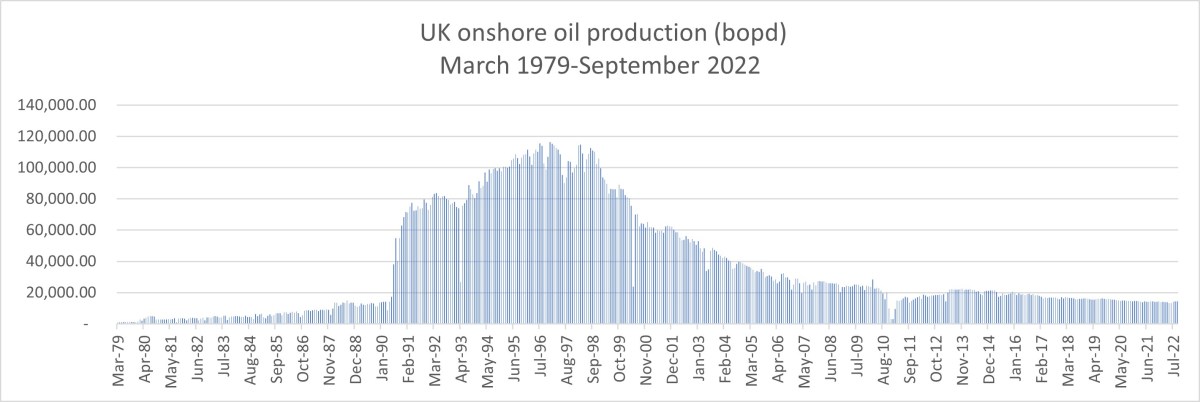

DrillOrDrop’s review of the latest UK onshore oil data for September 2022: First production figures published for Egdon’s Wressle oil site near Scunthorpe in North Lincolnshire.

This article includes revised data released this month by the North Sea Transition Authority (NSTA) for July 2022 and August 2022. As a result, there will be disparities in the charts between this and the two previous articles in the series.

Key figures

Daily production: 14,325 barrels per day (bopd)

Weight: 56,295 tonnes

Volume: 68,321m3

Volume of onshore as a proportion of UK total oil production: 2.3%

Volume of flared gas at UK onshore oilfields: 782m3

Volume of vented gas at UK onshore oilfields: 115m3

The data in this post was compiled and published by the North Sea Transition Authority (NSTA) from reports by oil companies. This is published about three months in arrears. All the charts are based on the NSTA data.

