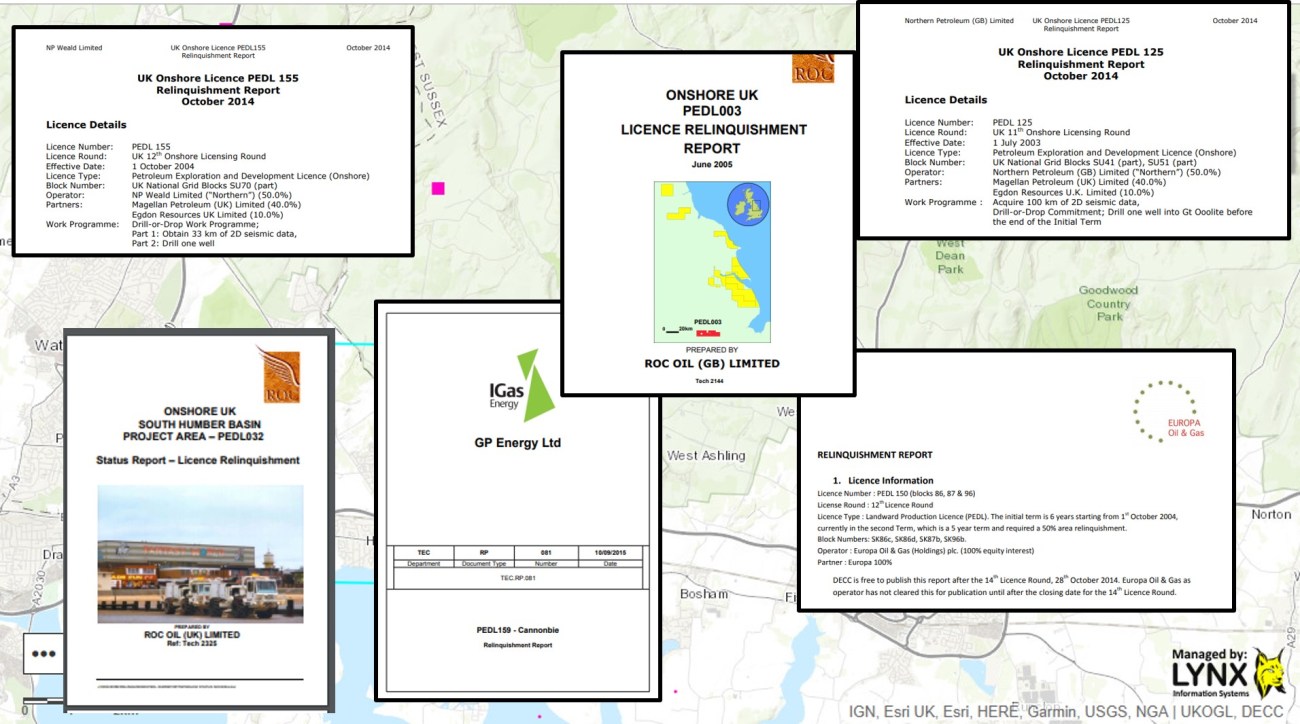

Source: UKOGL

In the week that IGas confirmed its Tinker Lane well had missed the Bowland shale, campaigner Ben Dean investigates the high failure rate of UK onshore oil and gas licences in the past two decades.

In this guest post, he reveals that 80% of exploration licences, known as PEDLs, issued from 1996 up to 2015 no longer exist. 10% of the licences offered since then have not been taken up.

DrillOrDrop always welcomes guest post. Please contact us if you have an idea.

By Ben Den

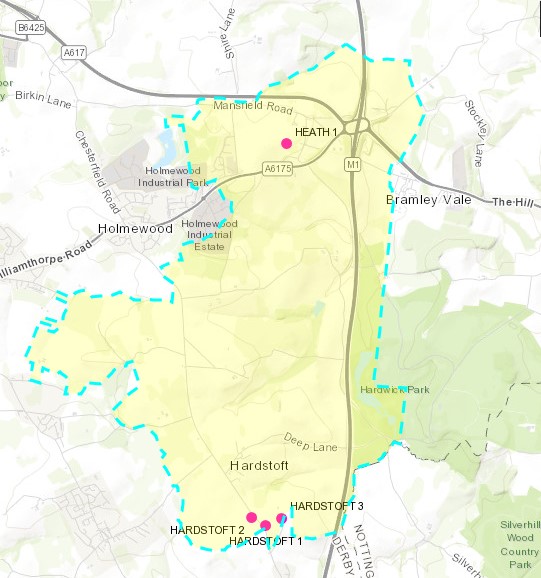

PEDL001 covers a wedge of land between Mansfield and Chesterfield in the east midlands. It was awarded to Coalgas UK Ltd to explore for mine gas in 1995 by the then Department of Trade and Industry.

