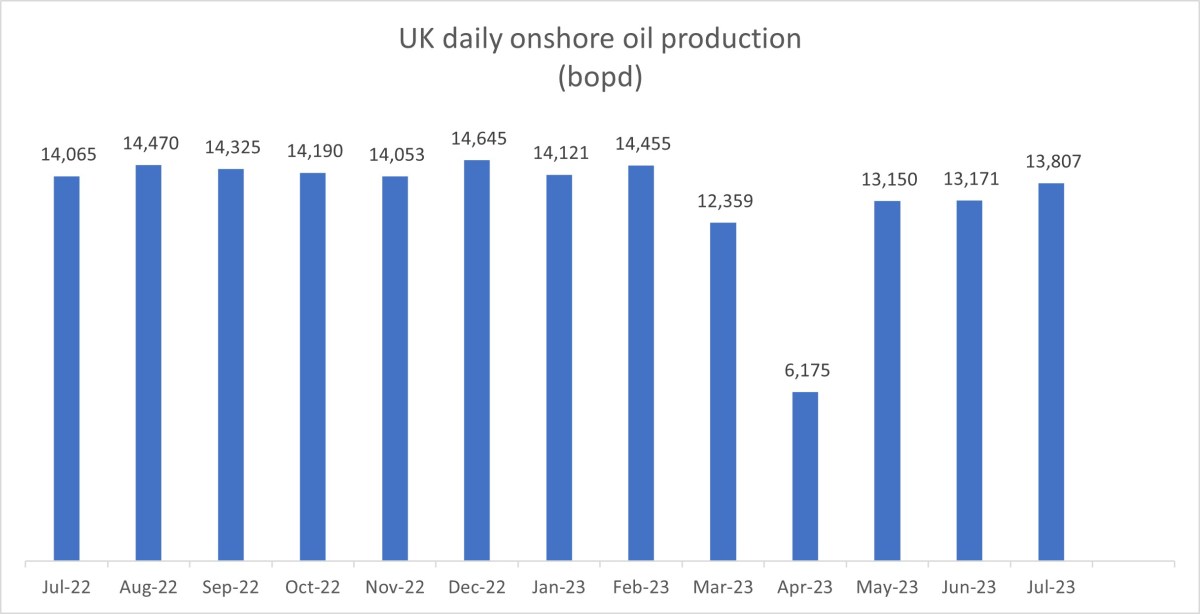

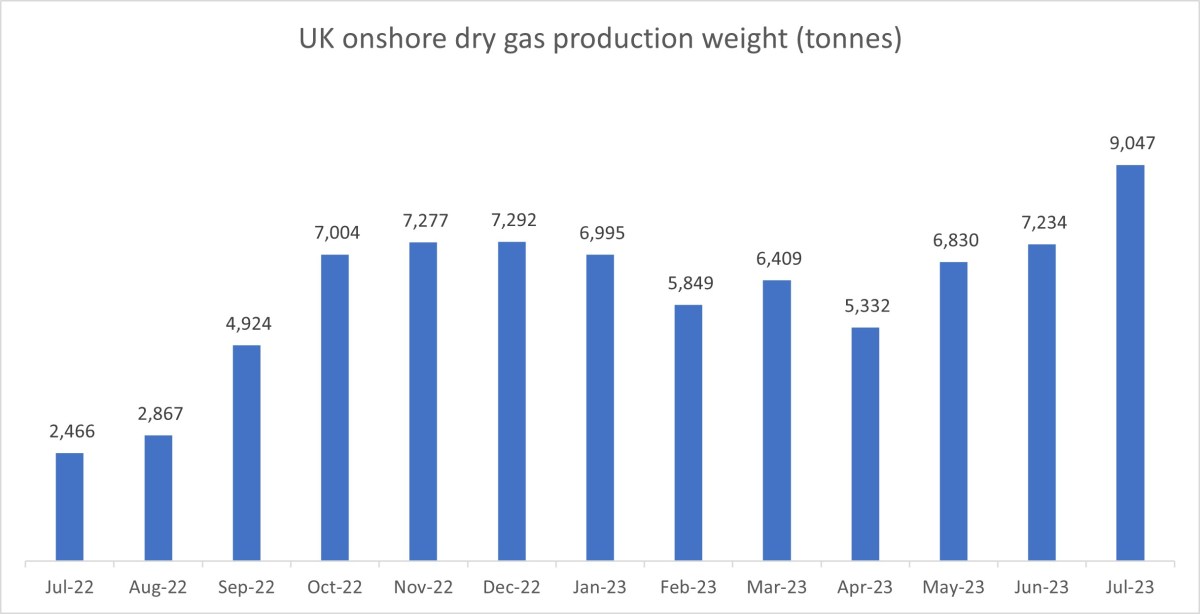

New monthly high for gas production at Saltfleetby, pushing up UK onshore volumes in July 2023 to the highest level for four years. Oil production was down at Wressle, the UK’s newest onshore field.

Key figures

Daily production: Oil: 13,807 barrels per day (bopd). Gas: 12 standard cubic feet per day (mmscf/d)

Volume: Oil: 68,045m3. Gas: 11,063 thousand cubic meters (ksm3)

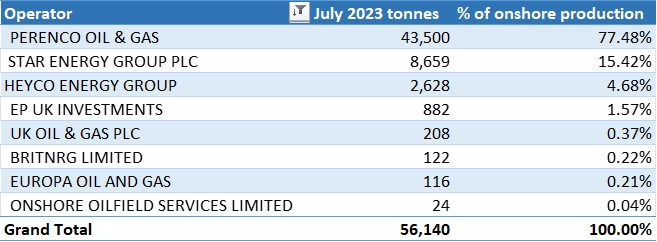

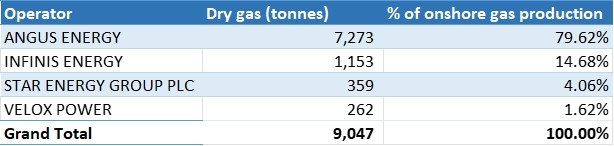

Weight: Oil: 56,140 tonnes. Gas: 9,047 tonnes.

Onshore contribution to UK total production: 1.99% of oil and 1.16% of gas

Volume of flared gas at UK onshore oilfields: 1,204ksm3

Volume of vented gas at UK onshore oilfields: 118ksm3

The data in this post was compiled and published by the North Sea Transition Authority (NSTA) from reports by oil companies. This is published about three months in arrears. All the charts are based on the NSTA data.

Details

Daily production

Volume and weight

Contribution to UK production

Flaring and venting

Top producing fields

Oil top 20

Ranking risers: Singleton, Palmers Wood, Gainsborough, Kimmeridge, East Glentworth and Whisby

Ranking fallers: Welton, Cold Hanworth, Beckingham, Corringham and Goodworth

The UK’s biggest onshore oil field, at Wytch Farm in Dorset, increased its weight of production by 11% from 39,024 tonnes in June 2023 to 43,308 tonnes in July 2023. It also increased its share of UK onshore oil production to 77%.

