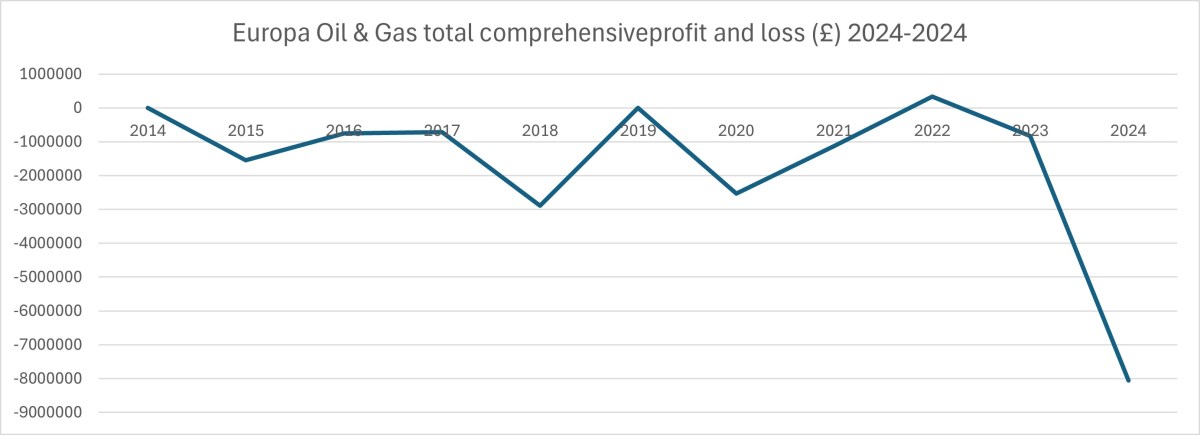

Comprehensive loss for the year after taxation: £8,062,000 (2023: £836,000)

Dividend payment: £nil (2023: £nil)

Revenue: £3,470,000 (2023: £6,653,000)

Gross profit: £252,000 (2023: £3,385,000)

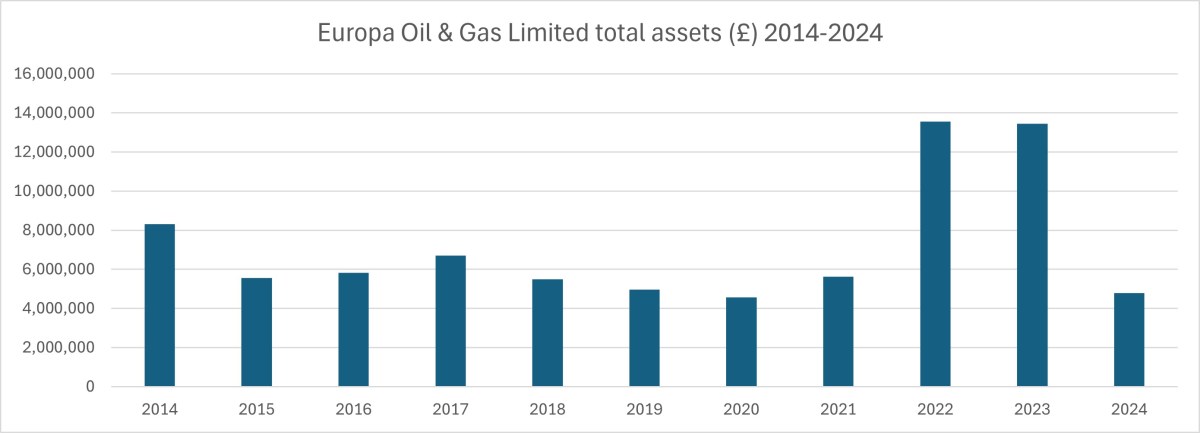

Total assets: £4,794,000 (2023: £13,449,000)