It was the first PEDL to be issued and was in a collection of onshore petroleum licences awarded by the government under the seventh round, or auction.

PEDL001, marked in blue, in Nottinghamshire. Source: UKOGL

Since then, a total of 349 PEDLs have been awarded to oil and gas companies. The most recent group of licences – the 14th round – were awarded three years ago in 2015.

Of these 349 PEDLs awarded since 1996, just 134 remain in operation – known as extant in the oil and gas industry. PEDL001 is one of them, now operated by Alkane Energy. But PEDL002, PEDL003 and PEDL004 and many others have disappeared from the list of UK PEDLs.

A total of 205 PEDLs have either been relinquished or surrendered before they completed their term. Another 10 companies have declined to take up the licence offer.

Of the 134 extant PEDLs, 83 are from the most recent 14th round.

Excluding the 14th round licences, just 51 PEDLs out of 256 awarded since 1996 have survived. This is a failure rate of 80%.

Based on the data available, the life of these relinquished PEDLs ranges from one to around 12 years.

So why has there been such a high failure rate and what does it mean for the most recently awarded PEDLs? To find out, I’ve been looking in the Oil and Gas Authority (OGA) data centre (link) and the UK Onshore Geophysical Library (link).

Why were 80% of pre-14th round licences relinquished?

PEDL operators must provide a relinquishment report to the Oil and Gas Authority (OGA) within three months of giving up a licence. This explains why the operator is relinquishing the PEDL and what work it has done.

The reports are published in the UK Onshore Geological Library – but only if the PEDL operator confirms that it gives permission. This may explain why 97 of what must be a total of around 205 relinquishment reports are available.

The information contained in these industry reports suggests that onshore oil and gas has done well to survive as an industry for viable investment to the end of 2018.

The relinquishment reports cover areas across the UK and give the following main reasons for relinquishment of a PEDL:

- Drilled well or wells were dry

- Unable to obtain landowner access agreement

- Geological issues or faults

- Not economically viable

- Geopolitical issues (falling oil price)

- Previous mine workings

- To allow existing PEDLs to be offered in the 14th round

- Refusal of the Environment Agency to grant environmental permits

What do the operators say about why they gave up?

Here are quotes from some relinquishment report.

PEDL003: awarded 1996, relinquished 2005

“Technical evaluation of the licence was based on data from ca 450km of oil exploration and 180km of coal exploration seismic and over 60 wells.” Link

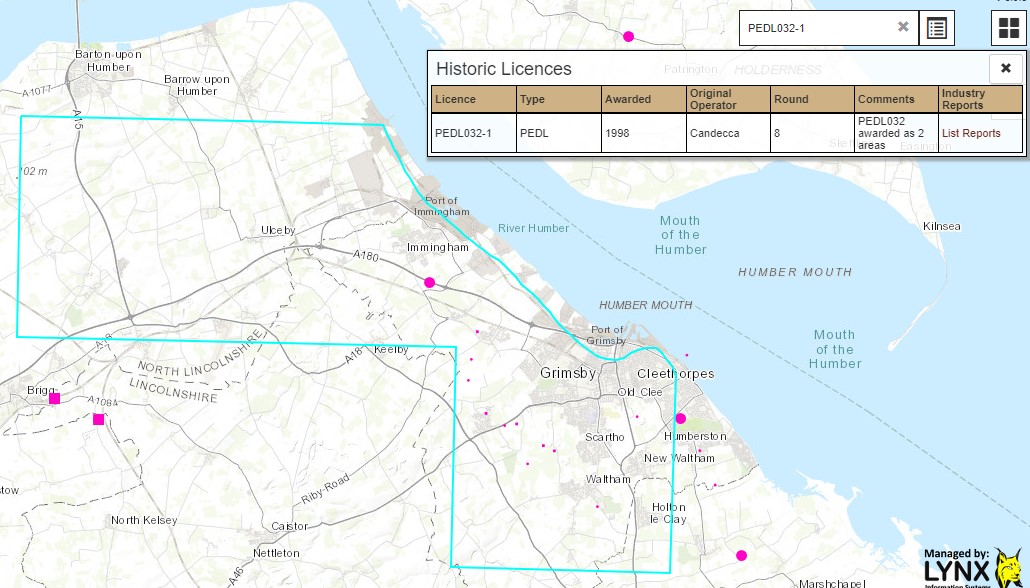

PEDL032. Source: UKOGL

PEDL032: awarded 1997, relinquished 2004

“The 3D data set is still believed to be a very poor quality product.” Link

PEDL059: acquired by Alkane 2000, relinquished 2011

“On securing PEDL059 … Alkane appointed specialist consultants. … The consultants concluded that a significant proportion of the mine workings were already likely to be flooded.” Link