Details

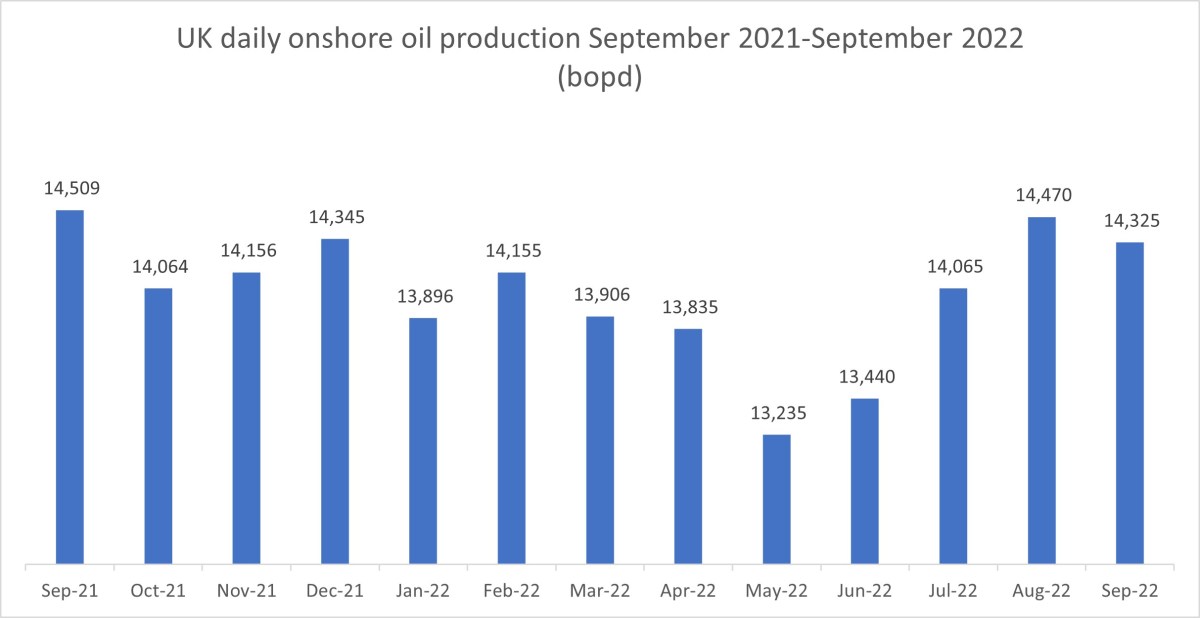

Daily production

- New official figures from the Wressle well (included by the NSTA this month back to July 2022) increased daily production to almost the highest levels since September 2021

- On the revised monthly figures, total UK onshore daily production rose nearly 5% from June 2022 to July 2022 and almost 3% from July 2022 to August 2022

- September 2022 saw a 1% fall compared with revised figures for August 2022

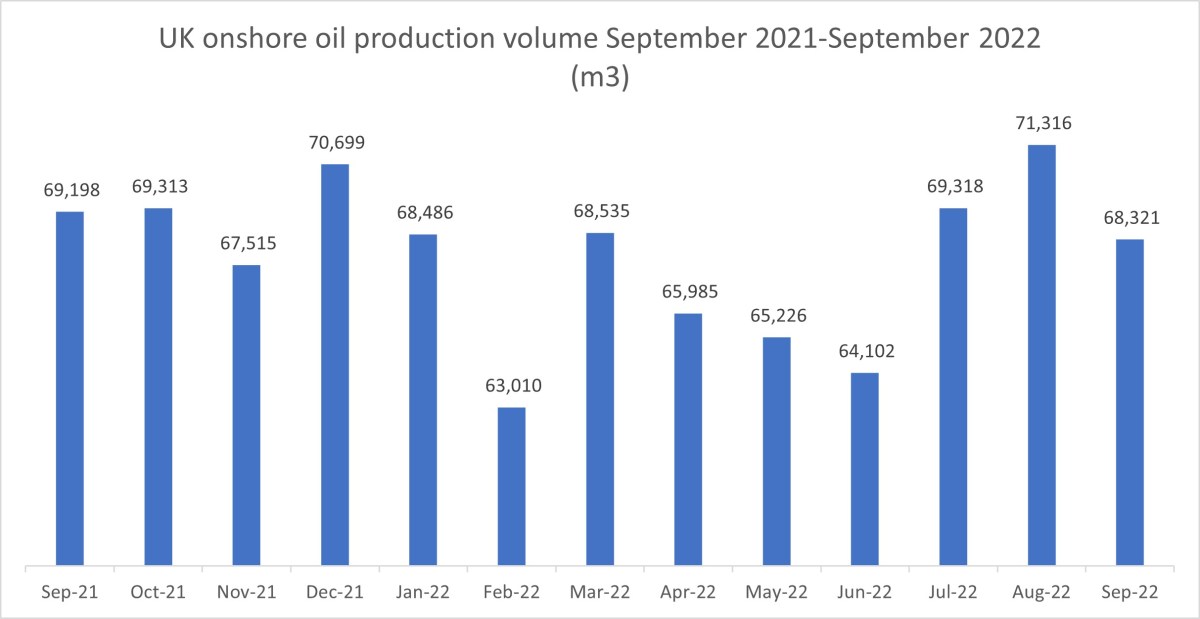

Volume and weight

- The revised data, which included the Wressle oil site for the first time, saw weight and volume rise more than 7.5% between June 2022 and July 2022.

- Both measures rose by nearly 3% between July 2022 and August 2022, to reach the highest level for more than a year.

- But volume and weight dropped by more than 4% between August 2022 and September 2022, to below the level of September 2021.

- This may, at least partly, reflect the shorter month in September.