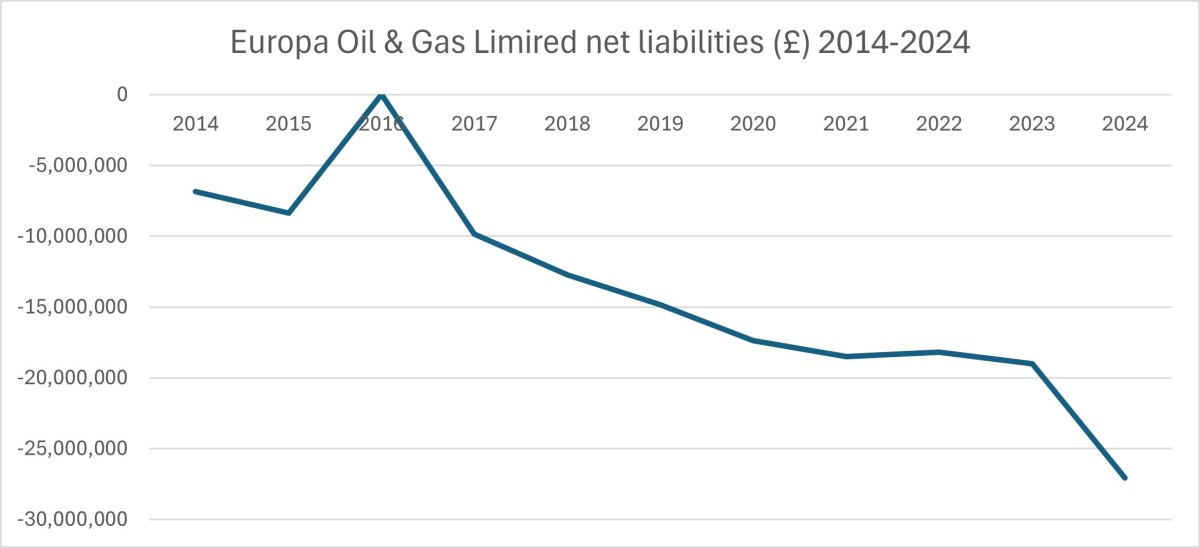

Total liabilities: £31,869,000 (2023: £32,462,000)

Net liabilities: £27,075,000 (2023: £19,013,000)

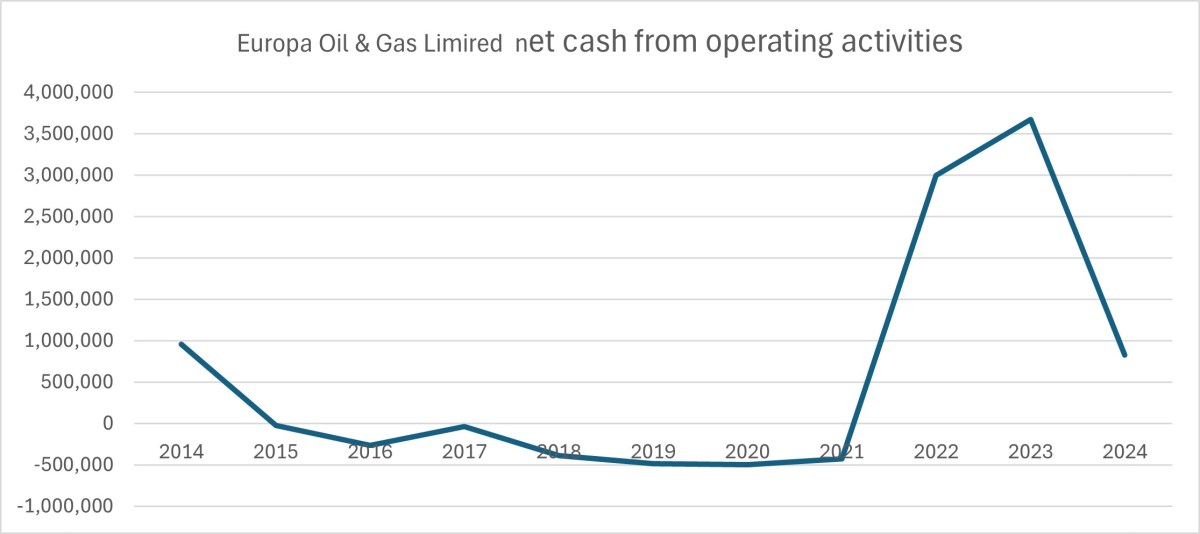

Net cash generated from operating activities: £826,000 (2023: £3,661,000)