PEDL060: acquired by Alkane 2000, relinquished 2011

“Alkane has requested an extension of the Second Term of the licence but has been advised that DECC is unable to grant this. Accordingly I hereby request to relinquish PEDL060 with immediate effect.” Link

PEDL069: awarded 2000, relinquished 2011

“A final voluntary relinquishment of the licence was made in May 2011 ahead of the end of the second period to facilitate the inclusion of the acreage in the 14th Landward Licencing Round.” Link

PEDL092: awarded 2000, relinquished by IGas 2011

“A previous attempt at establishing CBM production on PEDL092-1 (Nexen’s Mill Farm 1) failed due to inappropriate well design” Link

PEDL107: awarded 2002, relinquished by IGas 2014

“Access to SPPL1481 was always planned through an onshore to offshore long-reach drilling campaign. However, for the duration of this Licence, there remained an unlicensed area between PEDL 107 and SPPL 1481 that related to difference between the mean high water mark and mean low water mark (onshore and offshore licence boundaries respectively).” Link

PEDL125: awarded 2003, relinquished 2004

“One possible site was subject to a planning application on local authority land. The application was submitted prior to signing a lease for the site, the terms of which had been agreed with the local authority. However local community opposition led to the local authority refusing to sign the lease and the planning application therefore had to be withdrawn.” Link

PEDL136: awarded 2004, relinquished 2010

“All the dry holes in the area appear to have failed due to being located off-structure.” Link

Pedl150: awarded 2004, relinquished 2014

“Europa Oil and Gas drilled the Hykeham 1 (L46/12-17) and Hykeham 1z (L46/22-17z) sidetrack well to test the Gravel Pitts prospect. The first well failed to find the stratigraphic traps at the prognosed depth forecast. A previously unseen fault was detected and so the drilling rig pulled back.” Link

PEDL151: awarded 2004, relinquished 2006

“Following the unsuccessful Sandhills-2 2Z appraisal well in PEDL113 and the dry hole result of the Bouldnor Castle Copse-1 well drilled in PEDL089 in 2005 which reduced the perceived prospectivity to zero, the PEDL151 Group decided to relinquish the licensed area in its entirety at the end of its second term” Link

PEDL153: awarded 2004, relinquished 2010

“Unfortunately the Group has been forced to conclude that it is not possible to find a suitable site that would have any chance of being accepted by the Planning Authority or the local community…….It has reluctantly decided to relinquish the Licence.” Link

PEDL155. Source: UKOGL

PEDL155: awarded 2004, relinquished 2014

“Following agreement from DECC in 2011 the Initial Term of PEDL155 was extended to eleven years and the Second Term reduced to zero years. The licence was due for relinquishment in August 2015. Following the receipt of planning permission a wellsite was constructed in the adjacent Licence, PEDL256 from which the Havant prospect could be drilled, the prospect extending into PEDL155. Opposition from the Environment Agency has prevented the PEDL256 Group from getting the necessary approvals for drilling. Consequently the PEDL155 Group decided to relinquish the Licence in its entirety.” Link

PEDL159: awarded outside a PEDL round, relinquished 2015 after a total of seven wells drilled

“PEDL159 is being relinquished due to the complex structures within the Carboniferous strata making the area unsuitable for CBM development. Current economic and geopolitical would limit the viability and pace of a field development.

“Oil and gas exploration in the region has by-in-large, proved unsuccessful.” Link

PEDL073 and PEDL074

These PEDLs in the Scottish Midlands and Somerset have been relinquished although no relinquishment reports are publicly available. UKOGL does, though, have a prospectivity report for coalbed methane in each PEDL.

The operator estimated in PEDL073 a total number of wells to be drilled at 370 in an area of 119.5sqkm (link). For PEDL074 in Somerset the estimate was 337 wells in an area of 98sqkm (link).

90% failure rate for older licences?

Before there were PEDLs, there were ALs, CEs, DLs, EXLs, MLs and PLs. These were earlier versions of onshore petroleum licences.

Licence CE001 covering the Chatsworth area of Derbyshire. Source: UKOGL

The oldest existing onshore licence is CE001, granted to his Grace The Duke of Devonshire, on 26 March 1923 for land covering the Chatsworth Estate.

Not surprisingly the grant of this licence was symbolic, but it remains extant.