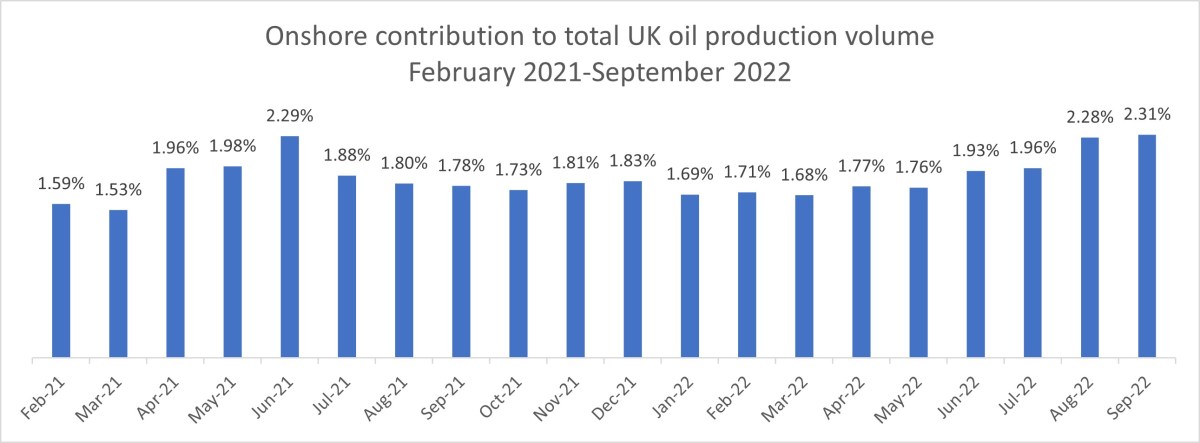

Contribution to UK oil production volume

- The contribution of onshore oil to the UK monthly total was higher than levels last seen in June 2021.