The newest onshore field at Wressle in North Lincolnshire dropped more than 500 tonnes in July 2023, despite the longer month. Singleton in West Sussex and Welton in Lincolnshire swapped places in the rankings in July 2023, compared with the month before.

Corringham in Lincolnshire and Storrington in West Sussex dropped out of the top 20.

Producing gas fields

Ranking risers: Albury and Markham Main

Ranking fallers: Stillingfleet, Wheldale and Prince of Wales coal mine vents

Production at Angus Energy’s Saltfleetby field in Lincolnshire rose again to another record since pumping resumed in September 2022. The weight of gas reached 7,272 tonnes, up 26% from 5,759 in June 2023. Albury, in Surrey, also increased its ranking, weight and percentage share of UK onshore production.

Non-producers

Oil

There was no production at 13 UK onshore oil fields in July 2023. This was two fewer than in June 2023. Stainton in Lincolnshire (Star Energy) and Crosby Warren in North Lincolnshire (Europa) returned to production in July 2023.

The non-producing fields were:

- Angus Energy: Lidsey, Brockham

- Britnrg Limited: Newton-on-Trent

- Egdon Resources: Dukes Wood, Fiskerton Airfield, Kirklington, Waddock Cross

- Star Enery (formerly IGas): Avington, Egmanton, Nettleham, Scampton, South Leverton

- Perenco: Wareham

Gas

There was no production reported at 16 UK onshore producing gas fields in July 2023. Production stopped again at Florence coal mine vent and Hatfield Moors but resumed at Markham Main.