Including CE001, there are a total of 49 extant older licences. After his Grace’s Chatsworth licence, the next oldest is ML003 between Mansfield and Lincoln, dating back to a start date of 1959. This licence is expected to last until 2033, a term of 74 years.

We have no access to information about how many of these pre-PEDL licenses were awarded.

But from the numbering of the extant licenses listed at the OGA Data Centre, it appears that at least 600 could have been issued.

If so, that would mean there were at least 551 relinquishments and a minimum relinquishment rate of more than 90% for onshore licenses issued before 1996.

Looking ahead

If at least 90% of historic licences were relinquished and 80% of licences issued from 1996 up to 2015, what does this mean for the future?

The 14th round offered 93 new onshore licences on 17 December 2015. 10% disappeared off the list early on when they were not picked up by the operator.

So will the remaining 83 licences see out their 30-year terms?

I expect the 14th round licences, awarded in 2015, with start dates of July 2016, will have a similar failure rate. It could even be higher because of geopolitical considerations and community awareness.

The successful 14th round companies have so far submitted just three planning applications. Two were in Rotherham and one in Derbyshire. All were refused by local authorities, though the decision on two were overturned at appeal. No work has been carried out on the sites.

The licences are now approaching the half-way point of their initial five-year exploration terms. The work commitments, which include securing seismic surveys and drilling and fracking wells, must be completed by 20 July 2021. This looks increasingly unlikely without changes in planning rules or an extension of the initial term.

I’ll return to the issue of the work programmes in 14th round licences in a future article.

DrillOrDrop always welcomes guest post. Please contact us if you have an idea.

Categories: guest post

You might want to look at how much the government give to oil and gas https://duckduckgo.com/?q=government+give+millions+to+oil+and+gas+uk&ia=web

why don’t you first try looking at revenue the government brings in from taxing the oil and gas business!!

Liz

I had a look. They set out measures to encourage 4 billion of private investment in N.Sea oil and gas ( as per the link ).

Plus 20Million to spend on seismic surveys offshore, and 2.5million from the Scottish gov to encourage decommissioning.

Now I need to deduct that £22.5 Million from the tax taken from the companies to come up with the amount given to the oil companies. Well perhaps not the £20 Million as that goes to seismic companies, and the Scottish cash is spent on a number of areas, some not being oil and gas companies.

The measures were as a result of the plunge in oil prices, when the golden goose stopped laying it’s oily eggs.

https://www.theguardian.com/business/2015/oct/21/north-sea-tax-revenues-plummet-negative-first-time-history

Some money did go back to the companies, as they can claw back tax paid from previous years if profits drop ( primarily due to the oil price ). But they do not claw it back, if they have not paid any in the first place.

https://www.telegraph.co.uk/news/2016/05/26/north-sea-oil-posts-its-first-annual-loss-for-the-taxpayer/

Nothing in there about onshore oil and gas, but I note the measures have the full support of the SNP.

Meanwhile, Wytch Farm continues to produce, and although a shadow of it’s former self as the largest on shore oil field in Europe, on it goes.

Probably not a lot of that size left to find but as oil prices move back towards $80/barrel then smaller sites will continue to be explored-unless they are covered in housing estates between now and then.

Ahh, the old Wytch Farm pedestal gets pushed out into the light of day again.

But lets look at some of the real issues with that production and its roll over a play dead methane pollution consequences from the related Kimmeridge well shall we?

https://dorseteye.com/kimmeridge-well-methane-pollution/

So, not so holier than thou is it?

Oil prices move towards how much Martin ? Its you that needs to keep up. Merry Xmas.

Brent crude LCOc1 futures fell $2.89, or 5.05 percent, to settle at $54.35 a barrel. U.S. West Texas Intermediate (WTI) crude CLc1 futures fell $2.29, or 4.75 percent, to settle at $45.88 a barrel.

Brent hit a session low of $54.28 a barrel, its lowest price since mid-September 2017, while WTI sank to $45.67, its lowest price since late August 2017.

https://www.reuters.com/article/us-global-oil/oil-prices-tumble-to-lowest-in-a-year-as-stock-markets-drop-idUSKCN1OJ06A

A very informative post. I wonder how many small investors lost money along the way?

The majority of investors will lose money in their pursuit of the golden egg.

AD

Correct, for smaller companies. But will they lose all their money?

The oil and gas industry is no different from UK mining ventures where you can see some recent failures ( Wolf, UK Coal ),Some hopefuls ( Sirius ), and some that just plod on, Salt mining, Gypsum and Potash come to mind.

But if you had invested in Bp, despite their dabbling in uk onshore oil, your investment would be good.