- The level exceeded 2% for two consecutive months – last seen in 2016

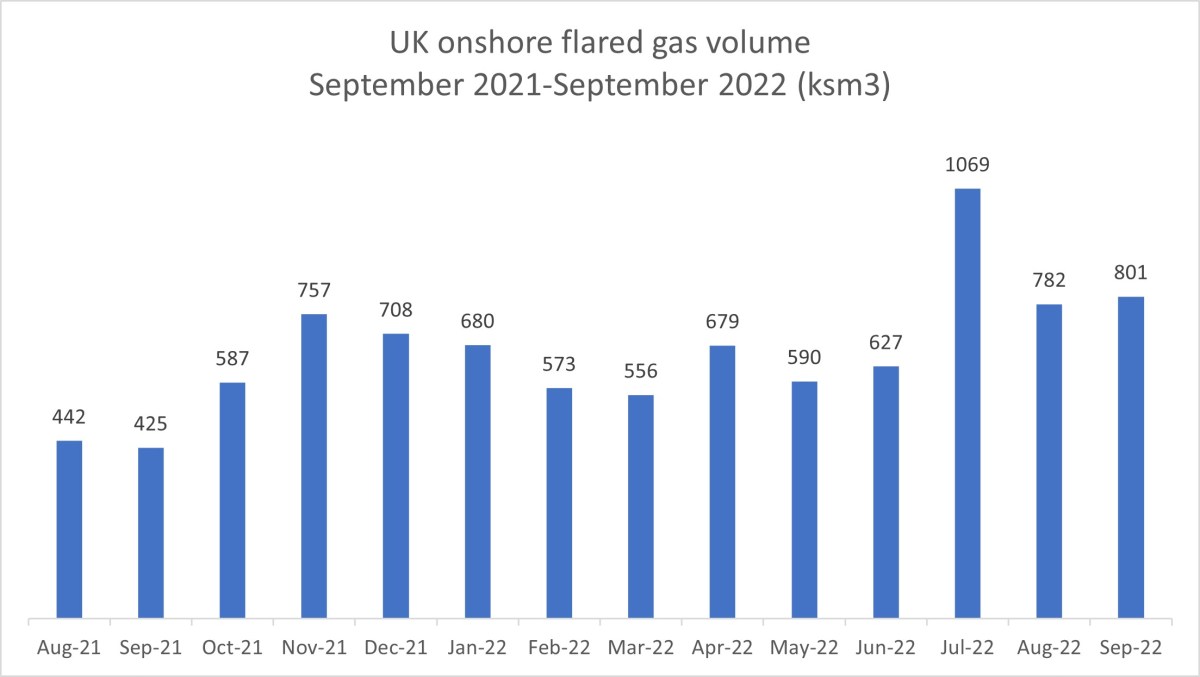

Flaring and venting

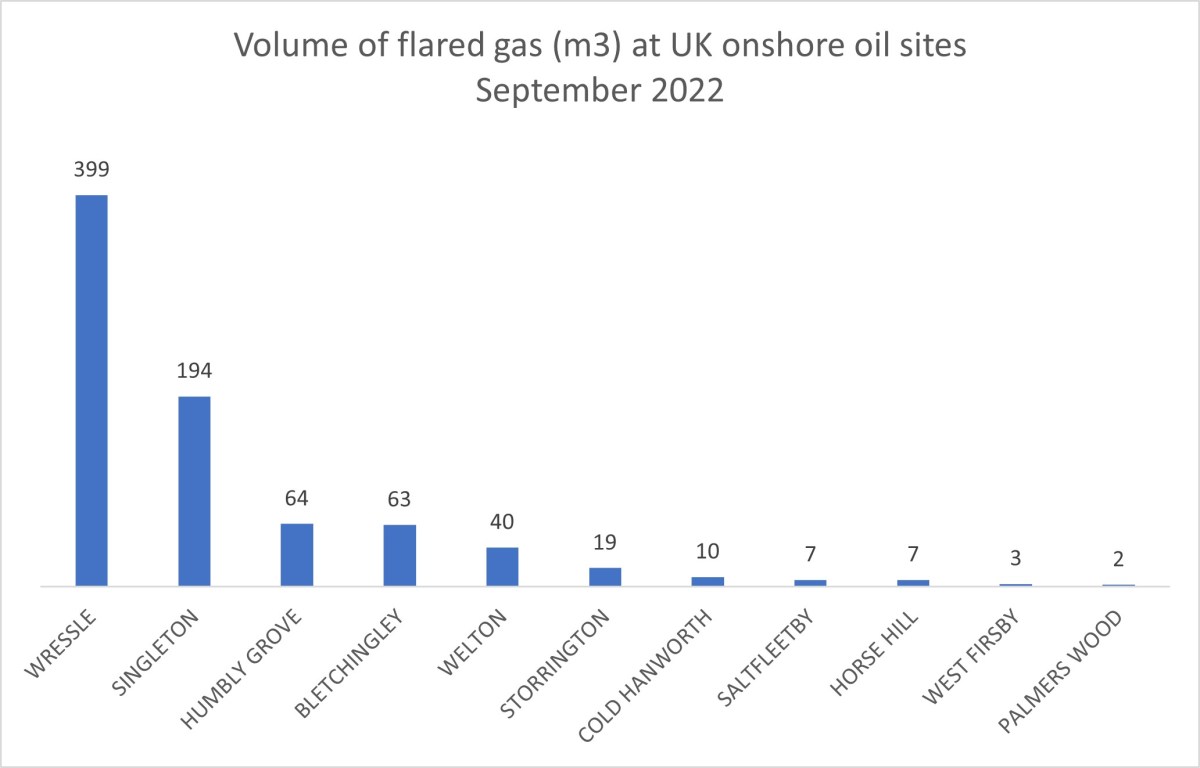

- Flaring from the Wressle site helped to push up the volume of gas flared from UK onshore fields to above 1,000,3 in July 2022.

- The volume of flaring rose by more than 70% between June and July 2022. It fell back by 26% between July and August 2022 and rose slightly in the September 2022 figures.

- The volume of vented gas rose slightly between June and July.