The non-producers were:

- Cuadrilla: Elswick

- Heyco (formerly Egdon Resources): Kirkleatham

- EP UK Investments: Humbly Grove Gas Storage

- Ineos: Airth, Doe Green

- Infinis Energy: coal mine vents at Askern, Bevercotes, Cadeby, Florence, Gedling, Kings Mill Hospital, Mansfield, Sherwood and Warsop

- Scottish Power UK plc: Hatfield Moor and Hatfield Moor Gas Storage Injection

Operators

Oil

Gas

2022-3 onshore oil data archive

August 2022 – see note about revised data

July 2022 – see note about revised data

Increased production is encouraging news as we head into winter.

The contribution of onshore UK fossil fuel production remains a near insignificant contribution to UK energy security and may, when accurately analysed, make no contribution whatsoever. Any claims that it aids energy security are highly questionable when 80% of UK offshore oil is exported alongside 60% of its gas. And the often claimed home produced is cheaper and more environmentally friendly than importing, has yet to be meaningfully substantiated. Power generation from renewable sources remains our best and most cost-effective option for energy security. With the cost of solar panel systems continuing to fall, speaking to a number of system installers, there appears to be a current increase in householders installing such system, many with battery storage backup. Within my own immediate living area, there have been at least 5 solar panel systems installed in 2023. Other moves by the energy companies (Octopus and others) providing tariffs that encourage people to shift their energy usage outside of the 4pm to 7pm peak demand period, made more possible by battery backup, should help to reduce the need for more energy generation from fossil fuels. A comment from an Octopus Energy user reminded me of the existence of storage heaters which, by storing heat during typically low demand and low cost overnight periods, could make a comeback.

9 million cubic feet of gas flowing into the UK gas network is surely to be welcomed ? re storage heaters, I actually have first hand experience of them. My first house, a newbuild, had them. Totally useless in winter. They heated the house when we were sleeping and were cold by lunchtime and for the rest of the day until late evening. Hopeless.

Well Malcolm I am an Octopus customer. I am still told that conversion of my property to a full heat pump system would cost at least £20k and would not warm my property as well as the existing gas boiler-although I do have a small heat pump for supplementary use in the conservatory-but that cost less than £3k, and I can reverse it to cooling in the summer.

Two locals invested in solar panels. One recorded 33p/day worth of electricity generation in the winter when he was wanting it to cover the cost of heating his swimming pool! Not enough for a kettle. The other young couple invested £15k and found once they deducted the cost of cleaning the system they just about broke even. The worst investment they made, according to them and they were really annoyed they had done the “right” thing and been truly done. I have a brother who invested, and then spent ages trying to get his roof repaired that was damaged in the process. Seems sub contractors can be rather difficult to pin down to get such things fixed.

Glad to hear you have decided UK on shore remains near insignificant. So, what is the fuss about?

Your comment about home produced v imported is just factually incorrect. The details have been explained many times on DoD and you are a regular reader, so even without doing any research anywhere else you should be aware of the details. My Octopus account gave me full details of my energy cost discount last winter which was from taxation upon UK oil and gas production. You could also take a look at maritime emissions and the process of LNG production and shipping to observe that it is a costly process and produces significant emissions, which local production avoids. (Wonder where that Windfall Tax will go this winter? Without which, who would fund whatever that will fund?)

The import/export nonsense has been fully explained numerous times yet you still bring it up repeatedly as if suddenly there are new readers to be fooled! UK is a net importer. Yes, it exports within that definition. That is actually good for the economy in terms of taxation revenue and balance of payments, which impacts positively upon the value of UK currency. No different to many other things like cars. Should UK not manufacture and export some cars just because it imports some? Perhaps you would prefer those buying from UK should buy from other suppliers-like Russia?

I am sorry Malcolm but to me your stance seems to ignore the consequences of your approach, yet you bang on about the consequences of other approaches. Every energy source comes with consequences. To cherry pick and then have others using the someone else will pay addition is hardly confirming a very attractive proposition. Perhaps with Civitas estimating that Net Zero will cost UK £4.5T by 2050 (£6k/household/year) there is a reason?