A good summary. Oil & gas exploration has always been high risk but high reward in the event of success. I wonder how many small investors made money along the way? The big guns gave up on UK onshore in the mid 1980’s as the fields discovered were too small for them. Only BP’s Wytch Farm was big enough for a large company. With Amoco we found oil fields in Hampshire (now IGas) and explored in North Yorks, Lancs and East Sussex in the 1980s without success. The geology offshore provided much larger accumulations.

Paul – the upsurge in onshore exploration in the 1980’s was also driven by the tax break given by the Thatcher government which allowed the oil companies to offset all exploration costs against Petroleum Revenue Tax. BP sold off 0.25% ‘units’ in the Forties Field, which allowed small exploration companies to buy production in the Forties Field and offset their onshore exploration costs against the PRT generated. When this tax break was removed onshore exploration plummeted and many licenses were subsequently relinquished.

Excellent post. And all the more reason why investment in oil and gas onshore in the UK is a fool’s errand.

Meanwhile those attempting to sell fracking to the gullible greedy investors continue to draw mega bucks wages!

The author of the article seems to suggest that the rate of onshore success is low but doesn’t really compare it to offshore either in terms of number of wells drilled or amount invested. For conventional, I always think in terms of 1 in 6 exploration wells being successful but they are very expensive. In shale gas exploration and appraisal on looks at drilling more wells at reduced cost. This doesn’t seem to be a story.

Some misunderstanding. Mainstream oil and gas exploration companies, and indeed gold, copper etc mineral exploration companies, always have a portfolio of exploration licenses – or PEDL. The cost of the license is low, but the work commitment may be high, and there may or may not be a commitment to drill a wildcat well. A major company, or a well-funded junior company, will hold a huge portfolio, far more than it could every fully explore, indeed more than it ever wants to explore. Often there is a requirement to relinquish a sizeable chunk of the area as soon as possible, or indeed to relinquish entire blocks in order to keep hold of a ‘Goldilocks” block. By this means, the Government wins all the data free of charge, and the companies lose very little by relinquishing blocks after blocks, provided they eventually discover a Goldilocks area. Depending on a lot of factors, the success rate for drilling need only be as low as 1 in 20 holes before a discovery well. Even then, a company might choose to sit on a block doing very little, in the hope that their block is next to someone else’s block where a discovery is made. Then the company that did very little can cash in its block for a decent profit. Indeed if a major company may simply wait on a cash mountain and then buy up junior companies who make wildcat discoveries of large size. Or to farm into a good block with a pot of cash. Remember that, as in life, learning is by doing; so most blocks are licensed just to learn as every region is different. Only after lots of learning by a string of dry wells can an exploration company figure out where to drill and what to drill. Then a real exploration and production rush takes place almost overnight. So, if you are an oil or gas company, then the exploration of unconventional resources of oil and gas has barely begun. And if you are not in favour of exploration of unconventional resources of oil and gas onshore UK then release that every day the companies and government gain more information from underground. Every seismic line adds to the learning. Reprocessing a seismic line clarifies the learning. And every deep well, dry or productive, right place or oops wrong place, translates mysterious seismic into proven geology and less risk. The show has barely begun. The learning stage is well under way. Once sufficient learning has been done, only then does the oil and gas industry move at speed.

Robin Grayson MSc – Liberal Democrat Geologist

Robin – i couldn’t agree more. In the unconventional world many of us use the mantra – “learn to lean”. By this we mean putting a lot of expense into learning about the subsurface and then learn from data to cut costs in development wells. For the avoidance of doubt, cutting costs doesn’t mean compromising safety; it just means identifying the best drilling and completion techniques and then buying the technology in bulk so reducing on the overal cost.

Of course, what seems to be lost on many is that the technology that is developed and the datasets obtained contribute significantly to the renewable industry

Robin do you believe in climate science?

Good points.

‘For the avoidance of doubt, cutting costs doesn’t mean compromising safety’ – not at all Judith??

https://www.theguardian.com/environment/2018/jun/28/bp-deepwater-horizon-oil-spill-report

Why don’t you just post the whole Guardian every day it would save you a lot of copy and paste time…

Bwahahahahaha are you seriously calling someone for posting links? You! Kishney the master of the sh!te Neo/Con hyper link.

Your lack of any sense of irony is delicious.

https://www.theguardian.com/money/2010/aug/14/free-solar-panels

https://www.theguardian.com/environment/2018/jun/27/uk-home-solar-power-subsidies-costs-battery-technology

https://www.theguardian.com/money/2018/nov/25/homeowners-trapped-solar-panels

So not very hole drilled produces an economically viable oilfield. Well who would have thought it!