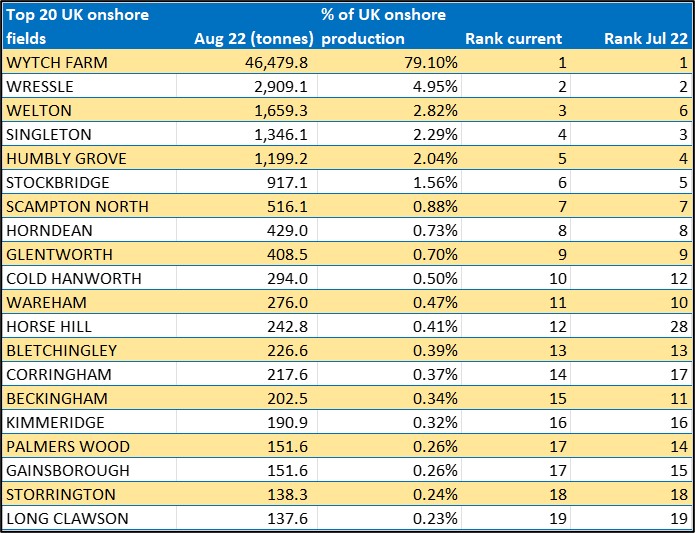

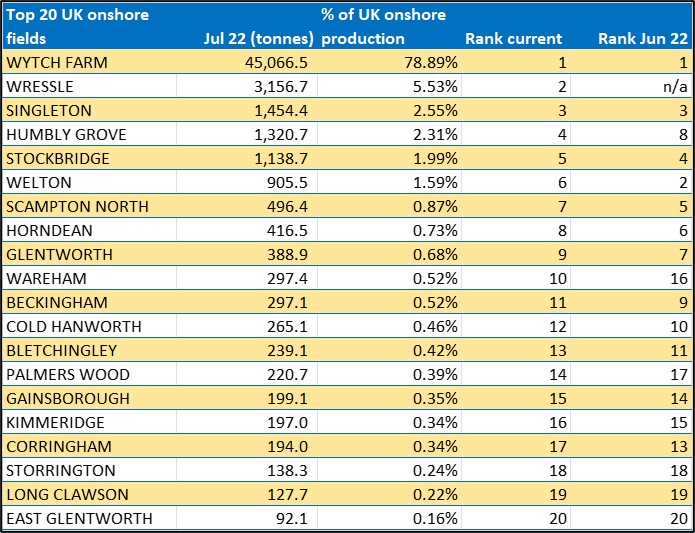

Top 20 fields

The late addition of the Wressle production data for July and August 2022 means the Top 20 tables in previous articles in this series are now out-of-date. Tables with the revised data are included below:

Wressle impact

The Wressle oil well went straight into the Top 20 tables at number 2 for its first three months.

In September 2022, the site represented just over 5% of UK total onshore production. It was 6.3% of the UK’s biggest onshore producer, Wytch Farm, in Dorset.

In September 2022, almost 90% of UK onshore oil was produced from just four fields: Wytch Farm, Wressle, Welton in Lincolnshire and Singleton in West Sussex.

Just five fields (as above plus Humbly Grove) each produced more than 1,000 tonnes of oil in September 2022.

Risers and fallers

Six onshore fields (Welton, Horndean, Cold Hanworth, Wareham, Whisby and Palmers Wood) saw production rise in September 2022, compared with revised figures for August 2022.

13 fields in the Top 20 (Wytch Farm, Wressle, Singleton, Humbly Grove, Stockbridge, Scampton North, Glentworth, Horse Hill, Bletchingley, Corringham, Kimmeridge, Gainsborough and Storrington) saw production fall in September 2022 compared with the revised figures for the previous month. This may, at least partly, reflect the shorter month in September.