Malcolm, power generation from renewable sources have a fatal flaw. They are frustratingly intermittent. I’ve come to expect that I should be able to put on the kettle ANY time I want a cup of tea, not wait until next Wednesday for the wind to blow. Because they are intermittent we are forced to have an alternative “reliable” source of power for when they don’t produce. This reliable source can take many forms as I’m sure you’re aware. You might also ask yourself the question, why are our energy prices not coming down as we spend increasing amounts of money installing renewables ? Why were there no takers in the last round of auctions for wind acreage ?Basically it’s just not viable without huge subsidies.

http://websites.milonic.com/notalotofpeopleknowthat.wordpress.com/

It appears to me that renewables are basically a waste of resources and slow our progress towards reliable power generation. Hopefully if we ever crack nuclear fusion all our worries will be over. In the meantime lets go all out for clean and reliable nuclear fission. We built our first nuclear power station (Calder Hall) in 1956 in less than 4 years. We seem to have allowed bureaucracy to get in our way since then.

‘It appears to me that renewables are basically a waste of resources’

Costs for materials to produce wind turbines may have doubled but compared to the massive hike in gas prices wind power is still cheaper. Not sure why you want to pay more for your cup of tea. Time to maximise on our wind and solar potential and start reducing the load on our gas powered stations.

https://www.carbonbrief.org/analysis-uk-renewables-still-cheaper-than-gas-despite-auction-setback-for-offshore-wind/

‘lets go all out for clean and reliable nuclear fission’

https://www.theguardian.com/world/2023/sep/29/japan-fukushima-nuclear-powerplant-wastewater-release-second-batch

John, I think you may be missing the point. No matter how much wind and solar we install, it produces NOTHING when the wind doesn’t blow and it’s dark. This means that we NEED to supplement it to the scale of 100% with something which IS reliable. The other issue is that the grid needs to be kept in balance at all times. Wind power is notoriously unstable and cannot be increased at will to stabilise the grid. Frankly if there was any evidence that renewables help reduce prices we would have seen evidence of it by now.

‘Wind power is notoriously unstable’

Offshore wind generating for 91% of the time.

https://orsted.com/en/insights/the-fact-file/is-offshore-wind-power-reliable

Time to maximise our wind potential

‘renewables help reduce prices we would have seen evidence of it by now’

https://www.carbonbrief.org/analysis-uk-renewables-still-cheaper-than-gas-despite-auction-setback-for-offshore-wind/

Recent report in the telegraph re the myth of affordable green energy.

https://www.telegraph.co.uk/news/2023/10/10/green-energy-plans-wind-solar-power-myth/?mc_cid=b8e6cdffc5&mc_eid=4961da7cb1

When my sons came up with the argument that the hot rod was cheap, I pointed them towards the insurance costs! Put the two together and the hot rod is no longer cheap.

That is why £200B plus £50+B is “conveniently” ignored, but the hot rod is no good without the insurance.

I have no issue with new nuclear, as it is required. Then the wind and solar is a nice add on and the unreliability is covered. The reason the cart was put before the horse is deliberate. The horse is expensive, so distract the public with the “cheap” cart.

Unfortunately for the jPs, the majority of the public have experience of the cheap hot rod scam and carts before horses. It will still be attempted but as the necessity for the nuclear becomes more and more apparent, so will the costs. “Someone else will pay” may be the cop out, but that is also known as a scam.

Sorry folks, but unless there is a sudden discovery of how to get new nuclear much cheaper than Hinkley, the combination will not be cheap and the consumer will pay. They will probably pay twice over as businesses will either require subsidizing to stay in UK or will take themselves overseas, together with their taxation payments.

£6k/household/year through to 2050. Should be a vote winner! (Although the reaction in Uxbridge would point to the irony.)

What about the costs of doing nothing to mitigate climate change?

Climate-related issues costing the UK an estimated 1% of GDP per year at present (1% of 3 trillion is 30 billion). This could rise to 7.4% of GDP by 2100 under present policies.