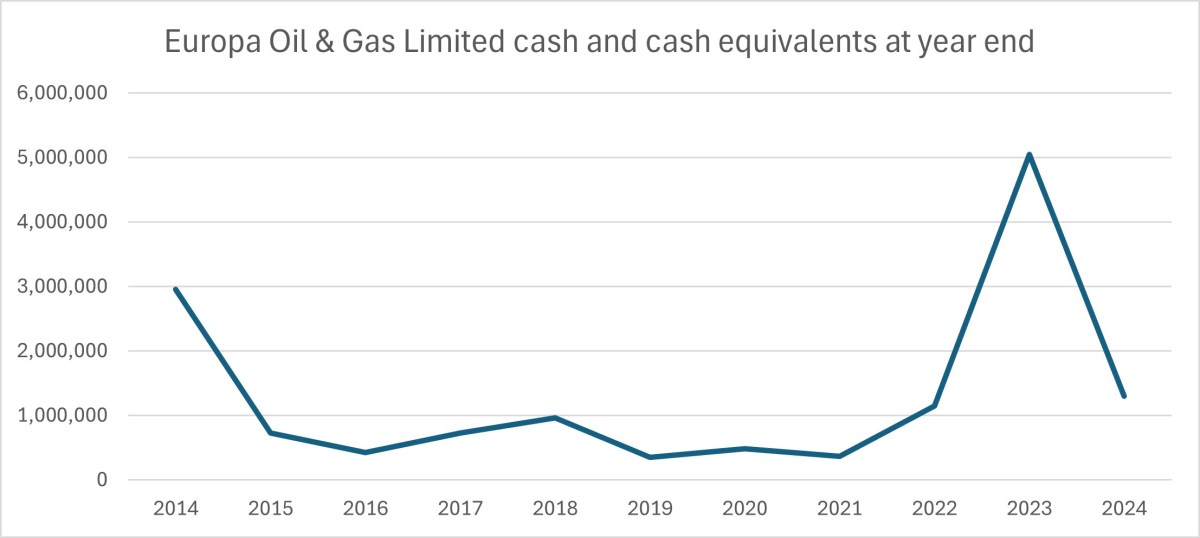

Cash and cash equivalents at year end: £1,300,000 (2023: £5,044,000

Staff costs: £319,000 (2023: £291,000)

Key management personnel paid by another group company

Average number of employees, including directors: 4 (2023: 5)

Exploration write-off: £4,998,000 (2023: 0) Largely the Serenity North Sea licence

Total long-term borrowing: £26,327,000 (2023: £27,582,000. Loan from Europa Oil & Gas (Holdings) plc in place since 2008. £3.6m repaid in 2024 (2023: £1.2m)

Financial trends

Source: Europa Oil & Gas Limited company accounts

Key financial activities

November 2025 funding sought for Burniston. Europa and its partner, Egdon Resources, announced they were seeking to raise £6.5m to drill the proposed Burniston appraisal well and carry out a 3D seismic survey. The two companies are jointly offering up to a 40% interest in the project. They jointly hold 80% of the exploration and development licence.

May 2025 Revenue Swap Agreement. Under an agreement with an Canadian investment company, Europa received an upfront payment of $500,000 in exchange for 4.5% of the remaining gross revenues generated from oil production at the Wressle well

December 2024 termination of Whisby-4 royalty agreement. Europa announced it terminated the royalty agreement with BritNRG, operator and licence holder of the Whisby field over the Whisby-4 well.