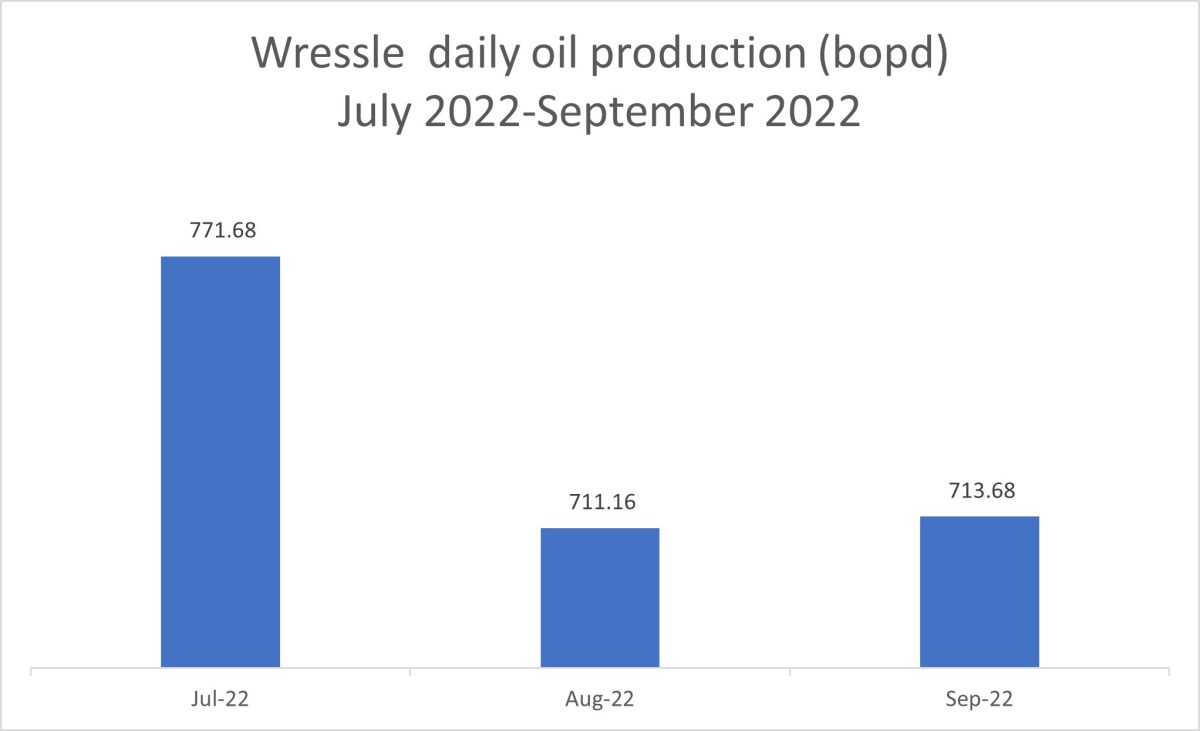

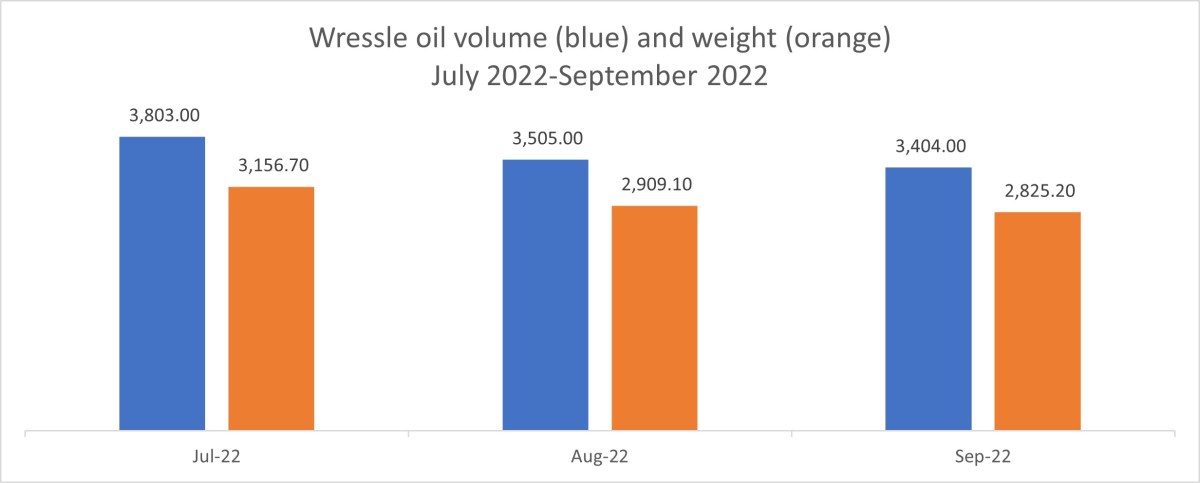

Wressle details

- Wressle maintained daily production of more than 700bopd in each of its first three months, giving it around 5% of UK onshore oil.

- But daily production dropped nearly 8% between July 2022 and August 2022.

- The oil well also saw a 10%+ decline in monthly production from 3,803m3 in July 2022 to 3,404 in September 2022.