Click to access Climate-costs-UK-policy-brief.pdf

And this is purely the economic cost – not the personal cost to individuals losing their lives or possessions through fires, floods.

No one I know is suggesting doing nothing, but I hear a lot on DoD excited by the subject coverage advocating “something must be done”. There is already a lot being done in UK and very little (net) in some countries that will dictate what happens globally, whilst the UK will not. The UK has done more already than nearly EVERY other country, yet the more that is done the more comment that it is not working! Perhaps there is a point at which people should start to ask if that has not worked perhaps there is something wrong with the proposal that was legally signed up to which would cost £Trillions without any prior consultation? Especially when no knowledge of a costly pandemic, European war and following cost of living hike was available.

Most things being done in UK cost money, that will be paid by the UK public. I ask again, why would anyone in their right mind want to reduce taxation income from UK oil and gas production and thus put MORE costs upon the public? Less UK production will NOT reduce consumption, it will just mean greater imports. I suppose one might state the exporting countries ARE in their right minds , although considering what many do with the revenues one may have second thoughts about that.

Cash for Ash is what you get Paul. I would suggest vested interests that are referred to regarding fossil fuels are also widespread within doing something and not quite as “green” as some would like to paint. Mr. Musk seems to get a lot of green stuff from his product being sold for him!

Not to worry. I note “we” are being told to HOPE things will improve if “we” give another lot their go. Strange job application detail, but I suppose it is no different to investing £Trillions in the hope it may work.

Paul this report is speculation of the highest order. Apparently international trade will be our biggest risk ? “As other countries suffer relatively worse climate change impacts than the UK, these effects spill over to the UK through channels such as trade” Seriously ? That’s our biggest risk ?

To mitigate this risk we have to forego reliable energy sources such as Oil, Coal and Gas, which we have in abundance and pay exorbitant subsidies to unreliable intermittent sources, destroying our economy in the process. Exporting jobs to China where they have no intention of copying us. Have our Pensioners deciding between heating and eating in the winter. I would ask you to go for a walk along your High St. and look at the devastation our dysfunctional energy policies are causing.

Thank you Graeme. Nice to see someone dealing with the reality.

I suspect that reality will be £200B on new nuclear, if some stupid politician doesn’t think the maths is unimportant. Of course, even then reality can not be grasped and someone else will pay has to be a comfort blanket, yet the costs of Hinkley Point are there to see and who the someone is! I accept new nuclear is required for all the reasons you give and that will cover the unreliable renewables, but it makes the combination pretty expensive even without the add on costs of waste disposal-another £50B. It is not difficult to see how the figures start adding up into £Trillions.

It will take a lot of productivity improvements to generate anything significant, and uncompetitive energy costs mean more subsidy to keep jobs in UK, so the equation doesn’t look to be that workable. With all those costs why would anyone want to load more onto the individual tax payer by not using the taxation possibility from domestic oil and gas?

Thanks Martin. As a retired Engineer I’ve been trying to understand the reasons why nuclear power plants are so expensive and slow to build, they are, after all, just industrial plants. I suspect there are a number of areas where we could make improvements without sacrificing quality or safety.

Noted an interesting piece this am about car insurance. Appears car insurance is so much more expensive on EVs as costs of repairs are so high, and their heavy weight a major factor to cause this. Then, there is also the very high costs of replacement parts and the possibility you may be without your car for up to 6 months (!!!!!!) before the parts arrive.

Once again, the consumer is being required to “do the right thing” and then finds out they pay through the nose for doing so. Not someone else paying. I would suggest for those who make their own decision willingly to follow the propaganda then they should accept the consequence, but it is somewhat different for those forced to do so.

There will be a lot more painful and expensive enlightenment over the next couple of decades. Should keep a constant turnover of politicians going, as they all seem prone to making the same mistakes that the voters eventually have thrust upon them.

The £6k/household/year is already looking as if it may need adjusting upwards.

However, to lighten the mood it is also being reported that if climate change continues to impact UK then grapes and hops will be abundant!

Another little myth exposed with the news ExxonMobil are to acquire Pioneer in the Permian.

Seems the acquisition will enable them to produce oil at under $35/barrel. Strange, when “we” have been told how expensive fracking is!

Don’t think OPEC will take another bash at undercutting.