Onshore production

Wressle

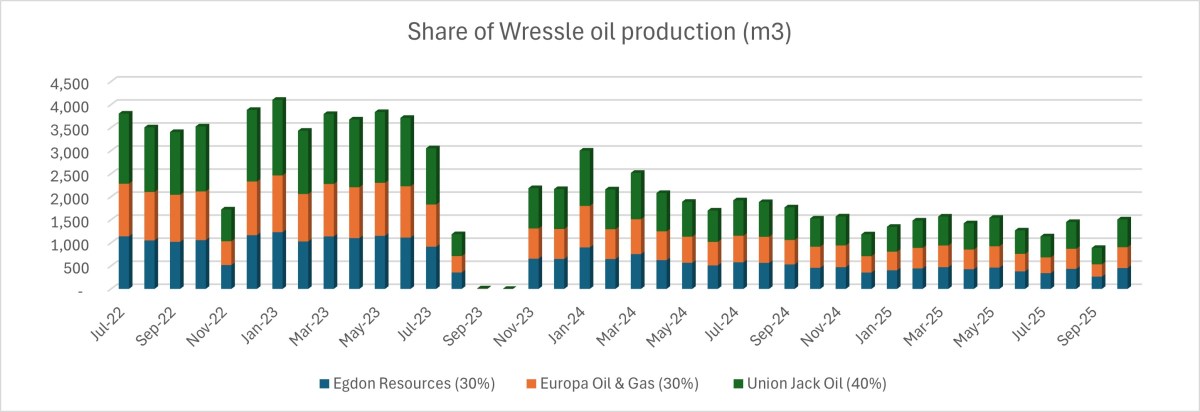

The majority of oil production recorded by Europa Oil & Gas Limited is from its 30% share in the Wressle licence.

But Wressle production volumes fell after the peak in 2023.

- 2022 Europa share of Wressle (6 months): 5,953m3 of total 19,843m3

- 2023 Europa share of Wressle (12 months): 9,346m3 of total 31,152m3

- 2024 Europa share of Wressle (12 months): 6,961m3 of total 23,203m3

- 2025 Europa share of Wressle (10 months): 4,086m3 of total 13,619m3

Source: NSTA formal production data. This data does not include oil produced during well testing.

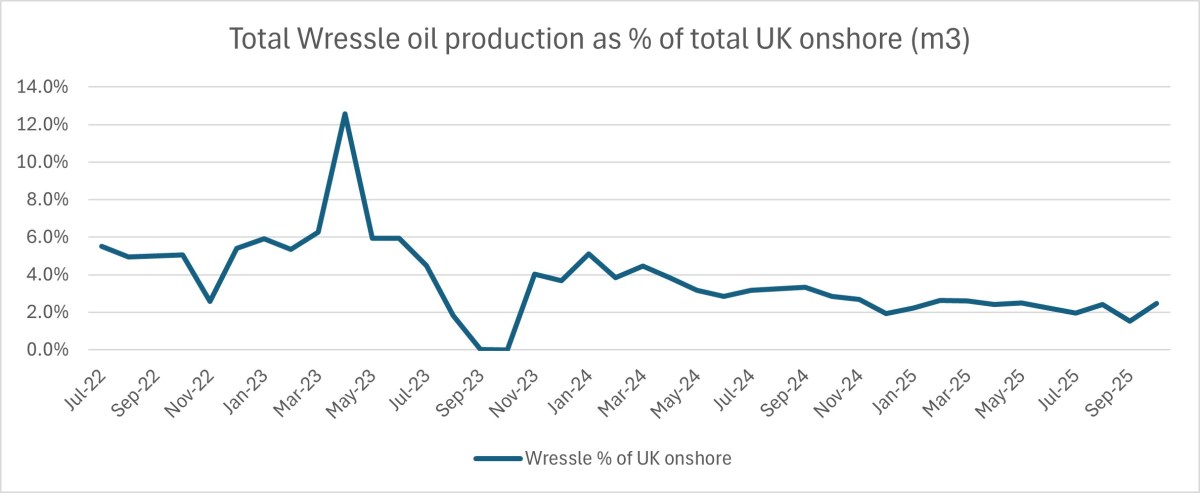

In the past year, Wressle oil production represented on average 2.3% of the UK onshore oil total.