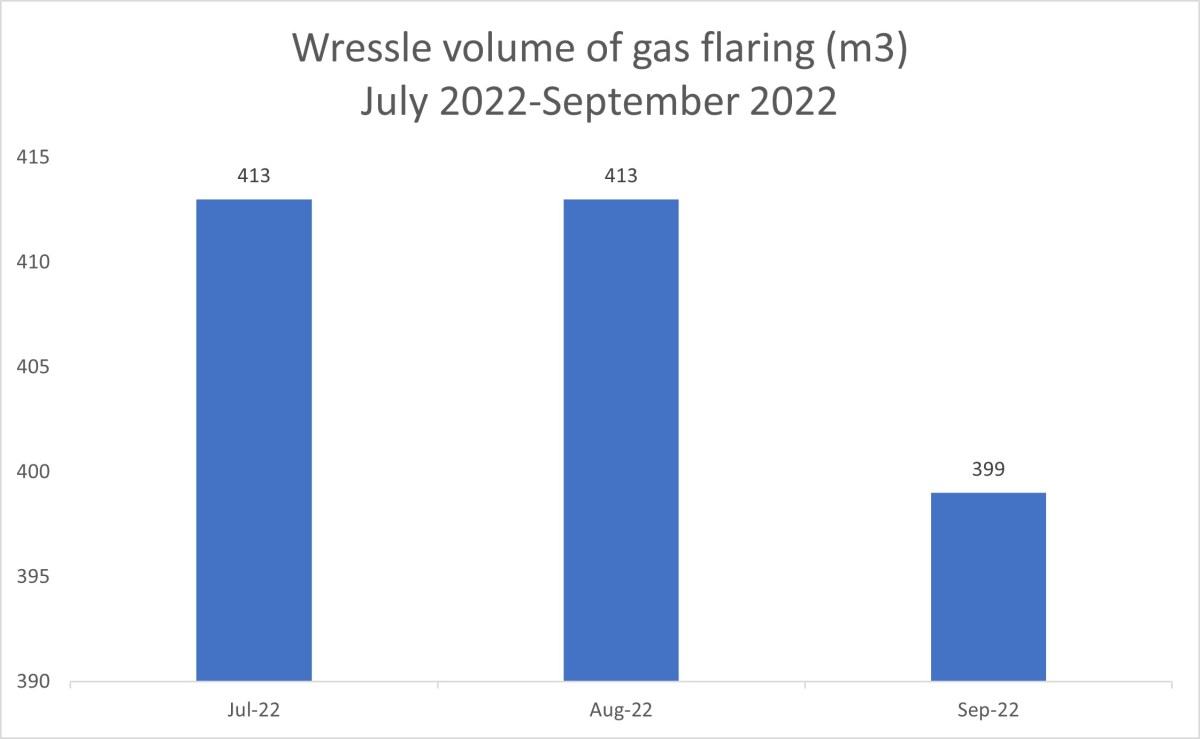

- The site operator, Egdon Resources, has reported that current production at the site is limited by the volume of gas that can be flared under the environmental permit.

- Proposals to use the gas for electricity generation would allow higher production, the company has said.

- Wressle flared 413m3 of gas in both July 2022 and August 2022 and 399m3 in September.

- In September 2022, Wressle ‘s flared the largest volume of gas of any UK onshore oil site, representing nearly 50% of UK onshore oil site flaring that month.

- Vented gas was 5m3 in July 2022 and 4m3 in both August 2022 and September 2022.

- So far, Wressle has reported no produced water.

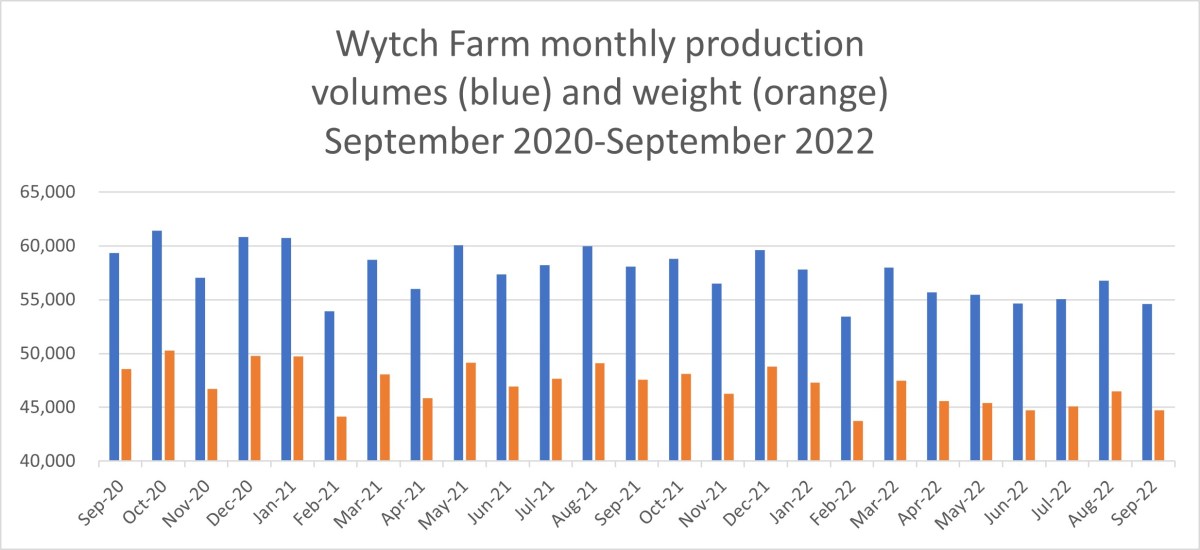

Wytch Farm

- With the addition of Wressle oil, Wytch Farm’s share of UK onshore production fell below 80%.

- Volume and weight fell nearly 4% in September 2022, compared with August 2022.

- Daily production was down slightly from 11,522 bopd in August 2022 to 11,451 bopd in September.

Horse Hill

- Production from the Horse Hill site, in Surrey, fell more than 7% in September 2022, compared with the month before (266m3, down from 287m3).

- September 2022’s volume was down 77% on the highest recorded production from the site, at 1160m3 in April 2020.

- Daily production was also down in September, from 58.2bopd in August 2022, to 55.8bopd.

Horndean

- The Horndean site in Hampshire saw monthly production rise for the fifth consecutive month.

- Volume reached 540m3 in September 2022, up nearly 5% on August 2022.

- Daily production also rose, to 113bopd in September, the highest level since February 2022.

Non producers

There was no production at 12 UK onshore fields:

- Angus Energy: Lidsey

- Britnrg Limited: Newton-on-Trent

- Egdon Resources: Dukes Wood, Fiskerton Airfield, Keddington, Kirklington, Waddock Cross

- IGas: Avington, Egmanton, Nettleham, Scampton, South Leverton

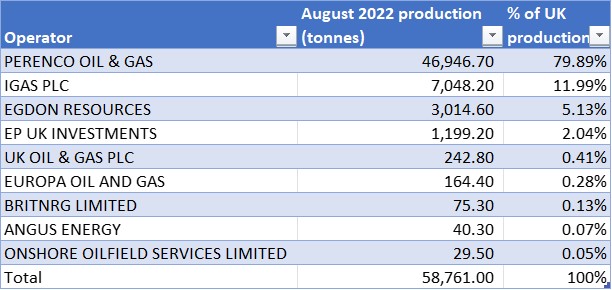

Operators

Egdon Resources moved into third place in the first three months of production from the Wressle site, it’s only operating field in September 2022.

Total production from second-place IGas fields dropped back below 7,000 tonnes after exceeding this level briefly in August 2022.

The leading onshore operator, Perenco, which runs Wytch Farm, as well as Kimmeridge and Wareham in Dorset, produced just above 80% of UK onshore oil in September 2022. But the company’s total production in tonnes was down nearly 4% in September, compared with the month before.

Britnrg Limited saw production rise from 75 tonnes in August 2022 to 223 tonnes in September 2022. This followed the reappearance of the company’s Whisby field in the September top 20.

The late addition of the Wressle production data for July and August 2022 means the operator tables in previous articles in this series are now out-of-date. Tables with the revised data are included below.

2022 onshore oil data archive

August 2022 – see note about revised data

July 2022 – see note about revised data

Categories: Industry, slider, Uncategorized

So, the antis at Wressle cost £400k in costs awarded, yet the operator was not put off and helped secure the transfer of production to a source local to demand.

Just goes to show who are the real heroes and who are the villains. Not only economically, but environmentally.

1. £400,000 well spent because it exposed Egdon’s poor safety procedures and resulted in the site being re-built with proper safety measures in place.

2. “A source local to demand”? Only if you can prove that the oil remains in Lincolnshire after refinement

3. High amounts of gas flaring/venting are an environmental disaster – locally and globally.

Alex, if Wressle flared about to 1200 cu mxm in 3 months that’s 4800 per year. One cow produces about 180 cu mxm in a year, so Wressle’s flaring is equivalent to the methane cold venting of 35 cows. That’s 35 of the 7 million or so cows in the U.K. Why do green activists have this particular fetish like antipathy to the U.K. onshore oil & gas industry which is producing a vital raw material in a greener way than producers overseas from whom we import. It’s bizarre.

£400k well spent? The antis lost, Alex. The taxpayer’s money was wasted. Those who gained were the legal lot.

Hmm, how many old people could be kept alive and warm this winter for £400k? Alex-what gives the antis the right to decide such issues? They have no right, as they accept no responsibility.

Certainly more local than Nigeria, Alex! Certainly more environmentally friendly than many imports of oil into UK and certainly better than oil from Russia.

Meanwhile, the met. office in UK issues a warning for cold weather in the coming days and the population will expect the gritters to be out there. Wonder where their diesel will come from?