In the initial month of formal production, Wressle produced 5.5% of the UK onshore total.

But this was exceeded in only three of the following months. Of these, two (March 2023 6.3% and April 2023 12.6%) were when production at the UK’s largest onshore producer was suspended because of a pipeline leak in Poole Harbour. (Total onshore oil production averaged 2.2% of the UK total.)

Other Europa fields

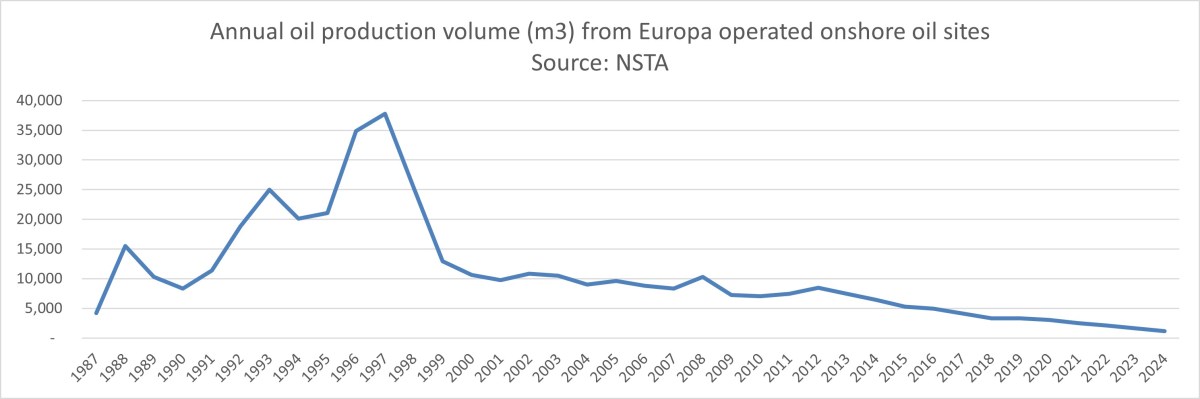

Europa Oil & Gas Limited operated fields at West Firsby and Crosby Warren produced a total of 1,169m3 in 2024, the most recent full-year figure. This was the lowest annual figure recorded in data for the fields from the NSTA.

Onshore licence relinquishments and surrendered interests

- PEDL181 Kiln Lane, North Lincolnshire: part relinquished in 2016 and 2023

- PEDL143 Holmwood, Surrey: farmouts to UK Oil & Gas plc (UKOG) in 2015, Union Jack Oil in 2016, Angus Energy in 2017 and replacement as operator by UKOG in 2019 after the Forestry Commission refused to extend the lease.

- PL199/215 Whisby 4, Nottinghamshire: termination in 2024 of royalty agreement related to the Whisby-4 wells, held with BritNRG, the operator of the Whisby field.

Injunction

Europa Oil & Gas was accused of harassment after it took out a High Court injunction in 2017 against protests at the Bury Hill Wood (also known as Leith Hill) site in its Holmwood licence in Surrey.

The injunction document named a community group, Surrey Hills Slings, which promoted breast feeding and the use of slings for infants. The group told the High Court:

“Following this event we found ourselves subject to ongoing intimidation and harassment by Europa.”

People found to have breached a High Court injunction could be found guilty of contempt of court and could face prison or fines.

Shareholder actions

In November 2023, Europa’s former chief executive and chairman, Simon Oddie, withdrew his candidacy for re-election to the company’s board, following consultation with shareholders.

Also that month, the company’s founders, Paul Barrett and Erika Syba, attempted to call a general meeting to consider resolutions to remove from the board the chief executive, William Holland as chief executive and chief operating officer, Alastair Stuart. The board said the proposed resolutions were not “in the best interests of the company and none of the directors would vote in favour”.